Question

Consider the following tradeable bonds. a) For the bonds listed, find the current bid and ask prices. b) Based on the

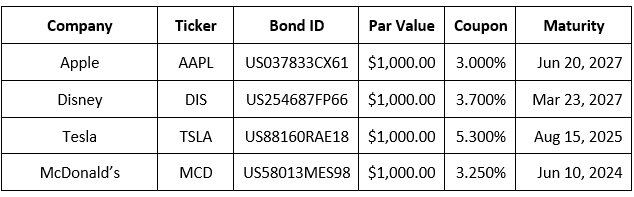

Consider the following tradeable bonds.

a) For the bonds listed, find the current bid and ask prices.

b) Based on the stock of WMT, TSLA, FB, and MCD study the appropriate bond.

i) Research the details of the bond for example, how often and at what dates are the bonds paying coupons; is the bond international or domestic; what is the size of the issue; is the bond fixed or floating rate; is the bond convertible, callable, or puttable.

ii) What is the credit rating of the issuer of the bond? How is this credit rating reflected in the yield of the bond? If possible, quantify the credit spread.

Follow these steps. First, approximate the maturity of the bond in years. Then find the yield of the US Treasury note with the same maturity. If necessary, take the average of two bonds. For example, if your bond matures in 4 years, use the 3-year and 5-year Treasuries.

Company Ticker Bond ID Par Value Coupon Maturity Apple AAPL US037833CX61 $1,000.00 3.000% Disney DIS US254687FP66 $1,000.00 3.700% Jun 20, 2027 Mar 23, 2027 Tesla TSLA US88160RAE18 $1,000.00 5.300% Aug 15, 2025 McDonald's MCD US58013MES98 $1,000.00 3.250% Jun 10, 2024

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started