Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following transactions for Derry Drug Store: (Click the icon to view the transactions.) Requirements 1. Journalize the purchase transactions. Explanations are not required.

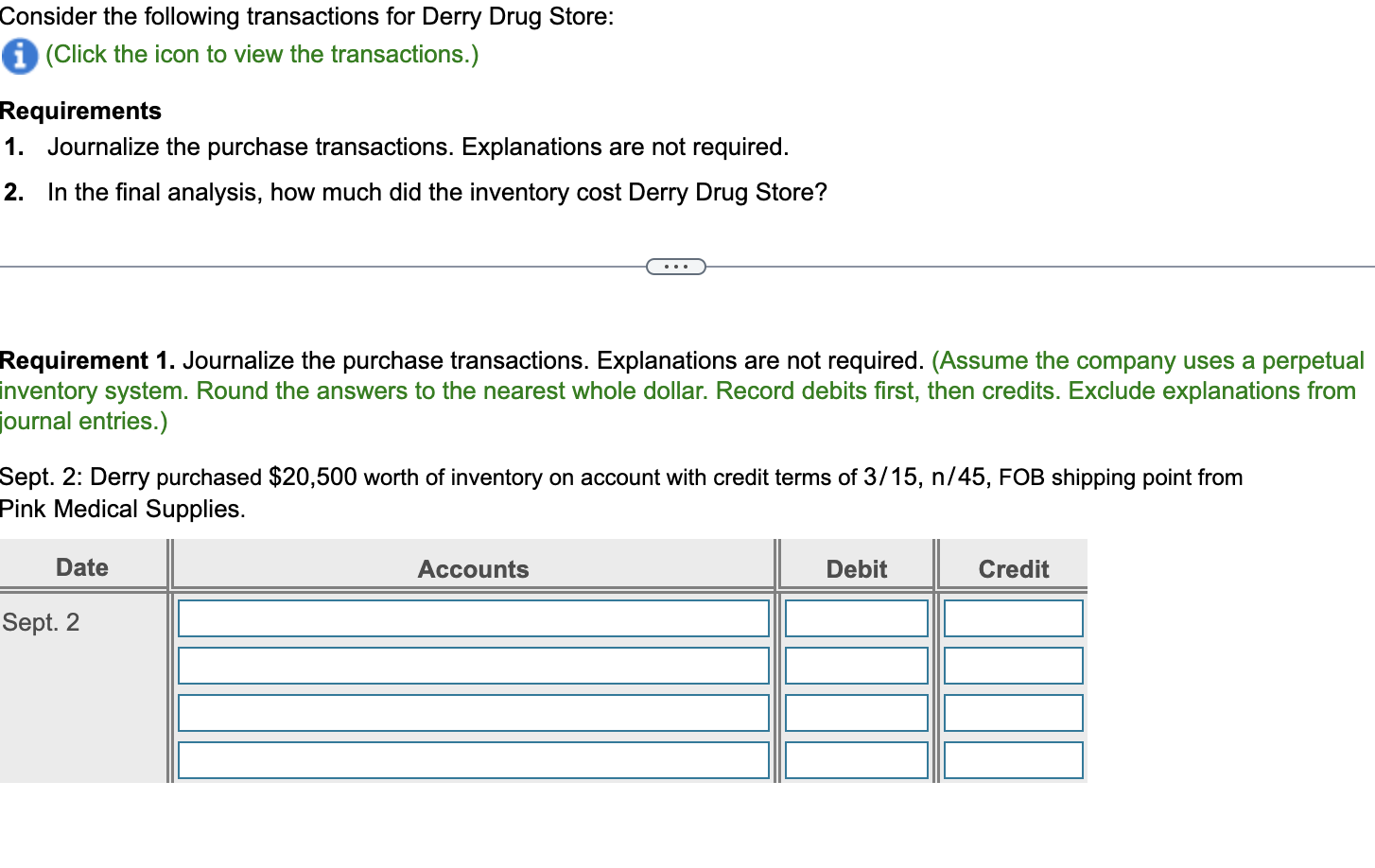

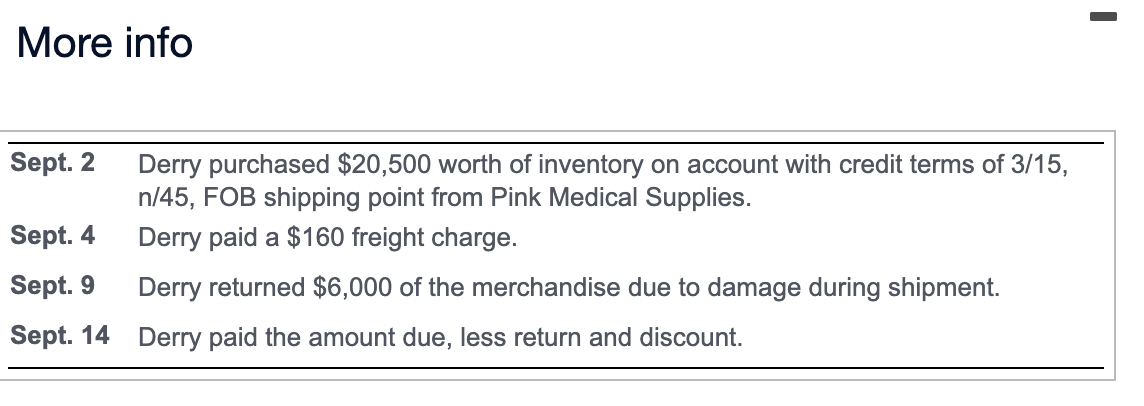

Consider the following transactions for Derry Drug Store: (Click the icon to view the transactions.) Requirements 1. Journalize the purchase transactions. Explanations are not required. 2. In the final analysis, how much did the inventory cost Derry Drug Store? Requirement 1. Journalize the purchase transactions. Explanations are not required. (Assume the company uses a perpetual inventory system. Round the answers to the nearest whole dollar. Record debits first, then credits. Exclude explanations from journal entries.) Sept. 2: Derry purchased $20,500 worth of inventory on account with credit terms of 3/15,n/45, FOB shipping point from Pink Medical Supplies. More info Sept. 2 Derry purchased $20,500 worth of inventory on account with credit terms of 3/15, n/45, FOB shipping point from Pink Medical Supplies. Sept. 4 Derry paid a $160 freight charge. Sept. 9 Derry returned $6,000 of the merchandise due to damage during shipment. Sept. 14 Derry paid the amount due, less return and discount

Consider the following transactions for Derry Drug Store: (Click the icon to view the transactions.) Requirements 1. Journalize the purchase transactions. Explanations are not required. 2. In the final analysis, how much did the inventory cost Derry Drug Store? Requirement 1. Journalize the purchase transactions. Explanations are not required. (Assume the company uses a perpetual inventory system. Round the answers to the nearest whole dollar. Record debits first, then credits. Exclude explanations from journal entries.) Sept. 2: Derry purchased $20,500 worth of inventory on account with credit terms of 3/15,n/45, FOB shipping point from Pink Medical Supplies. More info Sept. 2 Derry purchased $20,500 worth of inventory on account with credit terms of 3/15, n/45, FOB shipping point from Pink Medical Supplies. Sept. 4 Derry paid a $160 freight charge. Sept. 9 Derry returned $6,000 of the merchandise due to damage during shipment. Sept. 14 Derry paid the amount due, less return and discount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started