Answered step by step

Verified Expert Solution

Question

1 Approved Answer

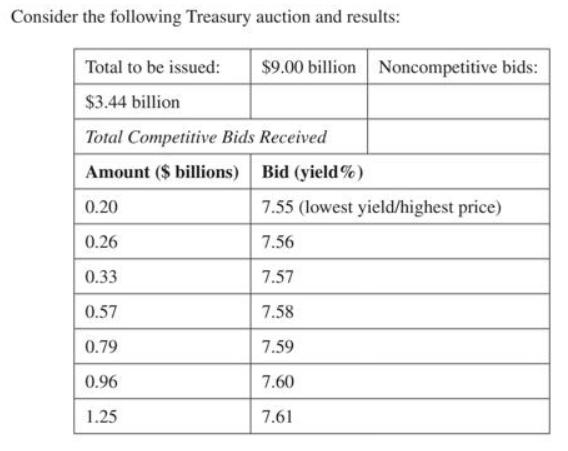

Consider the following Treasury auction and results: Total to be issued: $3.44 billion Total Competitive Bids Received Amount ($ billions) 0.20 0.26 0.33 0.57

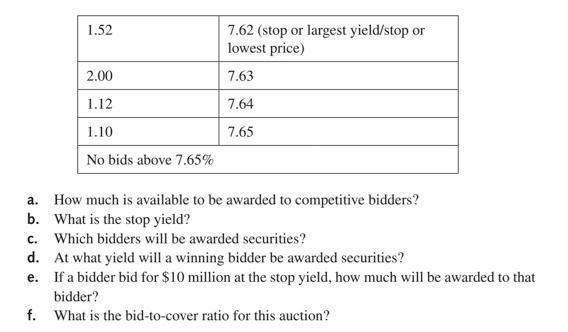

Consider the following Treasury auction and results: Total to be issued: $3.44 billion Total Competitive Bids Received Amount ($ billions) 0.20 0.26 0.33 0.57 0.79 0.96 1.25 $9.00 billion Noncompetitive bids: Bid (yield%) 7.55 (lowest yield/highest price) 7.56 7.57 7.58 7.59 7.60 7.61 d. e. 1.52 f. 2.00 1.12 1.10 No bids above 7.65% a. How much is available to be awarded to competitive bidders? b. What is the stop yield? c. Which bidders will be awarded securities? 7.62 (stop or largest yield/stop or lowest price) 7.63 7.64 7.65 At what yield will a winning bidder be awarded securities? If a bidder bid for $10 million at the stop yield, how much will be awarded to that bidder? What is the bid-to-cover ratio for this auction?

Step by Step Solution

★★★★★

3.60 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a 656 billion is available to be awarded to competitive bidders b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e325383056_182269.pdf

180 KBs PDF File

635e325383056_182269.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started