Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following two investment decisions: buy a certified deposit (CD) which will pay you a 10% annual interest rate, and buy some stocks

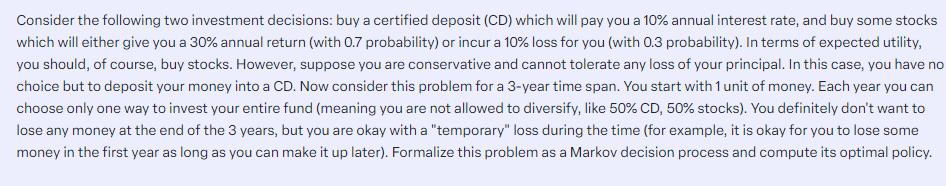

Consider the following two investment decisions: buy a certified deposit (CD) which will pay you a 10% annual interest rate, and buy some stocks which will either give you a 30% annual return (with 0.7 probability) or incur a 10% loss for you (with 0.3 probability). In terms of expected utility, you should, of course, buy stocks. However, suppose you are conservative and cannot tolerate any loss of your principal. In this case, you have no choice but to deposit your money into a CD. Now consider this problem for a 3-year time span. You start with 1 unit of money. Each year you can choose only one way to invest your entire fund (meaning you are not allowed to diversify, like 50% CD, 50% stocks). You definitely don't want to lose any money at the end of the 3 years, but you are okay with a "temporary" loss during the time (for example, it is okay for you to lose some money in the first year as long as you can make it up later). Formalize this problem as a Markov decision process and compute its optimal policy.

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To formalize the problem as a Markov decision process MDP we need to define the states actions transition probabilities rewards and the goal States The state at any time during the 3year time ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started