Question

Consider the following two mutually exclusive projects: Year Cash flow (A) Cash flow (B) 0 -$245000 -$53000 1 34000 31900 2 49000 21800 3

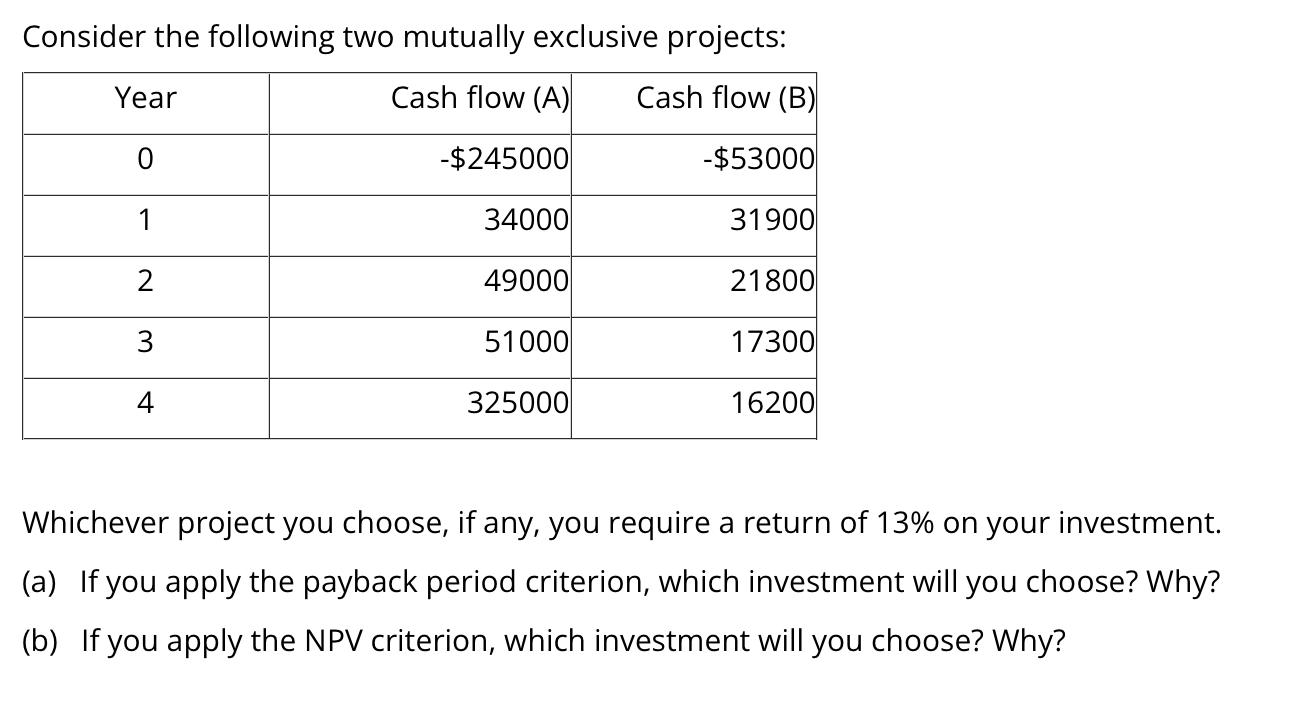

Consider the following two mutually exclusive projects: Year Cash flow (A) Cash flow (B) 0 -$245000 -$53000 1 34000 31900 2 49000 21800 3 51000 17300 325000 16200 Whichever project you choose, if any, you require a return of 13% on your investment. (a) If you apply the payback period criterion, which investment will you choose? Why? (b) If you apply the NPV criterion, which investment will you choose? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Corporate Finance

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

6th Edition

978-0073405131, 9780073405131

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App