Answered step by step

Verified Expert Solution

Question

1 Approved Answer

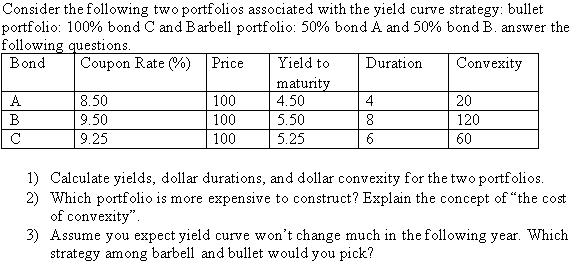

Consider the following two portfolios associated with the yield curve strategy: bullet portfolio: 100% bond C and Barbell portfolio: 50% bond A and 50%

Consider the following two portfolios associated with the yield curve strategy: bullet portfolio: 100% bond C and Barbell portfolio: 50% bond A and 50% bond B. answer the Convexity following questions. Bond A B C Coupon Rate (%) 8.50 9.50 9.25 Price 100 100 100 Yield to maturity 4.50 5.50 5.25 Duration 4 8 6 20 120 60 1) Calculate yields, dollar durations, and dollar convexity for the two portfolios. 2) Which portfolio is more expensive to construct? Explain the concept of "the cost of convexity". 3) Assume you expect yield curve won't change much in the following year. Which strategy among barbell and bullet would you pick?

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions Ill use the given information about the bond characteristics 1 Calculation of Yields Dollar Durations and Dollar Convexity a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started