Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following two-period (today and tomorrow) economy. A representative investor has an initial wealth of Wo to be allocated across two risky assets,

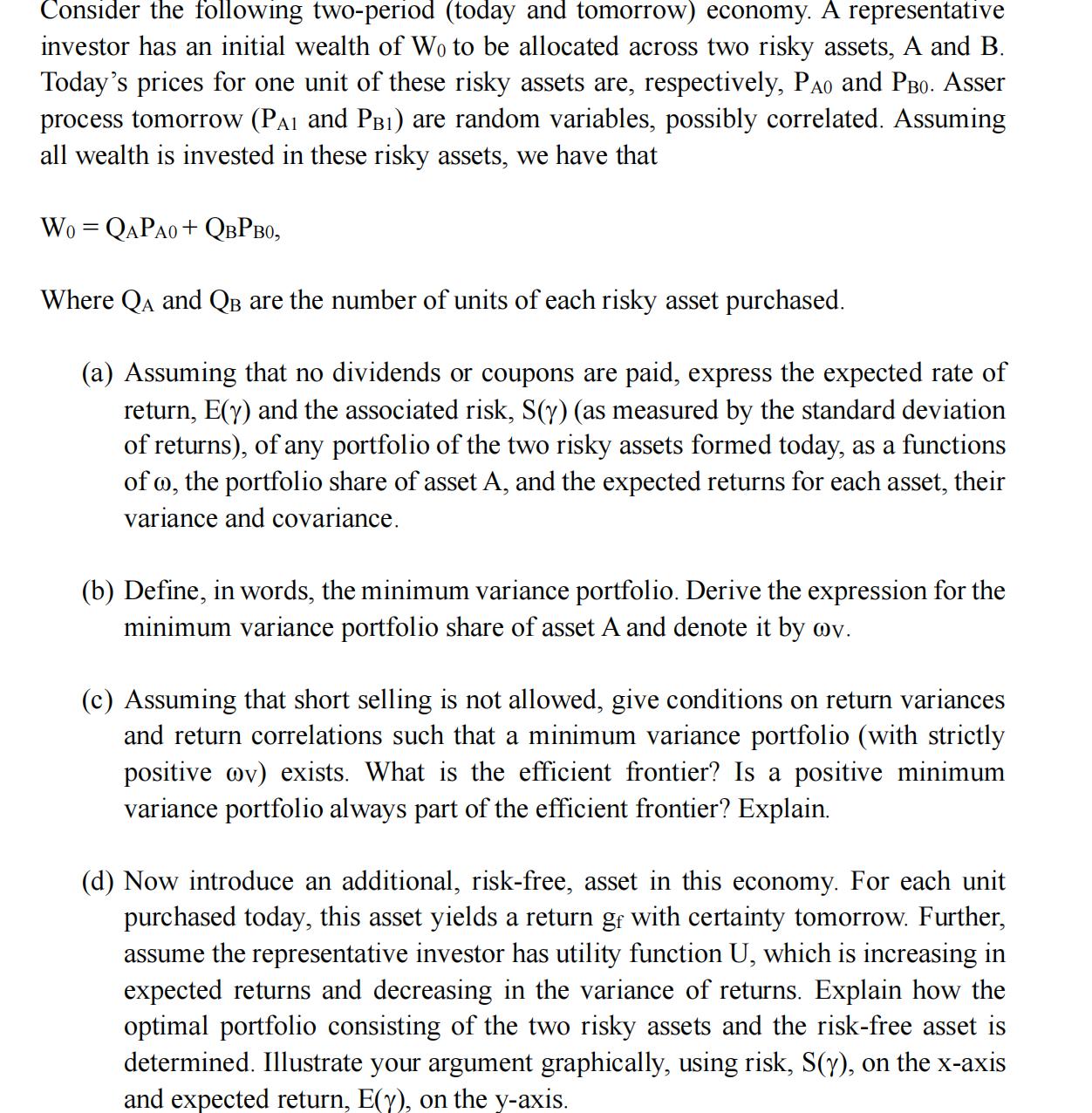

Consider the following two-period (today and tomorrow) economy. A representative investor has an initial wealth of Wo to be allocated across two risky assets, A and B. Today's prices for one unit of these risky assets are, respectively, PAO and PBO. Asser process tomorrow (PAI and PB) are random variables, possibly correlated. Assuming all wealth is invested in these risky assets, we have that Wo = QAPAO + QBPB0, Where QA and Q are the number of units of each risky asset purchased. (a) Assuming that no dividends or coupons are paid, express the expected rate of return, E(y) and the associated risk, S(y) (as measured by the standard deviation of returns), of any portfolio of the two risky assets formed today, as a functions of o, the portfolio share of asset A, and the expected returns for each asset, their variance and covariance. (b) Define, in words, the minimum variance portfolio. Derive the expression for the minimum variance portfolio share of asset A and denote it by ov. (c) Assuming that short selling is not allowed, give conditions on return variances and return correlations such that a minimum variance portfolio (with strictly positive ov) exists. What is the efficient frontier? Is a positive minimum variance portfolio always part of the efficient frontier? Explain. (d) Now introduce an additional, risk-free, asset in this economy. For each unit purchased today, this asset yields a return gf with certainty tomorrow. Further, assume the representative investor has utility function U, which is increasing in expected returns and decreasing in the variance of returns. Explain how the optimal portfolio consisting of the two risky assets and the risk-free asset is determined. Illustrate your argument graphically, using risk, S(y), on the x-axis and expected return, E(y), on the y-axis.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a To express the expected rate of return Ey and the associated risk Sy of a portfolio of two risky assets A and B formed today as a function of the po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started