Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following: - Your investment account has $250.000 of cash on January 15 before you begin trading on the same date. - The next

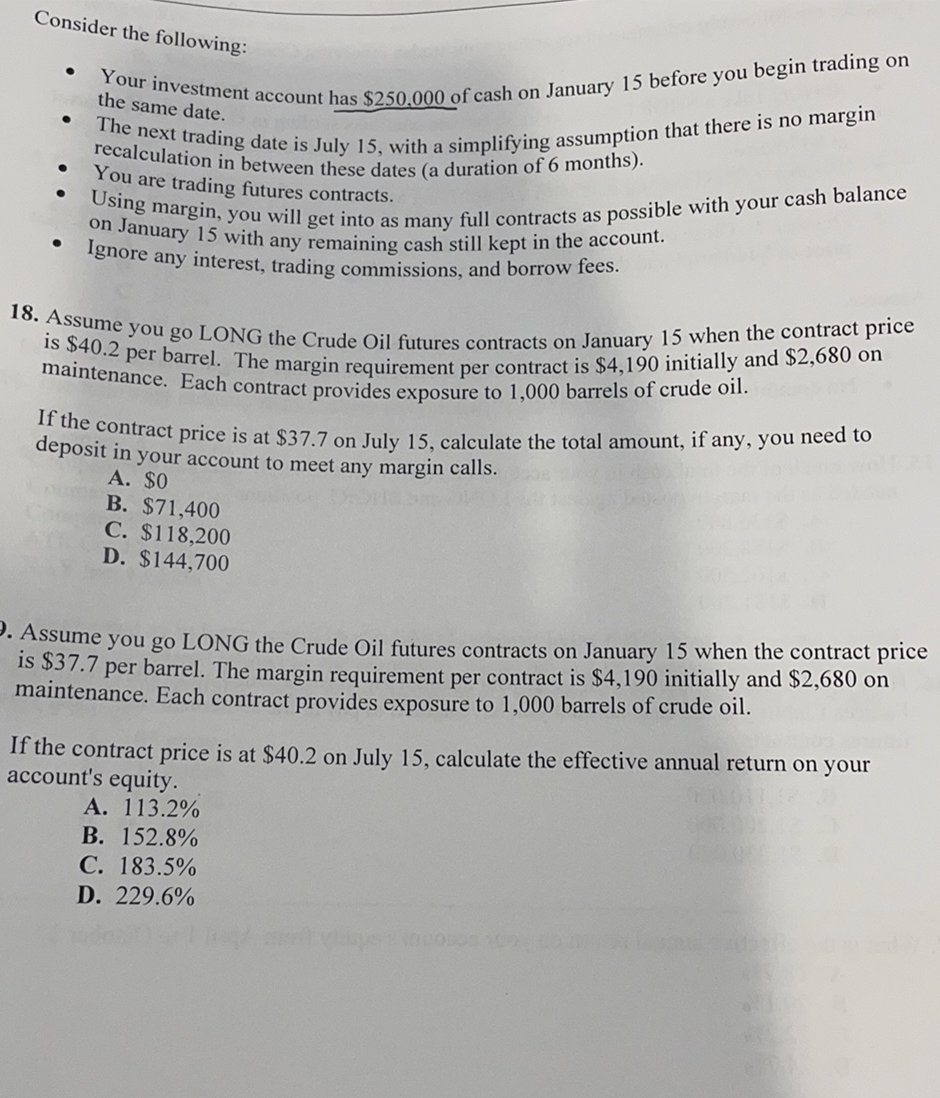

Consider the following: - Your investment account has $250.000 of cash on January 15 before you begin trading on the same date. - The next trading date is July 15 , with a simplifying assumption that there is no margin recalculation in between these dates (a duration of 6 months). - You are trading futures contracts. on January 15 with any remaining cash still kept in the account. - Ignore any interest, trading commissions, and borrow fees. 18. Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $40.2 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $37.7 on July 15 , calculate the total amount, if any, you need to deposit in your account to meet any margin calls. A. $0 B. $71,400 C. $118,200 D. $144,700 Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $37.7 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $40.2 on July 15 , calculate the effective annual return on your account's equity. A. 113.2% B. 152.8% C. 183.5% D. 229.6% Consider the following: - Your investment account has $250.000 of cash on January 15 before you begin trading on the same date. - The next trading date is July 15 , with a simplifying assumption that there is no margin recalculation in between these dates (a duration of 6 months). - You are trading futures contracts. on January 15 with any remaining cash still kept in the account. - Ignore any interest, trading commissions, and borrow fees. 18. Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $40.2 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $37.7 on July 15 , calculate the total amount, if any, you need to deposit in your account to meet any margin calls. A. $0 B. $71,400 C. $118,200 D. $144,700 Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $37.7 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $40.2 on July 15 , calculate the effective annual return on your account's equity. A. 113.2% B. 152.8% C. 183.5% D. 229.6%

Consider the following: - Your investment account has $250.000 of cash on January 15 before you begin trading on the same date. - The next trading date is July 15 , with a simplifying assumption that there is no margin recalculation in between these dates (a duration of 6 months). - You are trading futures contracts. on January 15 with any remaining cash still kept in the account. - Ignore any interest, trading commissions, and borrow fees. 18. Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $40.2 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $37.7 on July 15 , calculate the total amount, if any, you need to deposit in your account to meet any margin calls. A. $0 B. $71,400 C. $118,200 D. $144,700 Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $37.7 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $40.2 on July 15 , calculate the effective annual return on your account's equity. A. 113.2% B. 152.8% C. 183.5% D. 229.6% Consider the following: - Your investment account has $250.000 of cash on January 15 before you begin trading on the same date. - The next trading date is July 15 , with a simplifying assumption that there is no margin recalculation in between these dates (a duration of 6 months). - You are trading futures contracts. on January 15 with any remaining cash still kept in the account. - Ignore any interest, trading commissions, and borrow fees. 18. Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $40.2 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $37.7 on July 15 , calculate the total amount, if any, you need to deposit in your account to meet any margin calls. A. $0 B. $71,400 C. $118,200 D. $144,700 Assume you go LONG the Crude Oil futures contracts on January 15 when the contract price is $37.7 per barrel. The margin requirement per contract is $4,190 initially and $2,680 on maintenance. Each contract provides exposure to 1,000 barrels of crude oil. If the contract price is at $40.2 on July 15 , calculate the effective annual return on your account's equity. A. 113.2% B. 152.8% C. 183.5% D. 229.6% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started