Answered step by step

Verified Expert Solution

Question

1 Approved Answer

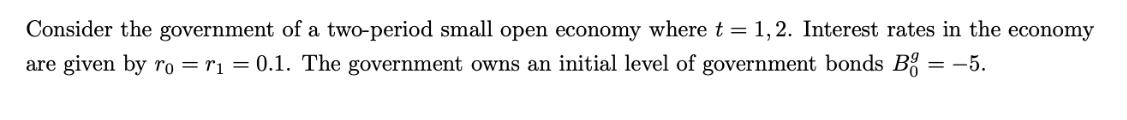

Consider the government of a two-period small open economy where t = 1,2. Interest rates in the economy are given by ro= r=0.1. The

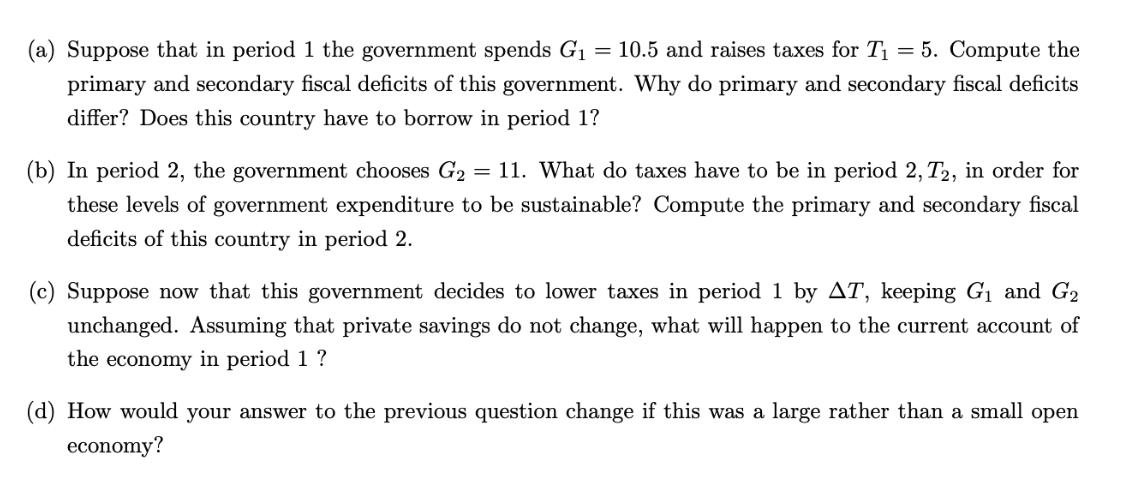

Consider the government of a two-period small open economy where t = 1,2. Interest rates in the economy are given by ro= r=0.1. The government owns an initial level of government bonds B = -5. (a) Suppose that in period 1 the government spends G = 10.5 and raises taxes for T = 5. Compute the primary and secondary fiscal deficits of this government. Why do primary and secondary fiscal deficits differ? Does this country have to borrow in period 1? (b) In period 2, the government chooses G = 11. What do taxes have to be in period 2, T2, in order for these levels of government expenditure to be sustainable? Compute the primary and secondary fiscal deficits of this country in period 2. (c) Suppose now that this government decides to lower taxes in period 1 by AT, keeping G and G unchanged. Assuming that private savings do not change, what will happen to the current account of the economy in period 1 ? (d) How would your answer to the previous question change if this was a large rather than a small open economy?

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Explanation The primary fiscal deficit measures the fiscal i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started