Answered step by step

Verified Expert Solution

Question

1 Approved Answer

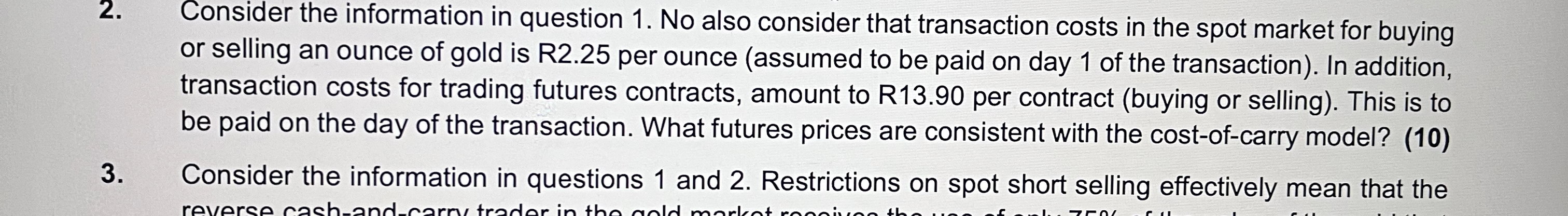

Consider the information in question 1 . No also consider that transaction costs in the spot market for buying or selling an ounce of gold

Consider the information in question No also consider that transaction costs in the spot market for buying or selling an ounce of gold is R per ounce assumed to be paid on day of the transaction In addition, transaction costs for trading futures contracts, amount to R per contract buying or selling This is to be paid on the day of the transaction. What futures prices are consistent with the costofcarry model?

Consider the information in questions and Restrictions on spot short selling effectively mean that the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started