Answered step by step

Verified Expert Solution

Question

1 Approved Answer

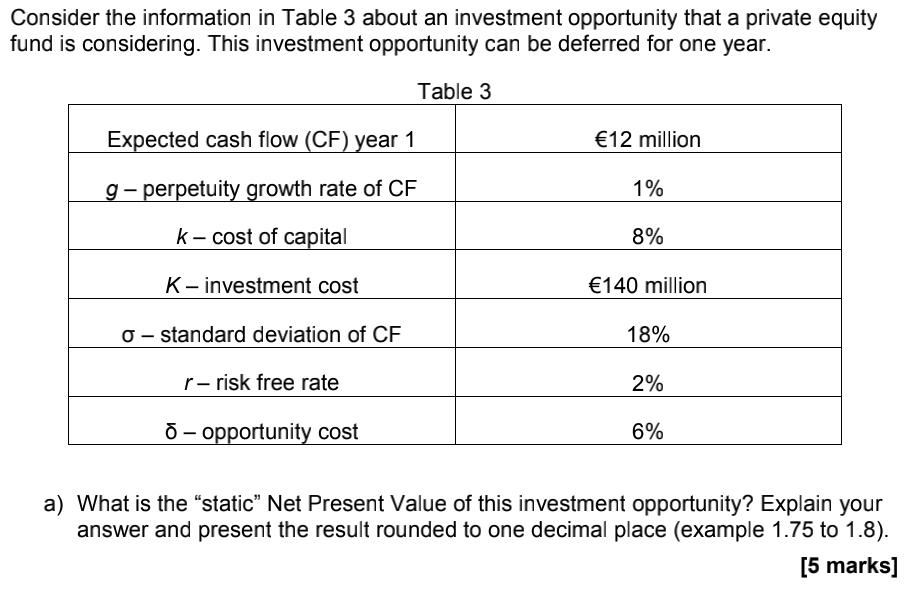

Consider the information in Table 3 about an investment opportunity that a private equity fund is considering. This investment opportunity can be deferred for

Consider the information in Table 3 about an investment opportunity that a private equity fund is considering. This investment opportunity can be deferred for one year. Table 3 Expected cash flow (CF) year 1 g-perpetuity growth rate of CF k- cost of capital K- investment cost o standard deviation of CF r-risk free rate - opportunity cost 12 million 1% 8% 140 million 18% 2% 6% a) What is the "static" Net Present Value of this investment opportunity? Explain your answer and present the result rounded to one decimal place (example 1.75 to 1.8). [5 marks] b) What is the value of this investment opportunity using the Dixit and Pindyck (D&P) model? Explain your answer (use the input B = 3.79 in the D&P model). Present your result rounded to one decimal place. [15 marks] c) Should this investment opportunity be accepted by the private equity fund? Explain your answer. [5 marks]

Step by Step Solution

★★★★★

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Calculating the Static Net Present Value NPV The static NPV for this investment opportunity consider...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started