Answered step by step

Verified Expert Solution

Question

1 Approved Answer

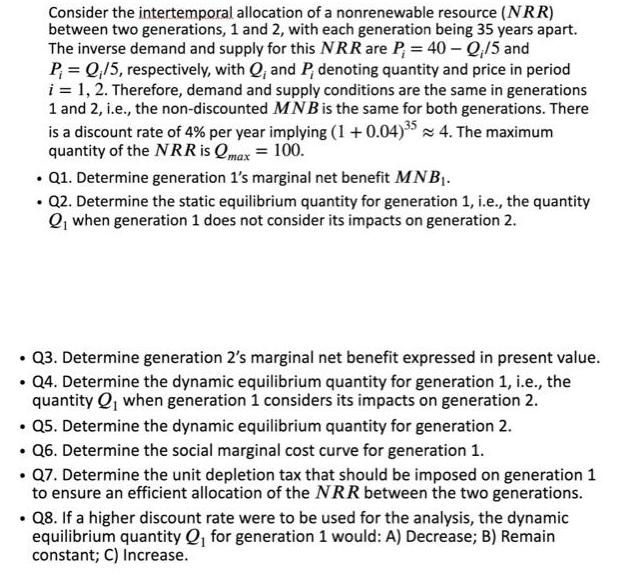

Consider the intertemporal allocation of a nonrenewable resource (NRR) between two generations, 1 and 2, with each generation being 35 years apart. The inverse

Consider the intertemporal allocation of a nonrenewable resource (NRR) between two generations, 1 and 2, with each generation being 35 years apart. The inverse demand and supply for this NRR are P = 40 - Q./5 and P = Q/5, respectively, with Q, and P, denoting quantity and price in period i = 1, 2. Therefore, demand and supply conditions are the same in generations 1 and 2, i.e., the non-discounted MNB is the same for both generations. There is a discount rate of 4% per year implying (1 +0.04)35 4. The maximum quantity of the NRR is Qmax = 100. . Q1. Determine generation 1's marginal net benefit MNB. . . Q2. Determine the static equilibrium quantity for generation 1, i.e., the quantity Q when generation 1 does not consider its impacts on generation 2. Q3. Determine generation 2's marginal net benefit expressed in present value. Q4. Determine the dynamic equilibrium quantity for generation 1, i.e., the quantity Q when generation 1 considers its impacts on generation 2. Q5. Determine the dynamic equilibrium quantity for generation 2. . Q6. Determine the social marginal cost curve for generation 1. Q7. Determine the unit depletion tax that should be imposed on generation 1 to ensure an efficient allocation of the NRR between the two generations. Q8. If a higher discount rate were to be used for the analysis, the dynamic equilibrium quantity Q for generation 1 would: A) Decrease; B) Remain constant; C) Increase.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The solutions to the problem in the image are 1 Calculate the marginal net benefit MNB for generatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started