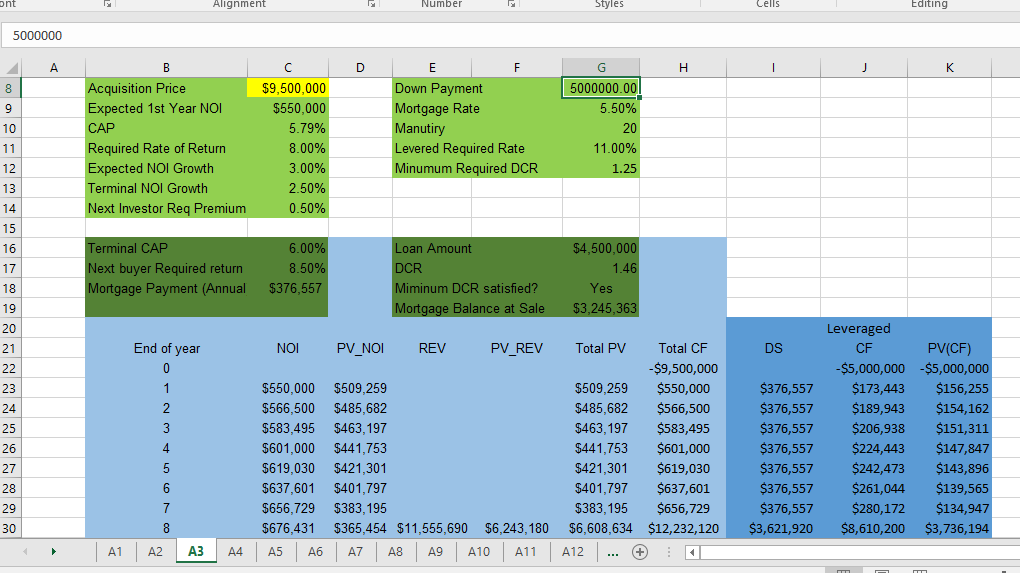

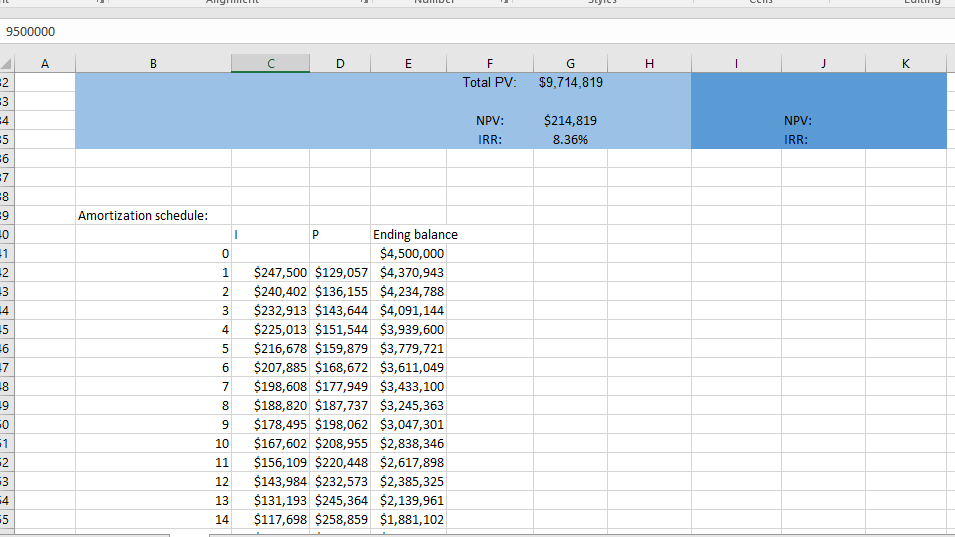

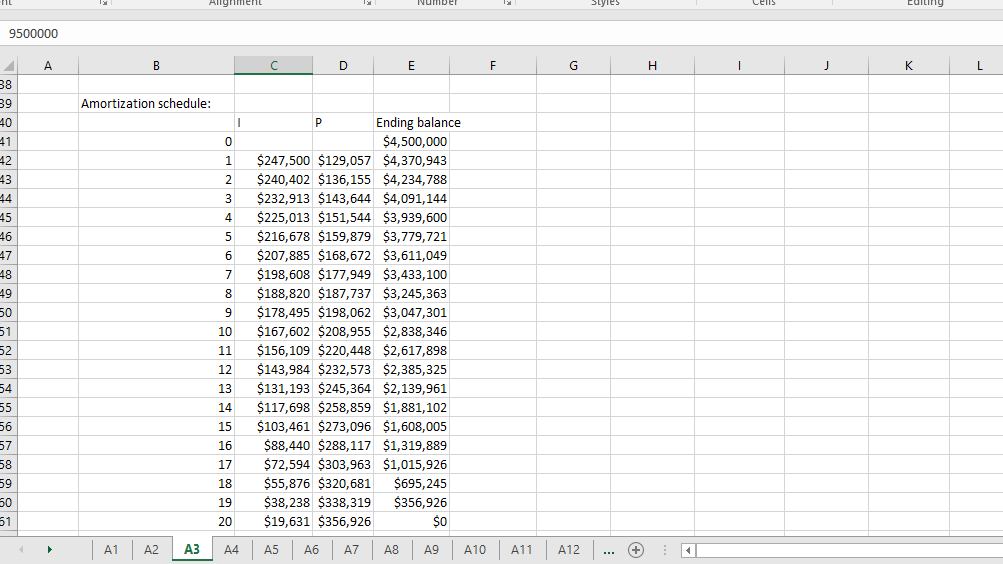

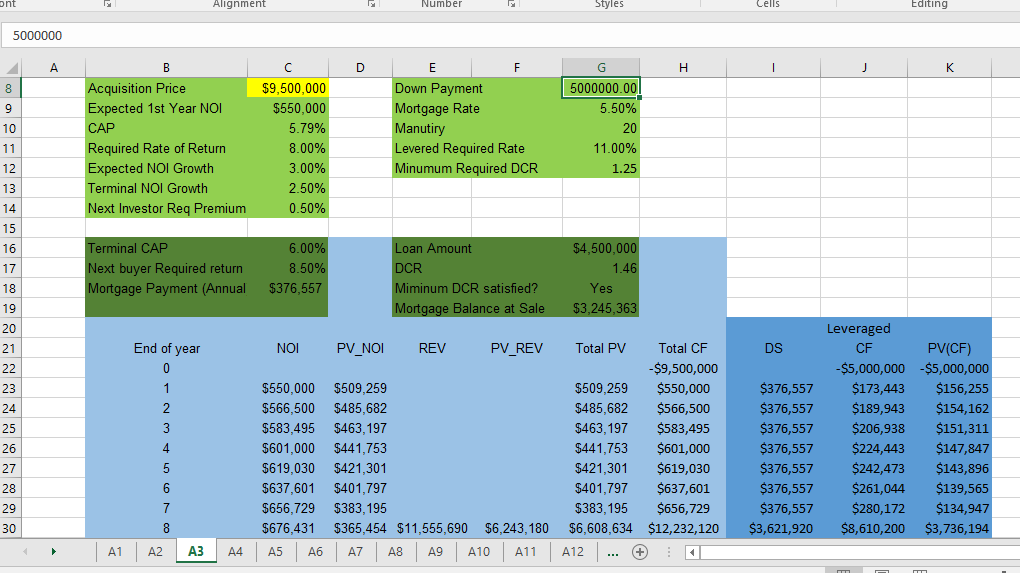

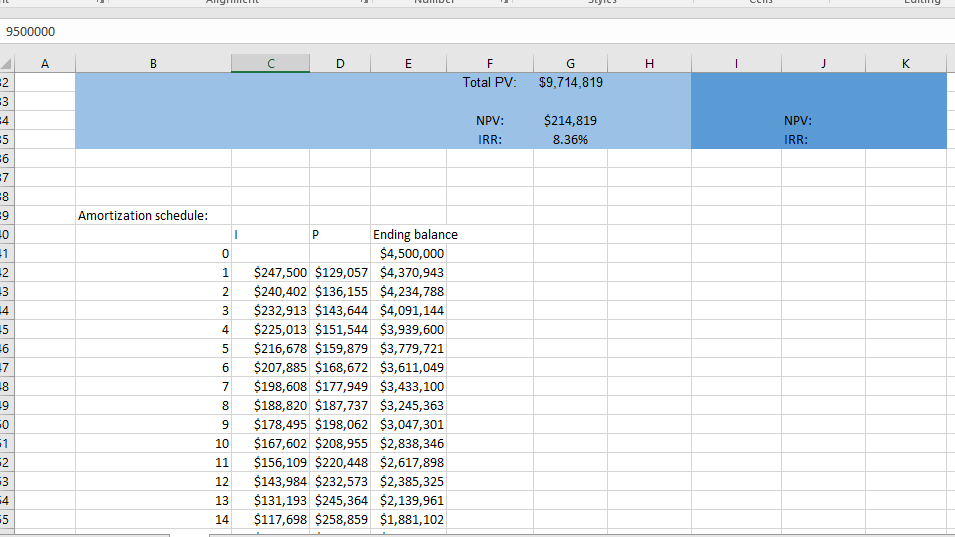

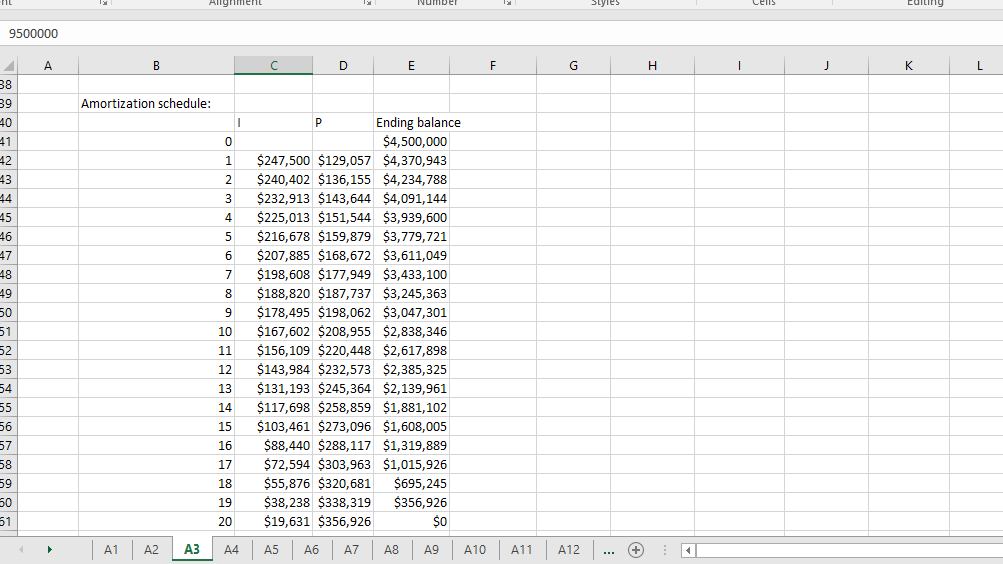

Consider the levered DCF model provided to you in tab A3 of the Excel spreadsheet. a. Calculate the maximum price that an investor with the assumptions made in the model should be willing to pay for that property. Show this maximum price in cell C8. b. If you expect a general increase in the risk premium for real estate investments over the next 8 years, how would this affect the expected levered return on this property? Briefly Explain.

Alignment Number Styles Cells Editing 5000000 D H K B Acquisition Price Expected 1st Year NOI CAP Required Rate of Return Expected NOI Growth Terminal NOI Growth Next Investor Req Premium $9,500,000 $550,000 5.79% 8.00% 3.00% 2.50% 0.50% E Down Payment Mortgage Rate Manutiry Levered Required Rate Minumum Required DCR G 5000000.00 5.50% 20 11.00% 1.25 Terminal CAP Next buyer Required return Mortgage Payment (Annual 6.00% 8.50% $376,557 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Loan Amount DCR Miminum DCR satisfied? Mortgage Balance at Sale $4,500,000 1.46 Yes $3,245,363 NOI PV_NOI REV PV_REV DS End of year 0 1 2 3 4 5 6 $550,000 $566,500 $583,495 $601,000 $619,030 $637,601 $656,729 $676,431 $509,259 $485,682 $463,197 $441,753 $421,301 $401,797 $383,195 $365,454 $11,555,690 $6,243,180 A7 A8 A9 A10 A11 Total PV Total CF -$9,500,000 $509,259 $550,000 $485,682 $566,500 $463,197 $583,495 $441,753 $601,000 $421,301 $619,030 $401.797 $637,601 $383,195 $656,729 $6,608,634 $12,232,120 $376,557 $376,557 $376,557 $376,557 $376,557 $376,557 $376,557 $3,621,920 Leveraged CF PV(CF) -$5,000,000 $5,000,000 $173,443 $156,255 $189,943 $154,162 $206,938 $151,311 $224,443 $147,847 $242,473 $143,896 $261,044 $139,565 $280,172 $134,947 $8,610,200 $3,736,194 7 8 A1 A2 A3 A4 A5 A6 A12 + 9500000 A B C D E H 1 J K F Total PV: G $9,714,819 2 3 -4 5 NPV: IRR: $214,819 8.36% NPV: IRR: 6 7 Amortization schedule: 1 -0 -1 0 1 2 3 4 -2 -3 -4 -5 -6 7 -8 -9 5 6 P Ending balance $4,500,000 $247,500 $129,057 $4,370,943 $240,402 $136,155 $4,234,788 $232,913 $143,644 $4,091,144 $225,013 $151,544 $3,939,600 $216,678 $159,879 $3,779,721 $207,885 $168,672 $3,611,049 $198,608 $177,949 $3,433,100 $188,820 $187,737 $3,245,363 $178,495 $198,062 $3,047,301 $167,602 $208,955 $2,838,346 $156,109 $220,448 $2,617,898 $143,984 $232,573 $2,385,325 $131,193 $245,364 $2,139,961 $117,698 $258,859 $1,881,102 7 8 9 10 1 11 12 13 4 5 14 Number Styles Lens Cailing 9500000 B D E F G H 1 J K L Amortization schedule: 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 50 51 1 Ending balance 0 $4,500,000 1 $247,500 $129,057 $4,370,943 2 $240,402 $136,155 $4,234,788 3 $232,913 $143,644 $4,091,144 4 $225,013 $151,544 $3,939,600 5 $216,678 $159,879 $3,779,721 6 $207,885 $168,672 $3,611,049 7 $198,608 $177,949 $3,433,100 8 $188,820 $187,737 $3,245,363 9 $178,495 $198,062 $3,047,301 10 $167,602 $208,955 $2,838,346 11 $156,109 $220,448 $2,617,898 12 $143,984 $232,573 $2,385,325 13 $131,193 $245,364 $2,139,961 14 $117,698 $258,859 $1,881,102 15 $103,461 $273,096 $1,608,005 16 $88,440 $288,117 $1,319,889 17 $72,594 $303,963 $1,015,926 18 $55,876 $320,681 $695,245 19 $38,238 $338,319 $356,926 20 $19,631 $356,926 SO A4 A5 A6 A7 A8 A9 A10 411 412 ... + A1 A2 A3 Alignment Number Styles Cells Editing 5000000 D H K B Acquisition Price Expected 1st Year NOI CAP Required Rate of Return Expected NOI Growth Terminal NOI Growth Next Investor Req Premium $9,500,000 $550,000 5.79% 8.00% 3.00% 2.50% 0.50% E Down Payment Mortgage Rate Manutiry Levered Required Rate Minumum Required DCR G 5000000.00 5.50% 20 11.00% 1.25 Terminal CAP Next buyer Required return Mortgage Payment (Annual 6.00% 8.50% $376,557 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Loan Amount DCR Miminum DCR satisfied? Mortgage Balance at Sale $4,500,000 1.46 Yes $3,245,363 NOI PV_NOI REV PV_REV DS End of year 0 1 2 3 4 5 6 $550,000 $566,500 $583,495 $601,000 $619,030 $637,601 $656,729 $676,431 $509,259 $485,682 $463,197 $441,753 $421,301 $401,797 $383,195 $365,454 $11,555,690 $6,243,180 A7 A8 A9 A10 A11 Total PV Total CF -$9,500,000 $509,259 $550,000 $485,682 $566,500 $463,197 $583,495 $441,753 $601,000 $421,301 $619,030 $401.797 $637,601 $383,195 $656,729 $6,608,634 $12,232,120 $376,557 $376,557 $376,557 $376,557 $376,557 $376,557 $376,557 $3,621,920 Leveraged CF PV(CF) -$5,000,000 $5,000,000 $173,443 $156,255 $189,943 $154,162 $206,938 $151,311 $224,443 $147,847 $242,473 $143,896 $261,044 $139,565 $280,172 $134,947 $8,610,200 $3,736,194 7 8 A1 A2 A3 A4 A5 A6 A12 + 9500000 A B C D E H 1 J K F Total PV: G $9,714,819 2 3 -4 5 NPV: IRR: $214,819 8.36% NPV: IRR: 6 7 Amortization schedule: 1 -0 -1 0 1 2 3 4 -2 -3 -4 -5 -6 7 -8 -9 5 6 P Ending balance $4,500,000 $247,500 $129,057 $4,370,943 $240,402 $136,155 $4,234,788 $232,913 $143,644 $4,091,144 $225,013 $151,544 $3,939,600 $216,678 $159,879 $3,779,721 $207,885 $168,672 $3,611,049 $198,608 $177,949 $3,433,100 $188,820 $187,737 $3,245,363 $178,495 $198,062 $3,047,301 $167,602 $208,955 $2,838,346 $156,109 $220,448 $2,617,898 $143,984 $232,573 $2,385,325 $131,193 $245,364 $2,139,961 $117,698 $258,859 $1,881,102 7 8 9 10 1 11 12 13 4 5 14 Number Styles Lens Cailing 9500000 B D E F G H 1 J K L Amortization schedule: 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 50 51 1 Ending balance 0 $4,500,000 1 $247,500 $129,057 $4,370,943 2 $240,402 $136,155 $4,234,788 3 $232,913 $143,644 $4,091,144 4 $225,013 $151,544 $3,939,600 5 $216,678 $159,879 $3,779,721 6 $207,885 $168,672 $3,611,049 7 $198,608 $177,949 $3,433,100 8 $188,820 $187,737 $3,245,363 9 $178,495 $198,062 $3,047,301 10 $167,602 $208,955 $2,838,346 11 $156,109 $220,448 $2,617,898 12 $143,984 $232,573 $2,385,325 13 $131,193 $245,364 $2,139,961 14 $117,698 $258,859 $1,881,102 15 $103,461 $273,096 $1,608,005 16 $88,440 $288,117 $1,319,889 17 $72,594 $303,963 $1,015,926 18 $55,876 $320,681 $695,245 19 $38,238 $338,319 $356,926 20 $19,631 $356,926 SO A4 A5 A6 A7 A8 A9 A10 411 412 ... + A1 A2 A3