Question

The following graph depicts the market for loanable funds. An investment tax credit effectively lowers the tax bill of any firm that purchases new capital

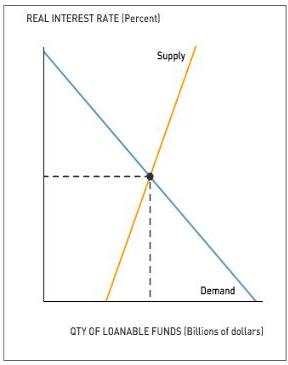

The following graph depicts the market for loanable funds. An investment tax credit effectively lowers the tax bill of any firm that purchases new capital in the relevant time period. Suppose the government repeals a previously existing investment tax credit. Shift the appropriate curve(s) on the following graph to show the impact of this policy.

|

The repeal of the previously existing tax credit causes the real interest rate to (?) and the level of investment to (?).

REAL INTEREST RATE (Percent) Supply Demand QTY OF LOANABLE FUNDS (Billions of dollars)

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

You are right The repeal of an investment tax credit would cause the demand for loa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Macroeconomics

Authors: Paul Krugman, Robin Wells, Iris Au, Jack Parkinson

3rd Canadian edition

1319120083, 1319120085, 1319190111, 9781319190118, 978-1319120054

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App