Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the Microsoft Corporation Stock that is currently trading at $334. a. Using Yahoo Finance or Bloomberg site, construct a covered call position using

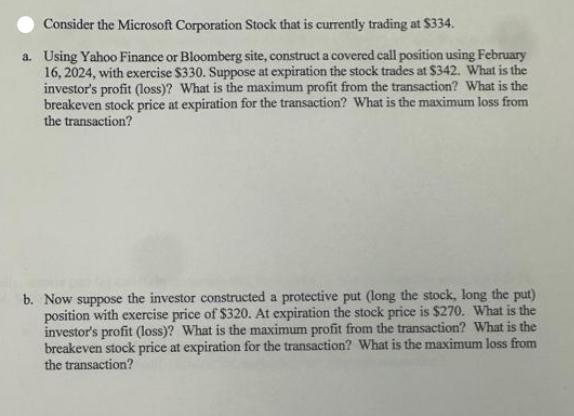

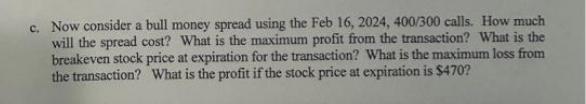

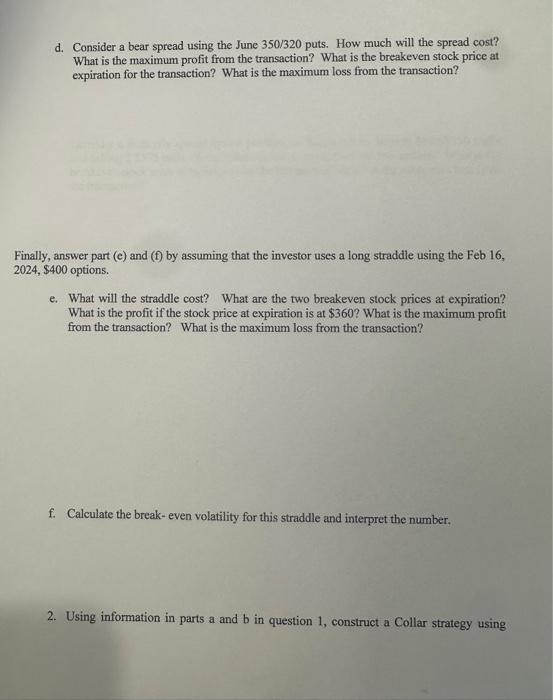

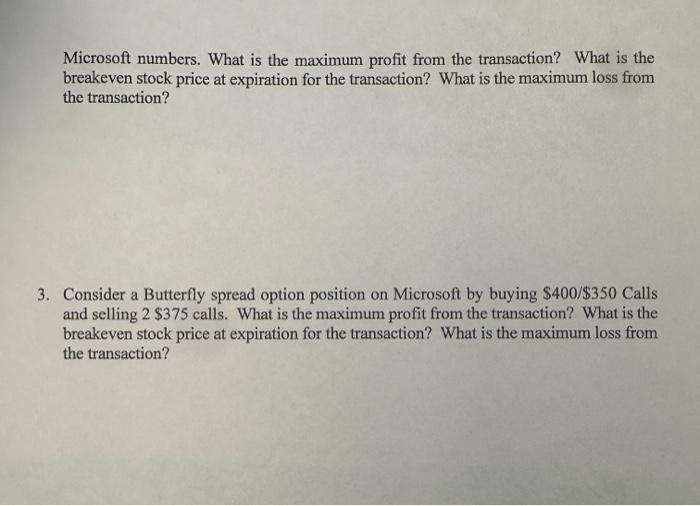

Consider the Microsoft Corporation Stock that is currently trading at $334. a. Using Yahoo Finance or Bloomberg site, construct a covered call position using February 16, 2024, with exercise $330. Suppose at expiration the stock trades at $342. What is the investor's profit (loss)? What is the maximum profit from the transaction? What is the breakeven stock price at expiration for the transaction? What is the maximum loss from the transaction? b. Now suppose the investor constructed a protective put (long the stock, long the put) position with exercise price of $320. At expiration the stock price is $270. What is the investor's profit (loss)? What is the maximum profit from the transaction? What is the breakeven stock price at expiration for the transaction? What is the maximum loss from the transaction? c. Now consider a bull money spread using the Feb 16, 2024, 400/300 calls. How much will the spread cost? What is the maximum profit from the transaction? What is the breakeven stock price at expiration for the transaction? What is the maximum loss from the transaction? What is the profit if the stock price at expiration is $470? d. Consider a bear spread using the June 350/320 puts. How much will the spread cost? What is the maximum profit from the transaction? What is the breakeven stock price at expiration for the transaction? What is the maximum loss from the transaction? Finally, answer part (e) and (f) by assuming that the investor uses a long straddle using the Feb 16, 2024, $400 options. e. What will the straddle cost? What are the two breakeven stock prices at expiration? What is the profit if the stock price at expiration is at $360? What is the maximum profit from the transaction? What is the maximum loss from the transaction? f. Calculate the break-even volatility for this straddle and interpret the number. 2. Using information in parts a and b in question 1, construct a Collar strategy using Microsoft numbers. What is the maximum profit from the transaction? What is the breakeven stock price at expiration for the transaction? What is the maximum loss from the transaction? 3. Consider a Butterfly spread option position on Microsoft by buying $400/$350 Calls and selling 2 $375 calls. What is the maximum profit from the transaction? What is the breakeven stock price at expiration for the transaction? What is the maximum loss from the transaction?

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Covered Call The investor has sold 100 shares of MSFT at 334 and purchased 100 calls with an exercise price of 330 If the stock price at expiration is 342 the investors profit would be Profit Sale P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started