Question

Consider the model Y = Bxi + U,; i = 1, 2,..., n (1) where u, a random variable with mean zero and constant

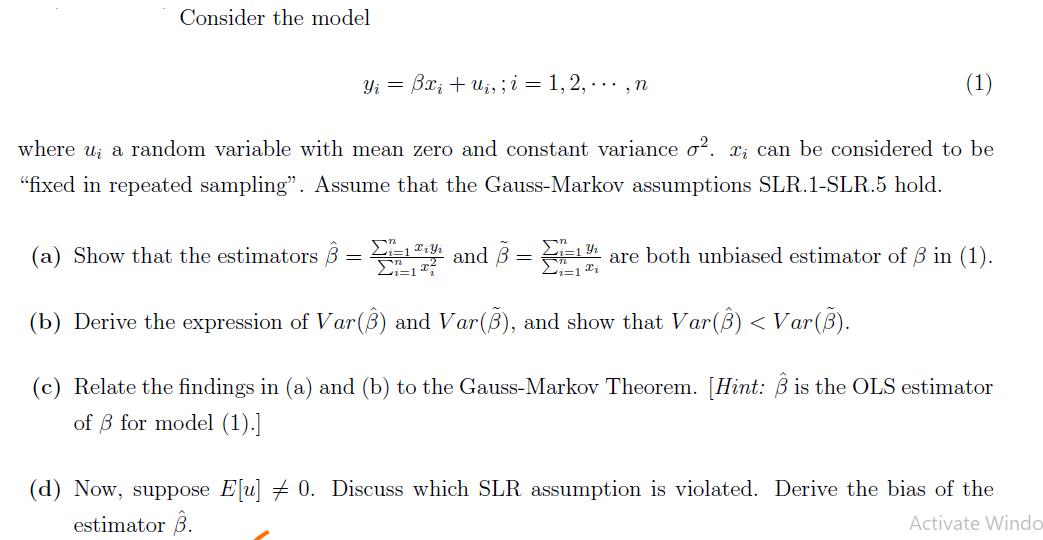

Consider the model Y = Bxi + U,; i = 1, 2,..., n (1) where u, a random variable with mean zero and constant variance o2. r, can be considered to be "fixed in repeated sampling". Assume that the Gauss-Markov assumptions SLR.1-SLR.5 hold. (a) Show that the estimators =1 and 3 n Dn = i=1 yi 2i=1 Fi (b) Derive the expression of Var(3) and Var(3), and show that Var(3) < Var (3). are both unbiased estimator of 3 in (1). (c) Relate the findings in (a) and (b) to the Gauss-Markov Theorem. [Hint: is the OLS estimator of 3 for model (1).] (d) Now, suppose E[u] 0. Discuss which SLR assumption is violated. Derive the bias of the estimator 3. Activate Windo

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Unbiasedness of OLS estimators By definition xi21 xiyi Taking expectations on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction to the Mathematics of financial Derivatives

Authors: Salih N. Neftci

2nd Edition

978-0125153928, 9780080478647, 125153929, 978-0123846822

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App