Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the MSFT option prices below (prices at closing on April 29, 2022). Microsoft current stock price is $278 Assume no dividends Expiry of options

Consider the MSFT option prices below (prices at closing on April 29, 2022).

- Microsoft current stock price is $278

- Assume no dividends

- Expiry of options October 21, 2022 (assume 172 days to expiration)

Calls (EXPIRATION: 12/20/2020) PUTS (EXPIRATION 12/20/2020)

| Strike | Price | Intrinsic value | Implied Variance |

| Strike | Price | Intrinsic Value | Implied Variance |

| 270 | $36.00 |

|

|

| 270 | $20.80 |

|

|

| 300 | $15.25 |

|

|

| 300 | $35.70 |

|

|

- Identify the above options as in-the-money and out-of-the-money.

- Why are the intrinsic values different from the market prices?

- What is the average implied variance of annual returns of MSFT shares in the above options?

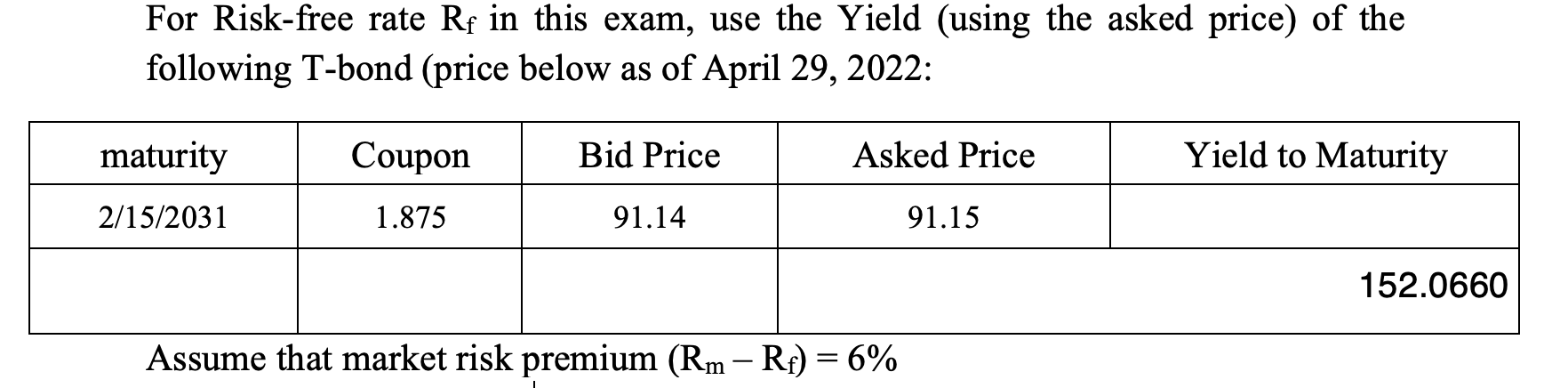

- Use the annual risk-free rate from the YTM of the 10-year bond and the call prices above to find the prices of Put options using the Put-Call Parity model. How do these prices compare to the market prices of the Puts? Are there any arbitrage opportunities?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started