Answered step by step

Verified Expert Solution

Question

1 Approved Answer

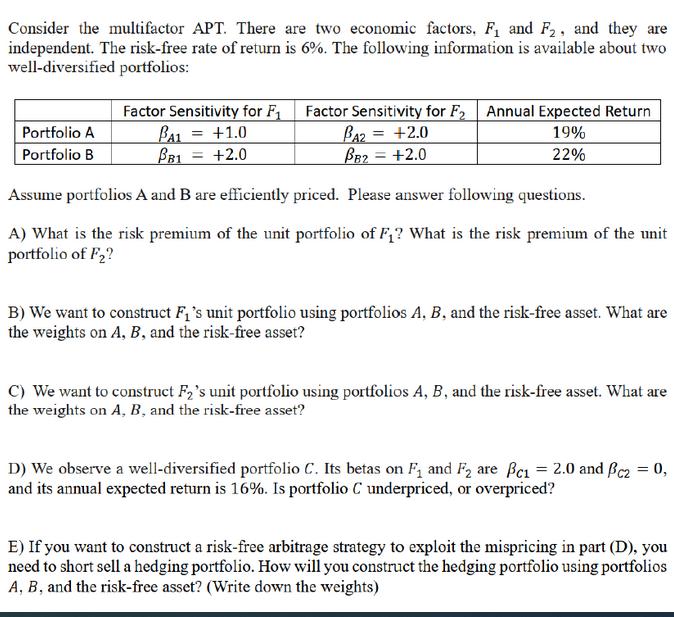

Consider the multifactor APT. There are two economic factors. F and F, and they are independent. The risk-free rate of return is 6%. The

Consider the multifactor APT. There are two economic factors. F and F, and they are independent. The risk-free rate of return is 6%. The following information is available about two well-diversified portfolios: Factor Sensitivity for F Factor Sensitivity for F Annual Expected Return Portfolio A BA1 = +1.0 Portfolio B BB1 = +2.0 BA2 = +2.0 BB2 = +2.0 19% 22% Assume portfolios A and B are efficiently priced. Please answer following questions. A) What is the risk premium of the unit portfolio of F? What is the risk premium of the unit portfolio of F? B) We want to construct F's unit portfolio using portfolios A, B, and the risk-free asset. What are the weights on A, B, and the risk-free asset? C) We want to construct F2's unit portfolio using portfolios A, B, and the risk-free asset. What are the weights on A, B, and the risk-free asset? == D) We observe a well-diversified portfolio C. Its betas on F and F2 are Bc1 = 2.0 and c2 = 0, and its annual expected return is 16%. Is portfolio C underpriced, or overpriced? E) If you want to construct a risk-free arbitrage strategy to exploit the mispricing in part (D), you need to short sell a hedging portfolio. How will you construct the hedging portfolio using portfolios A, B, and the risk-free asset? (Write down the weights)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started