Answered step by step

Verified Expert Solution

Question

1 Approved Answer

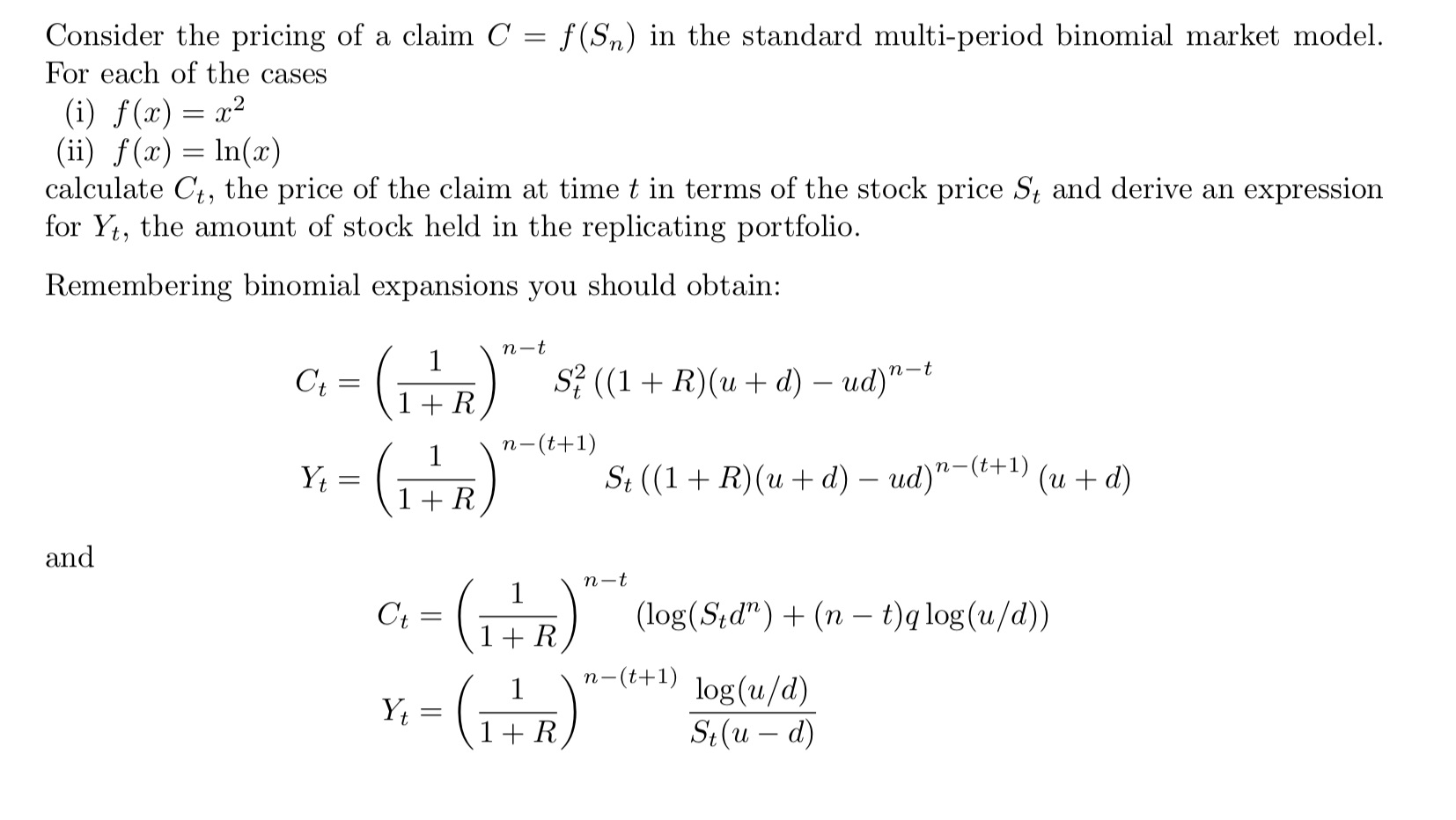

Consider the pricing of a claim C = f(Sn) in the standard multi-period binomial market model. For each of the cases (i) f(x) =

Consider the pricing of a claim C = f(Sn) in the standard multi-period binomial market model. For each of the cases (i) f(x) = x (ii) f(x) = ln(x) calculate Ct, the price of the claim at time t in terms of the stock price St and derive an expression for Yt, the amount of stock held in the replicating portfolio. Remembering binomial expansions you should obtain: and Ct = Yt = n-t n-t (1+R) S ((1 + R) (u + d) ud)t Ct = 1 + R = n-(t+1) 1 + R Yt Y = (1 + R) 1 - St ((1+R)(u+ d) - ud) "-(t+1) (u + d) n-t (log(Std) + (n t)q log(u/d)) n(t+1) log(u/d) St (u - d) -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets consider the pricing of a claim C fSn in the standard multiperiod binomial market model Well derive the expressions for Ct the price of the claim ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started