Question

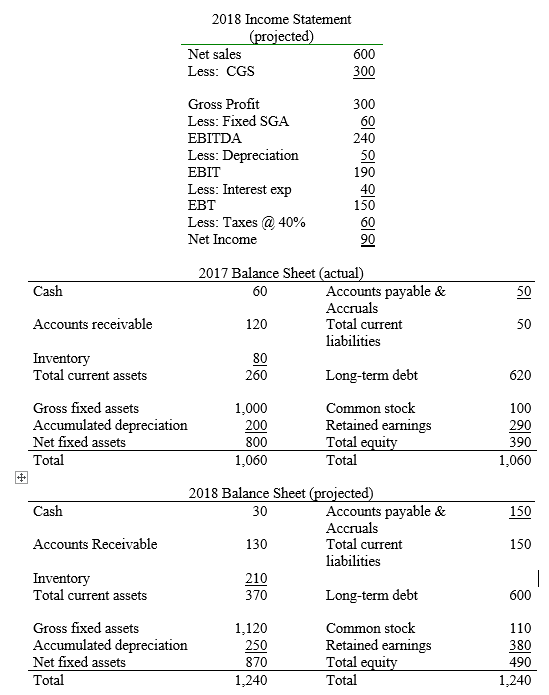

Consider the pro forma & actual financial statements below for MQ Software (MQ): 1. What is MQs projected Cash Build for 2018? 2.What is MQs

Consider the pro forma & actual financial statements below for MQ Software (MQ):

1. What is MQs projected Cash Build for 2018?

2.What is MQs projected Cash Burn for 2018?

3.Prepare MQs proforma Statement of Cash Flows for 2017. (Make sure you reconcile the beginning and ending cash balances)

4.What is the Companys EBITDA Breakeven in 2018?

5.What Degree of Operating Leverage (DOL) is imputed in MQs Operating Expense structure for 2018 at the projected Sales level of 600? (remember that Sales could be 600; 6,000; 6,000,000, or 60,000,000)

6.If Sales INCREASE by 20%; what would 2018 projected EBITDA be?

2018 Income Statement ected Net sales Less: CGS Gross Profit Less: Fixed SGA EBITDA Less: Depreciation EBIT Less: Interest exp EBT Less: Taxes @ 40% Net Income 300 300 240 190 150 2017 Balance Sheet (actual Cash Accounts payable & Total current liabilities Accounts receivable 120 50 Inventory Total current assets 260 1,000 800 Long-term debt 620 Gross fixed assets Accumulated depreciation Net fixed assets Total Common stock Retained earnings Total Total 100 290 390 1,060 1,060 2018 Balance Sheet (proiected Cash 30 Accounts payable & Total current liabilities Accounts Receivable 130 150 Inventory Total current assets 370 Long-term debt Gross fixed assets Accumulated depreciation Net fixed assets Total Common stock Retained earnings Total Total 110 1,120 250 870 1,240 490 1,240Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started