Answered step by step

Verified Expert Solution

Question

1 Approved Answer

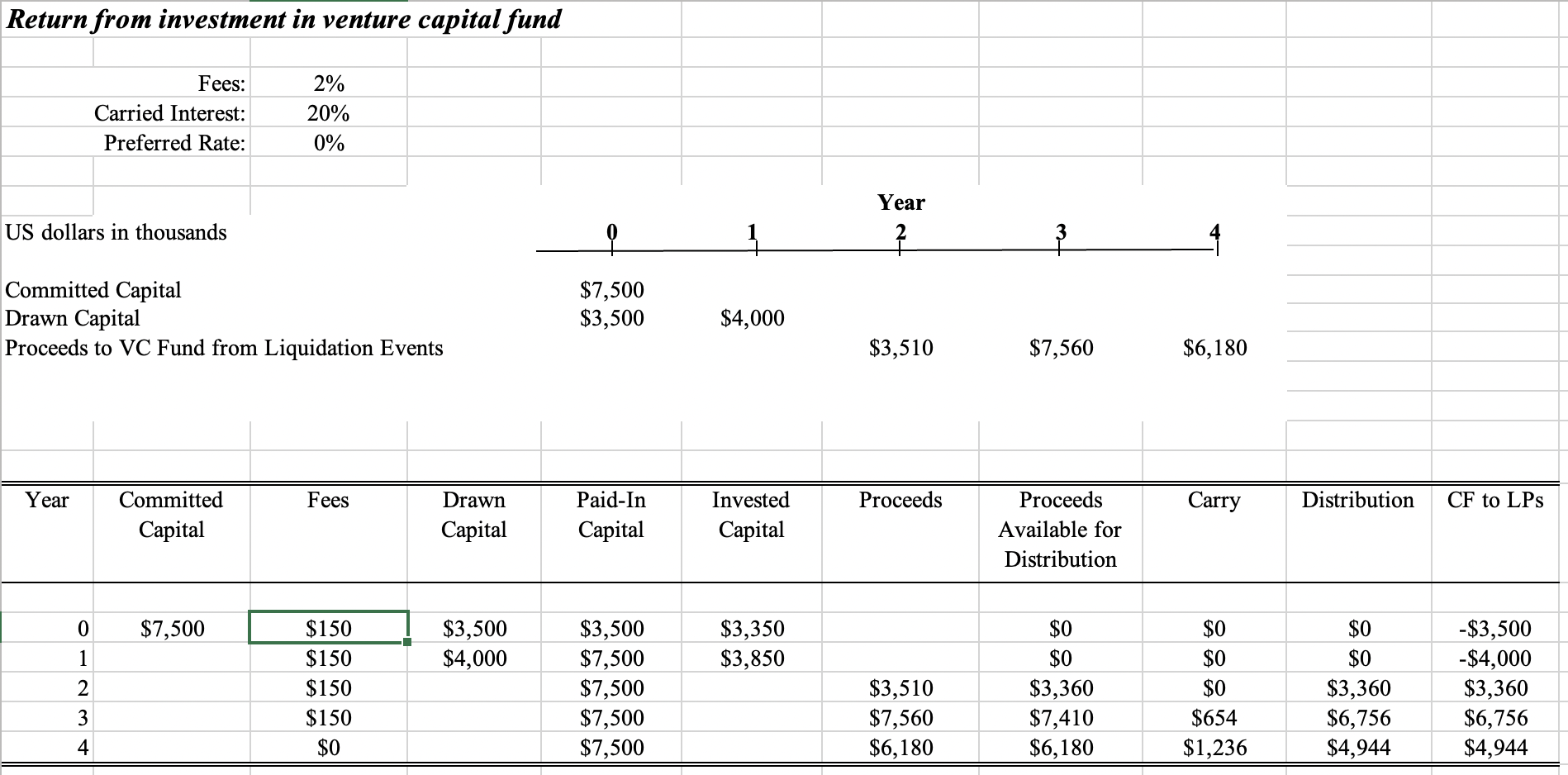

Consider the representative investment in the venture capital fund shown in the worksheet VC Fund I in the student spreadsheet file. Assume that the FoF

- Consider the representative investment in the venture capital fund shown in the worksheet "VC Fund I" in the student spreadsheet file. Assume that the FoF or Investure commits $7.5 million to VC Fund I.

- Estimate the returns to a limited partner that invests in VC Fund I through an FoF with the following terms: The FoF has a management fee of 1.5%, carried interest of 10%, and a preferred rate of 8% per annum, compounded annually.

- Estimate the returns to a limited partner that invests in VC Fund I through Investure. Investure has a management fee of 0.4%, carried interest of 3%, and a preferred rate of 10%. Profits above 20% are not subject to carried interest.

Return from investment in venture capital fund US dollars in thousands Fees: Carried Interest: Preferred Rate: Year Committed Capital Drawn Capital Proceeds to VC Fund from Liquidation Events 0 1 2 3 4 Committed Capital 2% 20% 0% $7,500 Fees $150 $150 $150 $150 $0 Drawn Capital $3,500 $4,000 $7,500 $3,500 Paid-In Capital $3,500 $7,500 $7,500 $7,500 $7,500 $4,000 Invested Capital $3,350 $3,850 Year $3,510 Proceeds $3,510 $7,560 $6,180 3 $7,560 Proceeds Available for Distribution $0 $0 $3,360 $7,410 $6,180 $6,180 Carry $0 $0 $0 $654 $1,236 Distribution $0 $0 $3,360 $6,756 $4,944 CF to LPs -$3,500 -$4,000 $3,360 $6,756 $4,944

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the returns to a limited partner LP that invests in VC Fund I through an FoF or Investure we need to calculate the net cash flows and inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started