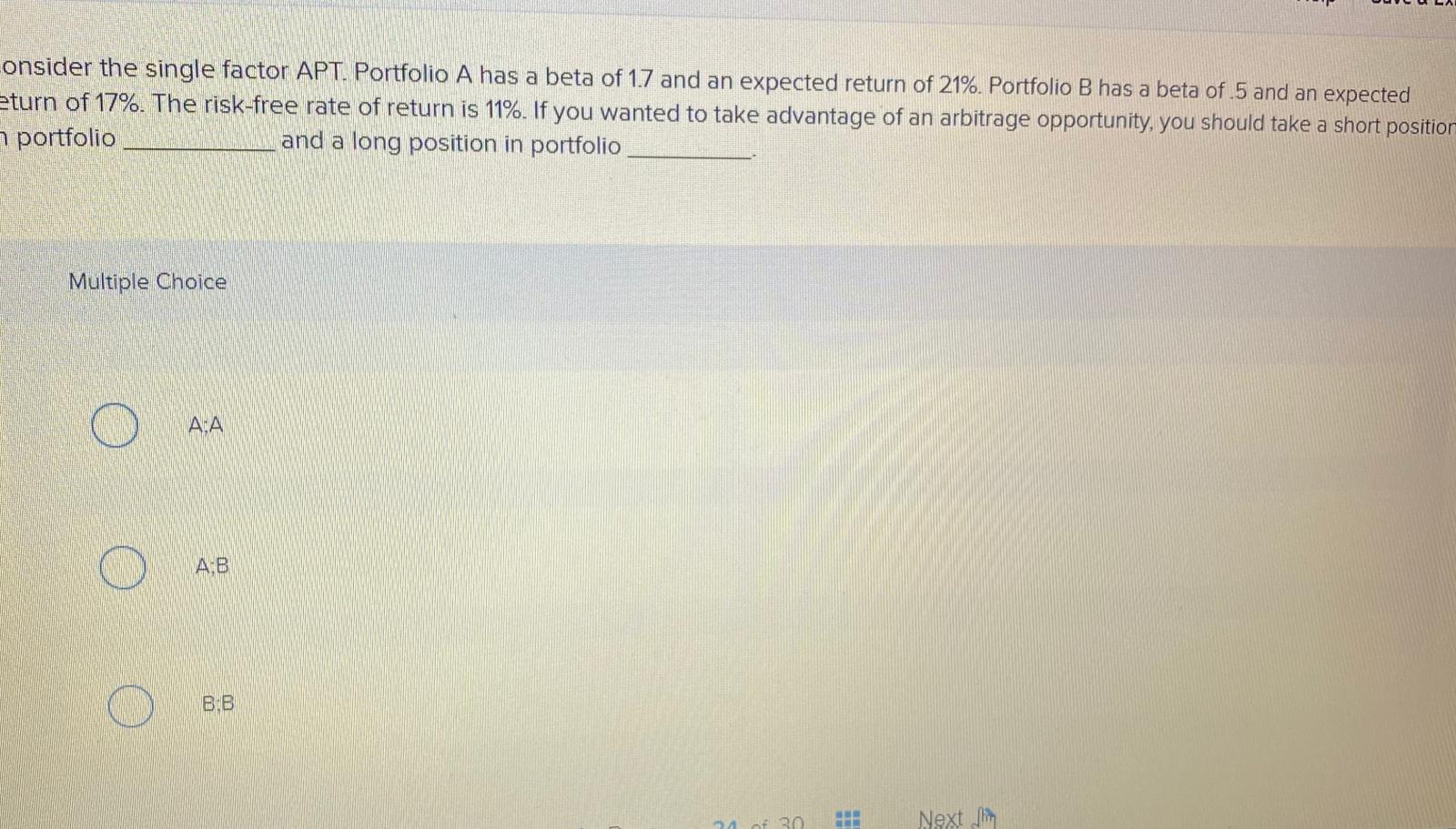

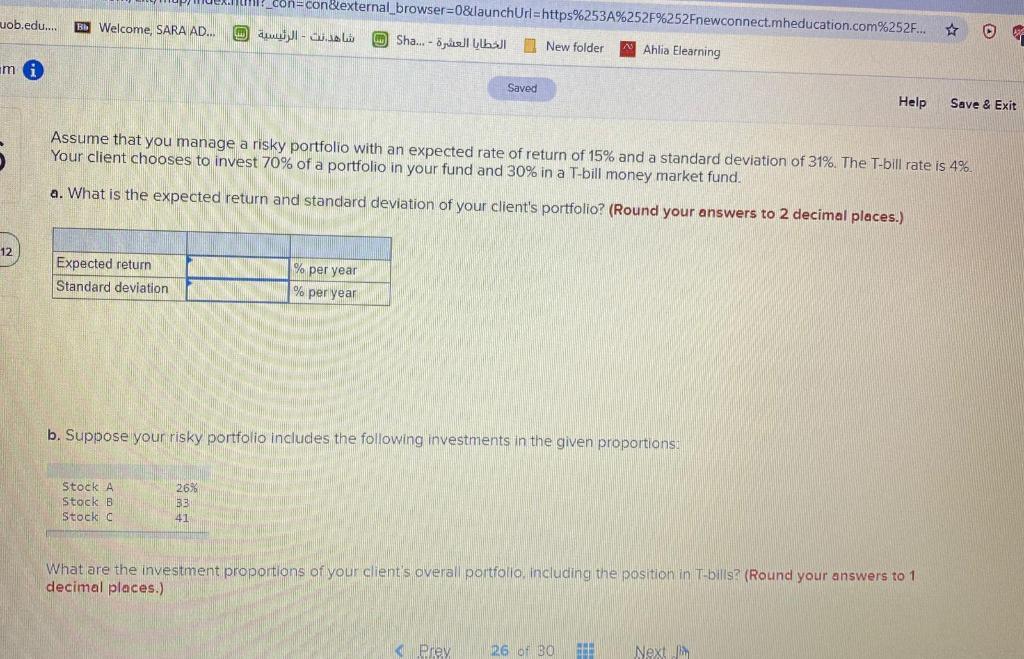

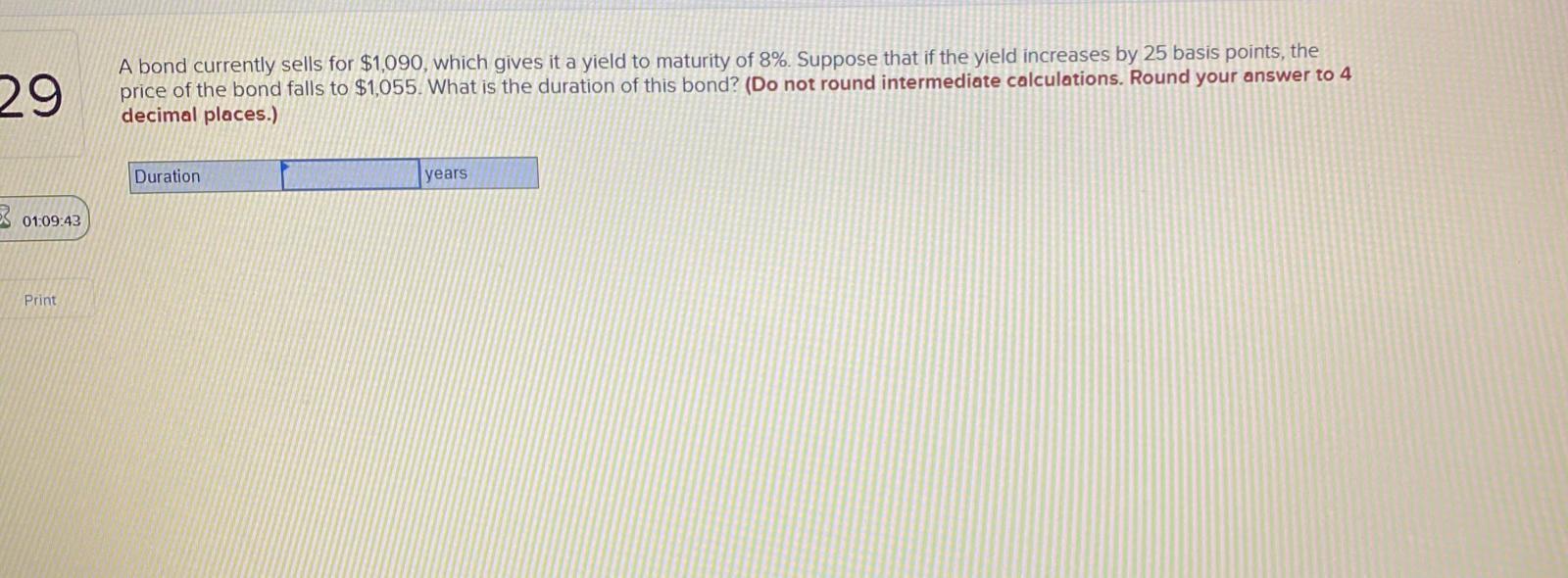

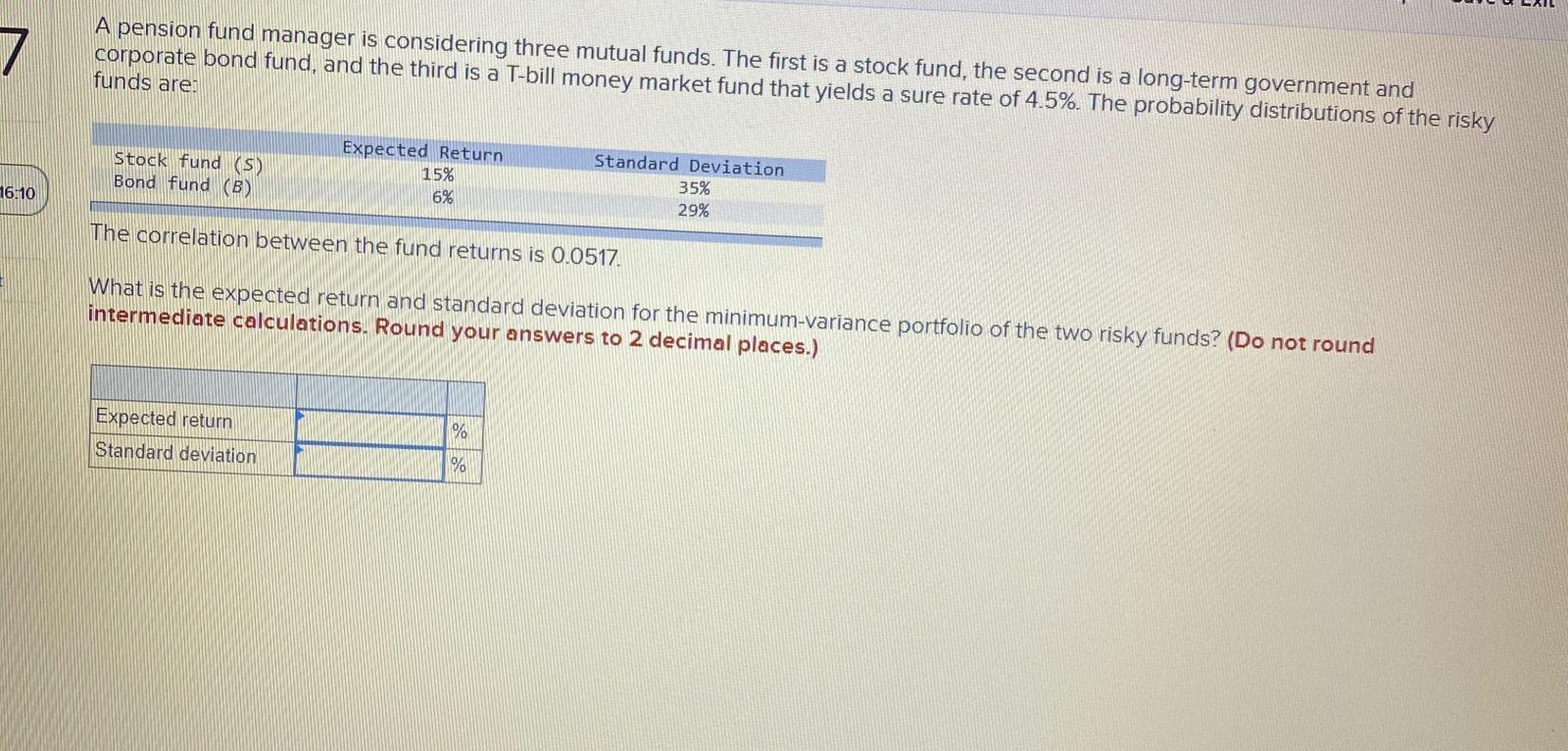

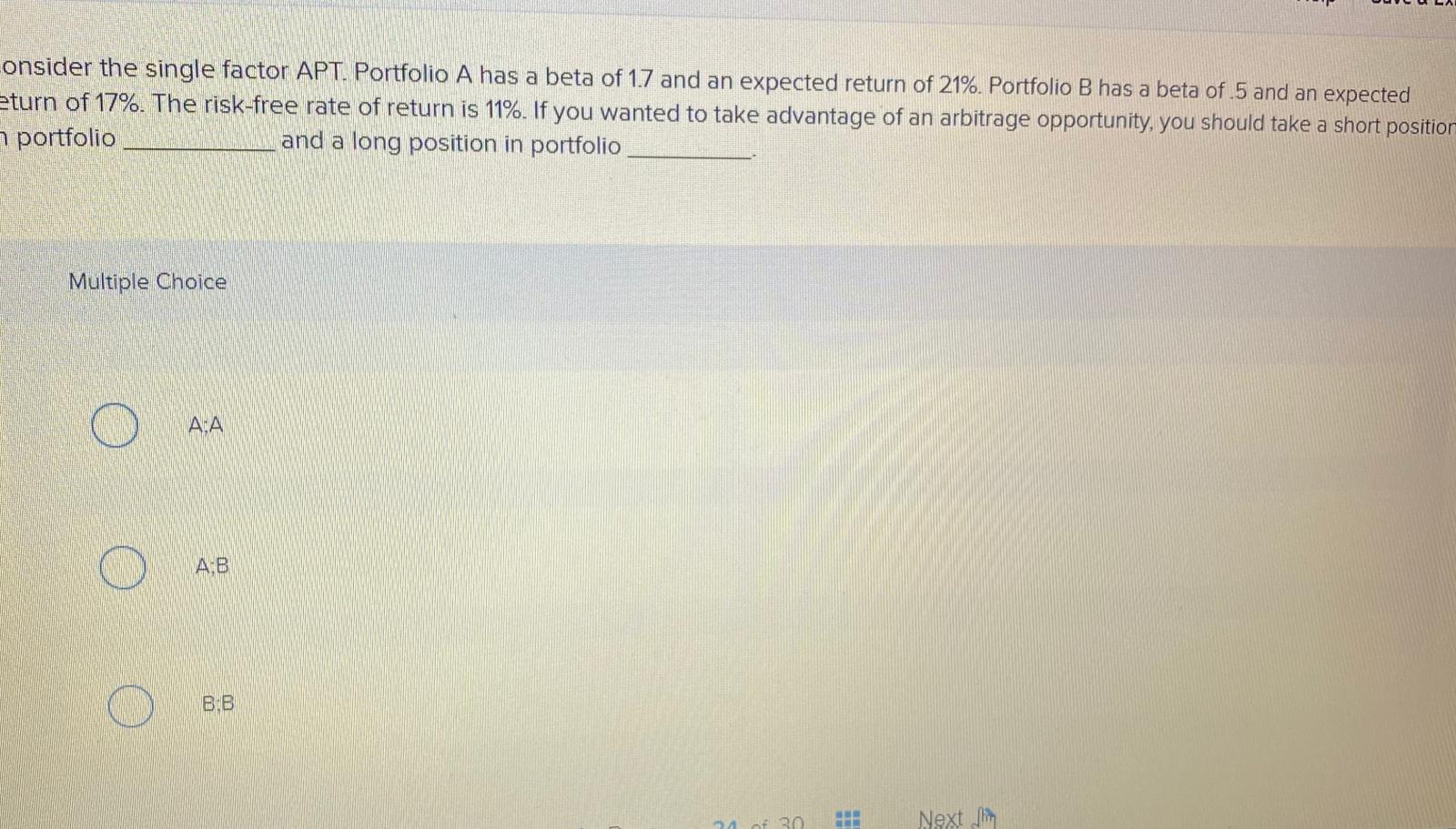

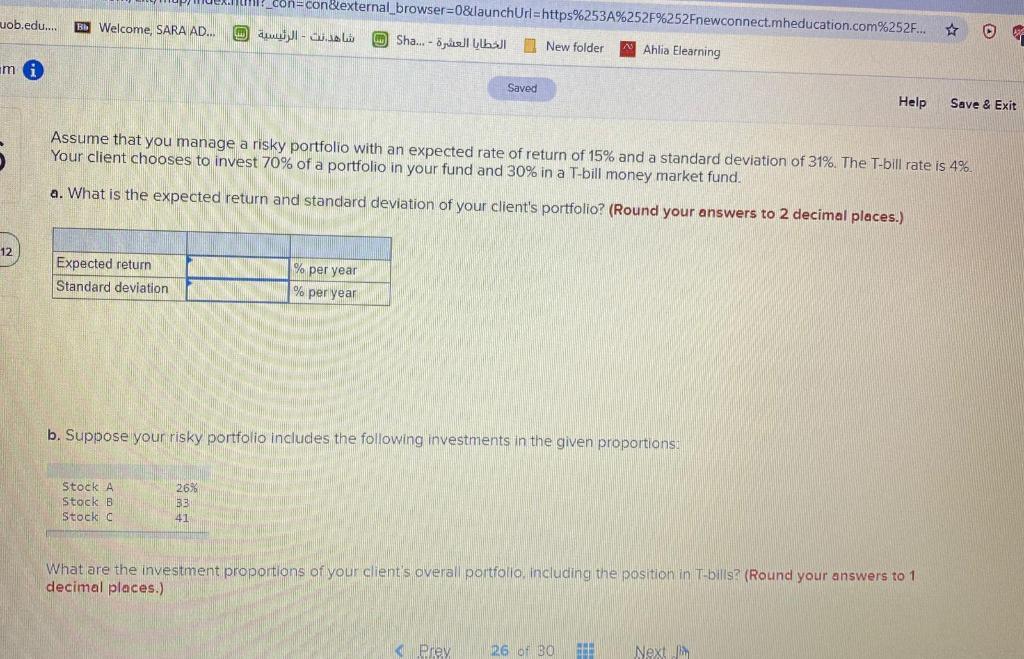

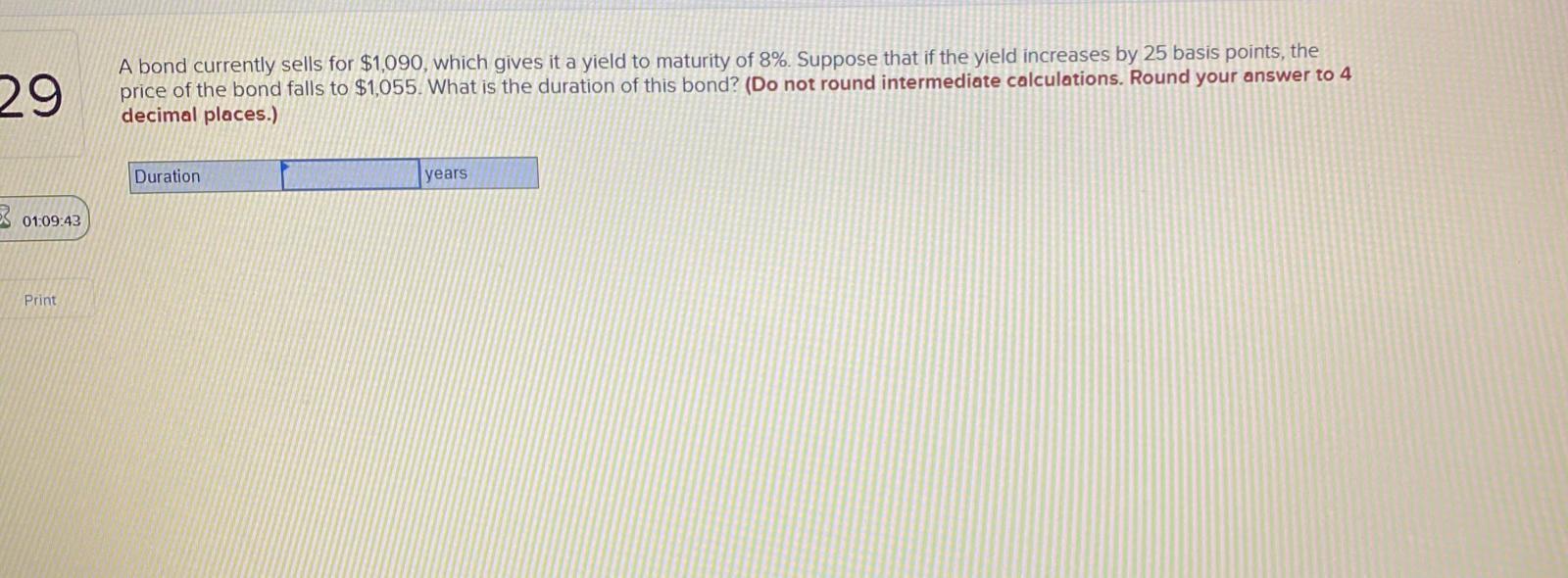

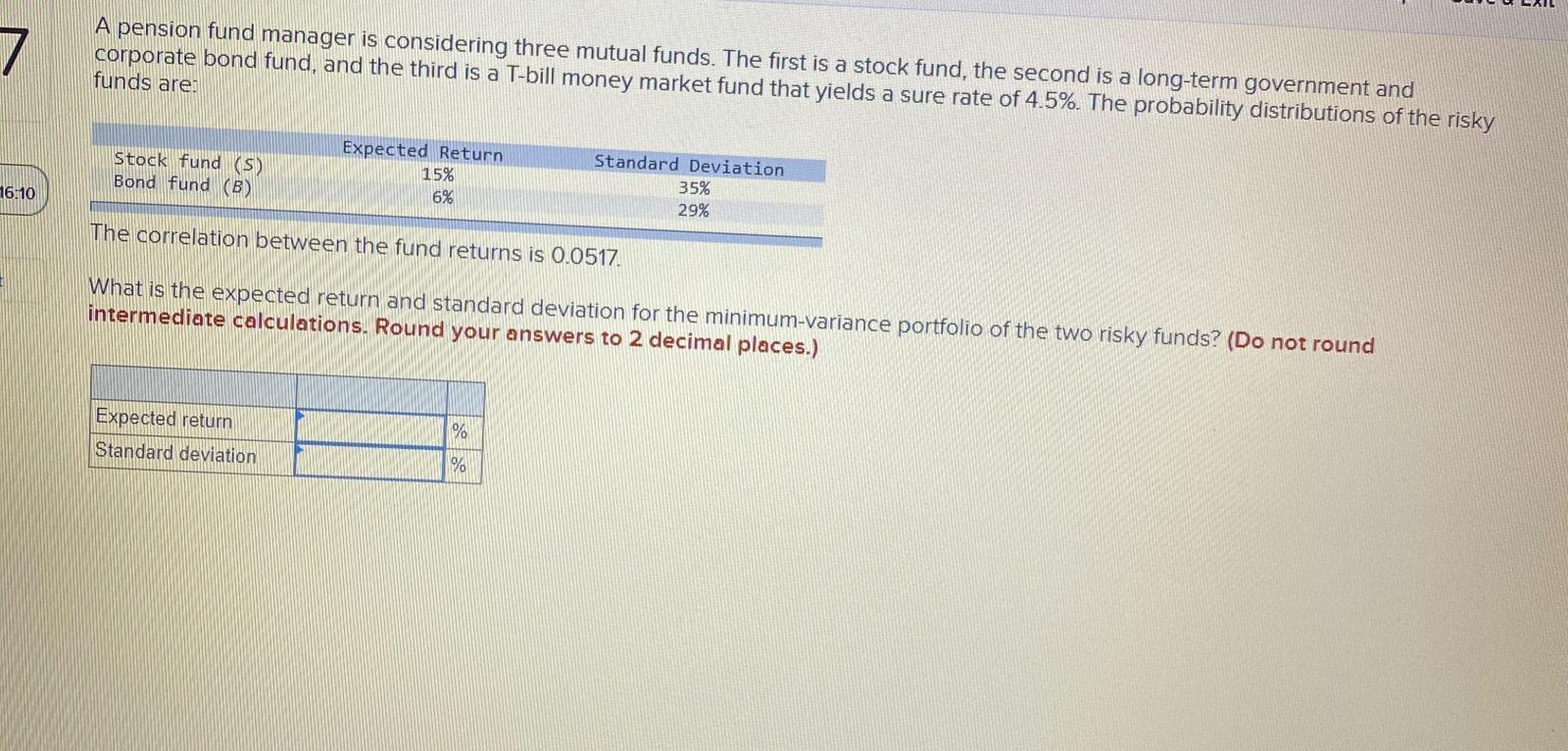

consider the single factor APT. Portfolio A has a beta of 17 and an expected return of 21%. Portfolio B has a beta of 5 and an expected eturn of 17%. The risk-free rate of return is 11%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position 7 portfolio and a long position in portfolio Multiple Choice AA A:B BB 30 Next to _con=con&external_browser=0&launchUri=https%253A%252F%252Fnewconnect.mheducation.com%252F... uob.edu... BB Welcome, SARA AD... * - - .Sha New folder Ahlia Elearning mi Saved Help Save & Exit Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 31%. The T-bill rate is 4% Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. a. What is the expected return and standard deviation of your client's portfolio? (Round your answers to 2 decimal places.) 12 Expected return Standard deviation % per year % per year b. Suppose your risky portfolio includes the following investments in the given proportions: Stock A Stock B Stock C 26% BB 41 What are the investment proportions of your client's overal portfolio, including the position in T-bills? (Round your answers to 1 decimal places.) Prey 26 of 30 Next 29 A bond currently sells for $1,090, which gives it a yield to maturity of 8%. Suppose that if the yield increases by 25 basis points, the price of the bond falls to $1,055. What is the duration of this bond? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Duration years ES 01:09:43 Print 7 A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 4.5%. The probability distributions of the risky funds are: Stock fund (5) Bond fund (8) Expected Return 15% 6% Standard Deviation 35% 29% 16:10 The correlation between the fund returns is 0.0517. What is the expected return and standard deviation for the minimum-variance portfolio of the two risky funds? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected return Standard deviation % % consider the single factor APT. Portfolio A has a beta of 17 and an expected return of 21%. Portfolio B has a beta of 5 and an expected eturn of 17%. The risk-free rate of return is 11%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position 7 portfolio and a long position in portfolio Multiple Choice AA A:B BB 30 Next to _con=con&external_browser=0&launchUri=https%253A%252F%252Fnewconnect.mheducation.com%252F... uob.edu... BB Welcome, SARA AD... * - - .Sha New folder Ahlia Elearning mi Saved Help Save & Exit Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 31%. The T-bill rate is 4% Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. a. What is the expected return and standard deviation of your client's portfolio? (Round your answers to 2 decimal places.) 12 Expected return Standard deviation % per year % per year b. Suppose your risky portfolio includes the following investments in the given proportions: Stock A Stock B Stock C 26% BB 41 What are the investment proportions of your client's overal portfolio, including the position in T-bills? (Round your answers to 1 decimal places.) Prey 26 of 30 Next 29 A bond currently sells for $1,090, which gives it a yield to maturity of 8%. Suppose that if the yield increases by 25 basis points, the price of the bond falls to $1,055. What is the duration of this bond? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Duration years ES 01:09:43 Print 7 A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 4.5%. The probability distributions of the risky funds are: Stock fund (5) Bond fund (8) Expected Return 15% 6% Standard Deviation 35% 29% 16:10 The correlation between the fund returns is 0.0517. What is the expected return and standard deviation for the minimum-variance portfolio of the two risky funds? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected return Standard deviation % %