Question

Return on Assets (ROA) The following information relates to the operating performance of two divisions of Campbell Food International Company's: 1) Soup and Sauces

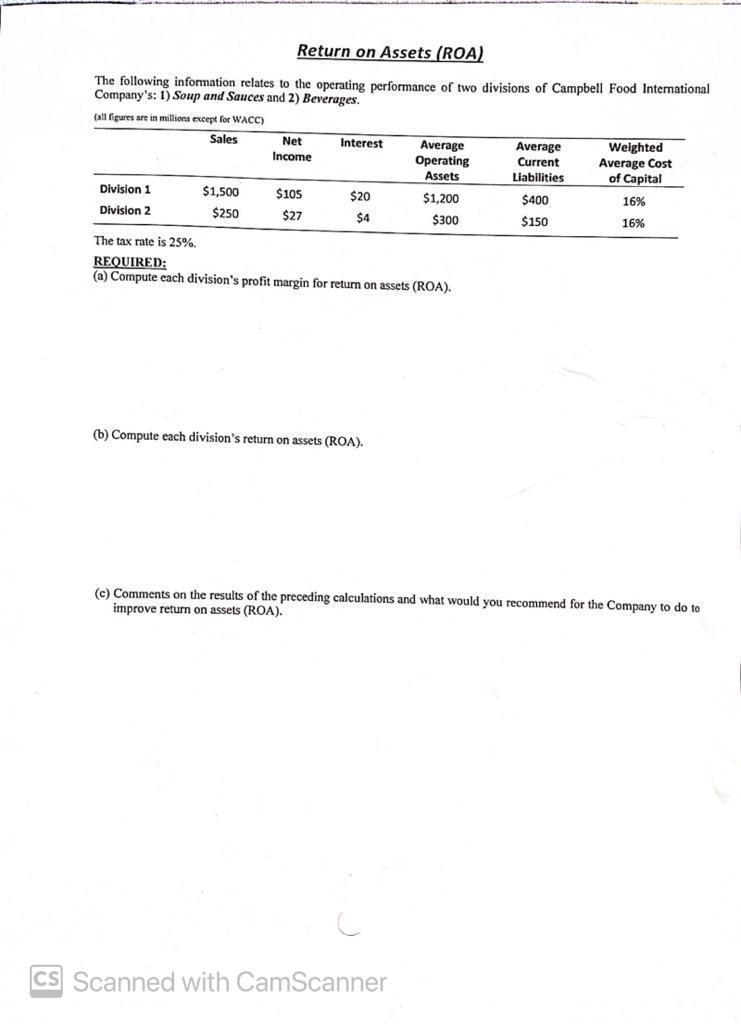

Return on Assets (ROA) The following information relates to the operating performance of two divisions of Campbell Food International Company's: 1) Soup and Sauces and 2) Beverages. (all figures are in millions except i WACC) Sales Division 1 Division 2 $1,500 $250 Net Income $105 $27 Interest $20 $4 The tax rate is 25%. REQUIRED: (a) Compute each division's profit margin for return on assets (ROA). (b) Compute each division's return on assets (ROA). Average Operating Assets $1,200 $300 CS Scanned with CamScanner Average Current Liabilities $400 $150 Weighted Average Cost of Capital 16% 16% (c) Comments on the results of the preceding calculations and what would you recommend for the Company to do to improve return on assets (ROA).

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elements of Electromagnetics

Authors: Matthew

3rd Edition

019513477X, 978-0195134773

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App