Answered step by step

Verified Expert Solution

Question

1 Approved Answer

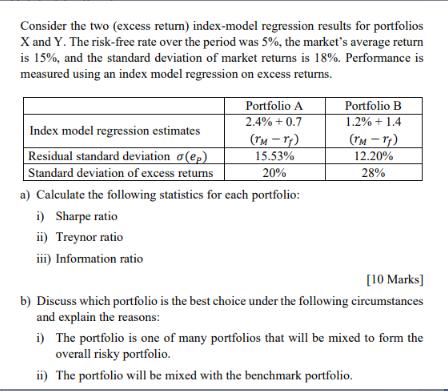

Consider the two (excess return) index-model regression results for portfolios X and Y. The risk-free rate over the period was 5%, the market's average

![iii) The portfolio is the only risky portfolio for an investor. [6 Marks] 2) In a particular year, Hoody](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/05/646dbb9ee9057_1684913053257.jpg)

Consider the two (excess return) index-model regression results for portfolios X and Y. The risk-free rate over the period was 5%, the market's average return is 15%, and the standard deviation of market returns is 18%. Performance is measured using an index model regression on excess returns. Portfolio A 2.4% +0.7 Index model regression estimates (TM-TT) Residual standard deviation a(ep) 15.53% Standard deviation of excess returns 20% a) Calculate the following statistics for each portfolio: i) Sharpe ratio ii) Treynor ratio iii) Information ratio Portfolio B 1.2 % +1.4. (TM-TT) 12.20% 28% [10 Marks] b) Discuss which portfolio is the best choice under the following circumstances and explain the reasons: i) The portfolio is one of many portfolios that will be mixed to form the overall risky portfolio. ii) The portfolio will be mixed with the benchmark portfolio. iii) The portfolio is the only risky portfolio for an investor. [6 Marks] 2) In a particular year, Hoody Mutual Fund made investments in the following asset classes. Bonds Stocks Cash Actual weight 30% 60% 10% Bonds (Baclay Bond Index) Stocks (S&P 500) Cash (money market) Actual return 3% 10% 1% The benchmark portfolio (i.e. the bogey) has the following characteristics: Benchmark weight Index return 50% 2% 40% 6% 10% 1% a) Calculate the average returns of Hoody Mutual Fund and the benchmark portfolio in the year. [2 marks] b) Calculate the total excess return of Hoody Mutual Fund over the benchmark portfolio. [2 marks] c) Calculate the contribution of sector and security selection to relative performance. [5 Marks] d) Calculate the contribution of asset allocation to relative performance. [5 Marks]

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here are the responses for the questions a i Sharpe ratio for portfolio A Average return Risk free r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started