Question

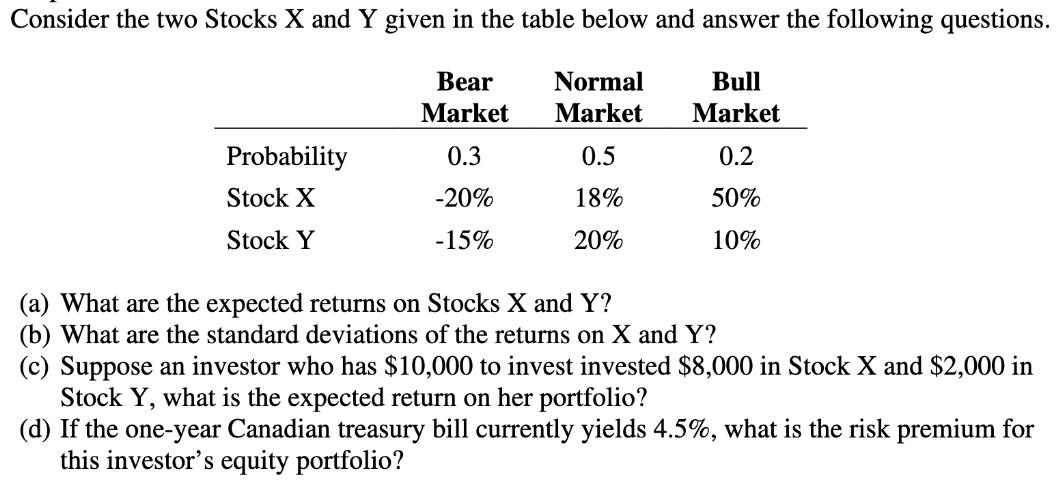

Consider the two Stocks X and Y given in the table below and answer the following questions. Bear Market 0.3 -20% -15% Probability Stock

Consider the two Stocks X and Y given in the table below and answer the following questions. Bear Market 0.3 -20% -15% Probability Stock X Stock Y Normal Market 0.5 18% 20% Bull Market 0.2 50% 10% What are the expected returns on Stocks X and Y? (b) What are the standard deviations of the returns on X and Y? (c) Suppose an investor who has $10,000 to invest invested $8,000 in Stock X and $2,000 in Stock Y, what is the expected return on her portfolio? (d) If the one-year Canadian treasury bill currently yields 4.5%, what is the risk premium for this investor's equity portfolio?

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Consider the two Stocks X and Y given in the table below and answer the following questions Bear Mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Basic Statistics

Authors: Charles Henry Brase, Corrinne Pellillo Brase

6th Edition

978-1133525097, 1133525091, 1111827028, 978-1133110316, 1133110312, 978-1111827021

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App