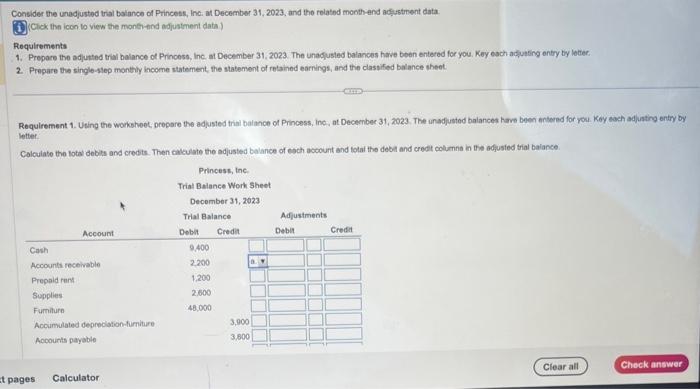

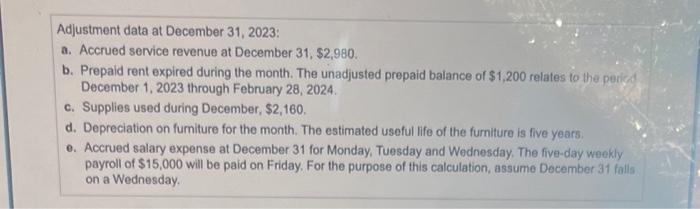

Consider the unadjusted trial balance of Princess, Inc. at December 31, 2023, and the related monthand adjustrment data [1] (Cick the icon to view the monthind adiutment data ) Requlrements 1. Prepare the adjutted trial balance of Prinoess, Inc. at December 31, 2023. The unadusted balances have been entered for you. K6y esch adjuting ontry ty letter. 2. Prepare the singlestep montily income statement, the statement of retained earnings, and the classifed balance sheot: Requirement 1. Ueing the workshoet, propare the adjusted trial balance of Princess, ine, at December 31, 2023. The unadjusted balances have been antered for you: Key each adjuting entry by letter. Calculate the lota deble and credts. Then calculate the adjusted balance of eoch account and totat the debal and crodit columne in the adiusted trial balance. Adjustment data at December 31, 2023: a. Accrued service revenue at December 31,$2,980. b. Prepaid rent expired during the month. The unadjusted prepaid balance of $1,200 relates to the perigd December 1, 2023 through February 28, 2024. c. Supplies used during December, $2,160. d. Depreciation on furmiture for the month. The estimated useful life of the furniture is five years: e. Accrued salary expense at December 31 for Monday, Tuesday and Wednesday. The five-day weekly payroll of $15,000 will be paid on Friday. For the purpose of this calculation, assume December 31 falls on a Wednesday. Consider the unadjusted trial balance of Princess, Inc. at December 31, 2023, and the related monthand adjustrment data [1] (Cick the icon to view the monthind adiutment data ) Requlrements 1. Prepare the adjutted trial balance of Prinoess, Inc. at December 31, 2023. The unadusted balances have been entered for you. K6y esch adjuting ontry ty letter. 2. Prepare the singlestep montily income statement, the statement of retained earnings, and the classifed balance sheot: Requirement 1. Ueing the workshoet, propare the adjusted trial balance of Princess, ine, at December 31, 2023. The unadjusted balances have been antered for you: Key each adjuting entry by letter. Calculate the lota deble and credts. Then calculate the adjusted balance of eoch account and totat the debal and crodit columne in the adiusted trial balance. Adjustment data at December 31, 2023: a. Accrued service revenue at December 31,$2,980. b. Prepaid rent expired during the month. The unadjusted prepaid balance of $1,200 relates to the perigd December 1, 2023 through February 28, 2024. c. Supplies used during December, $2,160. d. Depreciation on furmiture for the month. The estimated useful life of the furniture is five years: e. Accrued salary expense at December 31 for Monday, Tuesday and Wednesday. The five-day weekly payroll of $15,000 will be paid on Friday. For the purpose of this calculation, assume December 31 falls on a Wednesday