Answered step by step

Verified Expert Solution

Question

1 Approved Answer

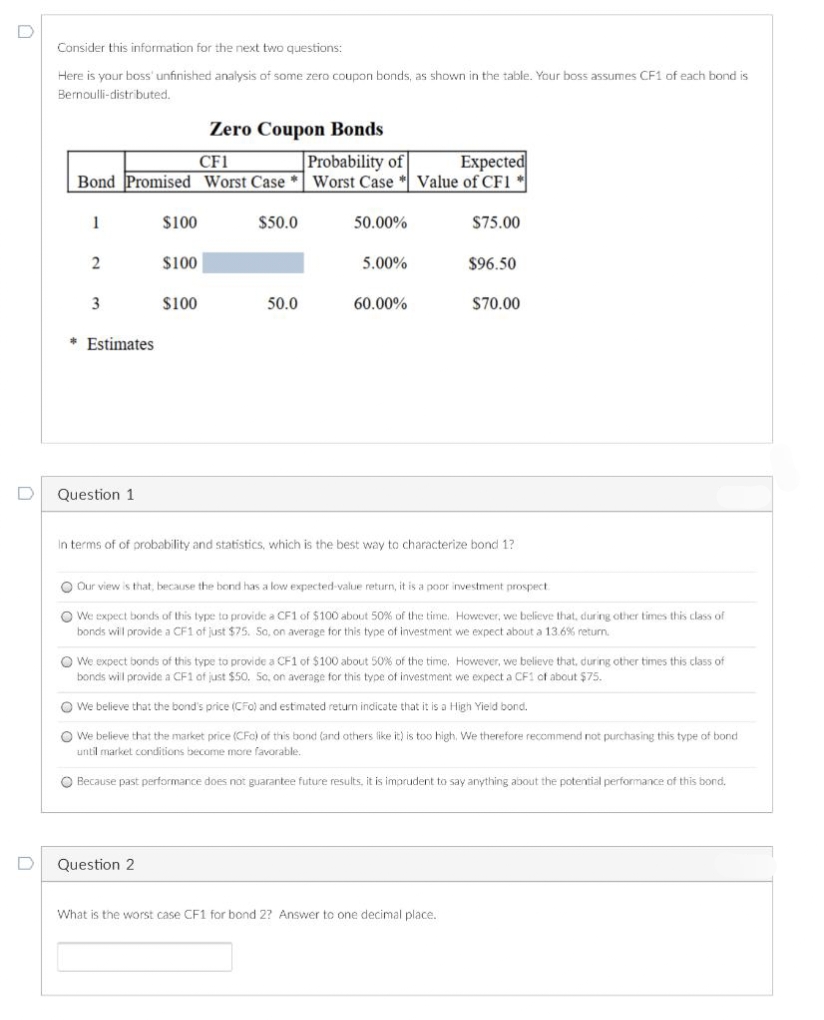

Consider this information for the next two questions: Here is your boss' unfinished analysis of some zero coupon bonds, as shown in the table.

Consider this information for the next two questions: Here is your boss' unfinished analysis of some zero coupon bonds, as shown in the table. Your boss assumes CF1 of each bond is Bernoulli-distributed. Zero Coupon Bonds CF1 Bond Promised Worst Case Worst Case Probability of Expected Value of CF1 1 $100 $50.0 50.00% $75.00 2 $100 5.00% $96.50 3 $100 50.0 60.00% $70.00 * Estimates Question 1 In terms of of probability and statistics, which is the best way to characterize bond 1? Our view is that, because the bond has a low expected-value return, it is a poor investment prospect We expect bonds of this type to provide a CF1 of $100 about 50% of the time. However, we believe that, during other times this class of bonds will provide a CF1 of just $75. So, on average for this type of investment we expect about a 13.6% return. We expect bonds of this type to provide a CF1 of $100 about 50% of the time. However, we believe that, during other times this class of bonds will provide a CF1 of just $50. So, on average for this type of investment we expect a CF1 of about $75. We believe that the bond's price (CFO) and estimated return indicate that it is a High Yield bond. We believe that the market price (CFC) of this bond (and others like it) is too high. We therefore recommend not purchasing this type of bond until market conditions become more favorable. Because past performance does not guarantee future results, it is imprudent to say anything about the potential performance of this bond. Question 2 What is the worst case CF1 for bond 2? Answer to one decimal place.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started