Answered step by step

Verified Expert Solution

Question

1 Approved Answer

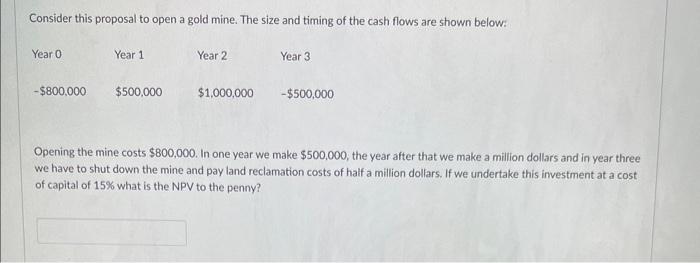

Consider this proposal to open a gold mine. The size and timing of the cash flows are shown below: Year 0 -$800,000 Year 1

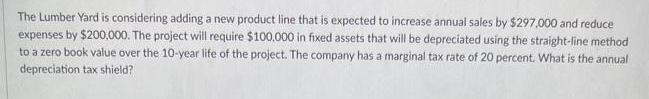

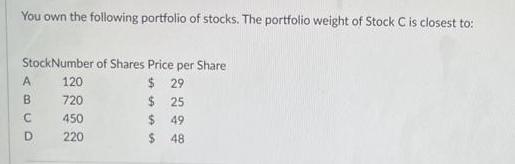

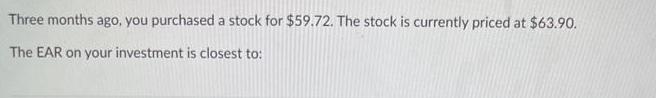

Consider this proposal to open a gold mine. The size and timing of the cash flows are shown below: Year 0 -$800,000 Year 1 $500,000 Year 2 $1,000,000 Year 3 -$500,000 Opening the mine costs $800,000. In one year we make $500,000, the year after that we make a million dollars and in year three we have to shut down the mine and pay land reclamation costs of half a million dollars. If we undertake this investment at a cost of capital of 15% what is the NPV to the penny? The Lumber Yard is considering adding a new product line that is expected to increase annual sales by $297,000 and reduce expenses by $200,000. The project will require $100,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 10-year life of the project. The company has a marginal tax rate of 20 percent. What is the annual depreciation tax shield? You own the following portfolio of stocks. The portfolio weight of Stock C is closest to: StockNumber of Shares Price per Share $ 29 A B C D 120 720 450 220 $25 $49 $ 48 Three months ago, you purchased a stock for $59.72. The stock is currently priced at $63.90. The EAR on your investment is closest to:

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Net Present Value NPV Calculation for Gold Mine Investment NPV 800000 500000115 10000001152 50000011...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started