Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider this scenario. The South African government announced that interest rates are expected to increase in the South Africa. Based on this simple scenario, select

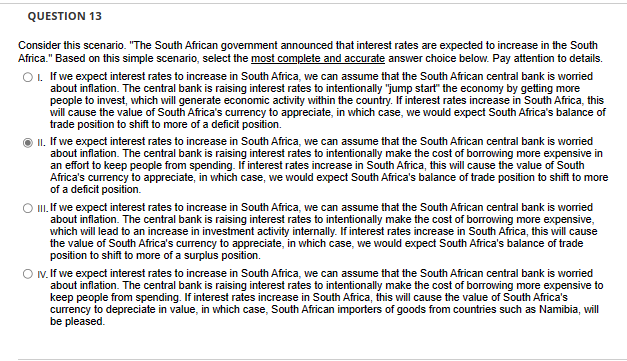

Consider this scenario. "The South African government announced that interest rates are expected to increase in the South Africa." Based on this simple scenario, select the most complete and accurate answer choice below. Pay attention to details. I. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally "jump start" the economy by getting more people to invest, which will generate economic activity within the country. If interest rates increase in South Africa, this will cause the value of South Africa's currency to appreciate, in which case, we would expect South Africa's balance of trade position to shift to more of a deficit position. II. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally make the cost of borrowing more expensive in an effort to keep people from spending. If interest rates increase in South Africa, this will cause the value of South Africa's currency to appreciate, in which case, we would expect South Africa's balance of trade position to shift to more of a deficit position. III. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally make the cost of borrowing more expensive, which will lead to an increase in investment activity internally. If interest rates increase in South Africa, this will cause the value of South Africa's currency to appreciate, in which case, we would expect South Africa's balance of trade position to shift to more of a surplus position. IV. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally make the cost of borrowing more expensive to keep people from spending. If interest rates increase in South Africa, this will cause the value of South Africa's currency to depreciate in value, in which case, South African importers of goods from countries such as Namibia, will be pleased

Consider this scenario. "The South African government announced that interest rates are expected to increase in the South Africa." Based on this simple scenario, select the most complete and accurate answer choice below. Pay attention to details. I. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally "jump start" the economy by getting more people to invest, which will generate economic activity within the country. If interest rates increase in South Africa, this will cause the value of South Africa's currency to appreciate, in which case, we would expect South Africa's balance of trade position to shift to more of a deficit position. II. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally make the cost of borrowing more expensive in an effort to keep people from spending. If interest rates increase in South Africa, this will cause the value of South Africa's currency to appreciate, in which case, we would expect South Africa's balance of trade position to shift to more of a deficit position. III. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally make the cost of borrowing more expensive, which will lead to an increase in investment activity internally. If interest rates increase in South Africa, this will cause the value of South Africa's currency to appreciate, in which case, we would expect South Africa's balance of trade position to shift to more of a surplus position. IV. If we expect interest rates to increase in South Africa, we can assume that the South African central bank is worried about inflation. The central bank is raising interest rates to intentionally make the cost of borrowing more expensive to keep people from spending. If interest rates increase in South Africa, this will cause the value of South Africa's currency to depreciate in value, in which case, South African importers of goods from countries such as Namibia, will be pleased Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started