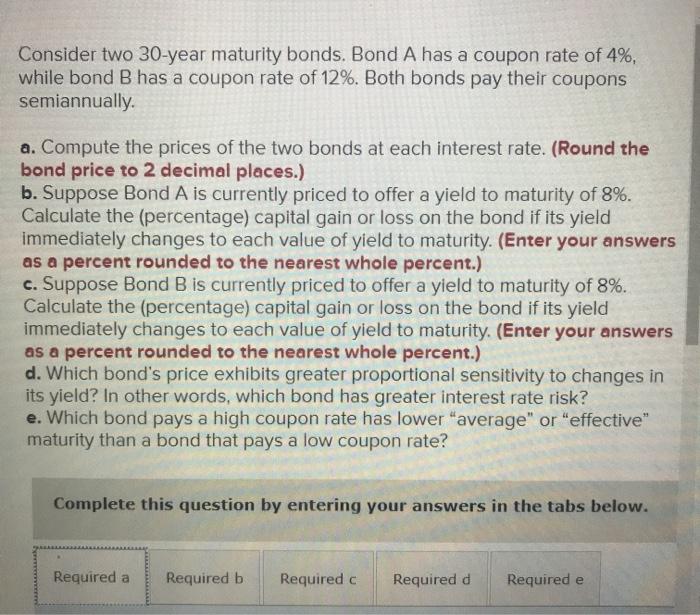

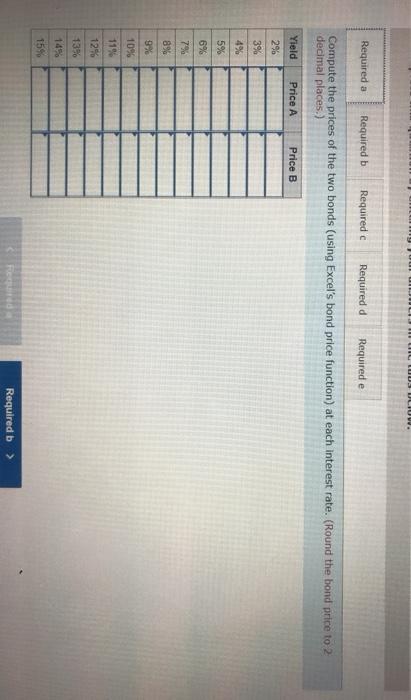

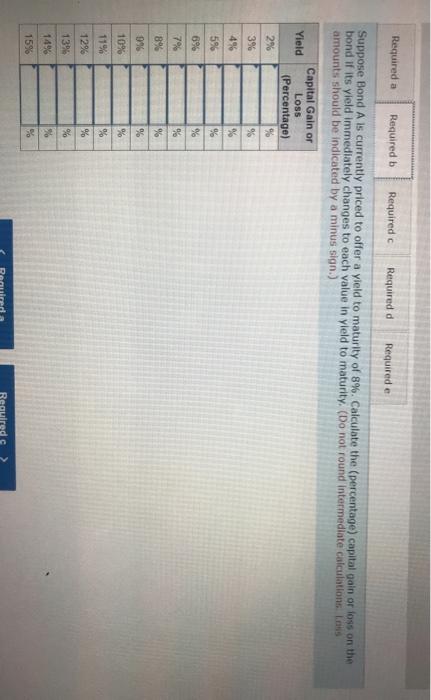

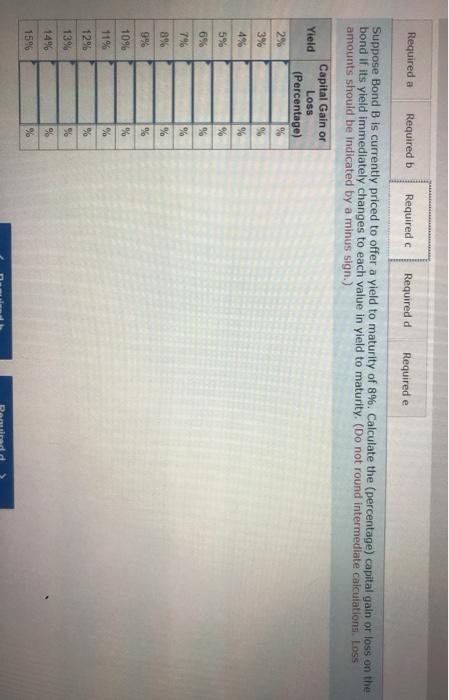

Consider two 30-year maturity bonds. Bond A has a coupon rate of 4%, while bond B has a coupon rate of 12%. Both bonds pay their coupons semiannually. a. Compute the prices of the two bonds at each interest rate. (Round the bond price to 2 decimal places.) b. Suppose Bond A is currently priced to offer a yield to maturity of 8%. Calculate the (percentage) capital gain or loss on the bond if its yield immediately changes to each value of yield to maturity. (Enter your answers as a percent rounded to the nearest whole percent.) c. Suppose Bond B is currently priced to offer a yield to maturity of 8%. Calculate the (percentage) capital gain or loss on the bond if its yield immediately changes to each value of yield to maturity. (Enter your answers as a percent rounded to the nearest whole percent.) d. Which bond's price exhibits greater proportional sensitivity to changes in its yield? In other words, which bond has greater interest rate risk? e. Which bond pays a high coupon rate has lower "average" or "effective" maturity than a bond that pays a low coupon rate? Complete this question by entering your answers in the tabs below. Required a Required b Required c Required d Required e Required a Required b Required c Required d Required e Compute the prices of the two bonds (using Excel's bond price function) at each interest rate. (Round the bond price to 2 decimal places.) Price A Price B Yield 2% 3% 5% 6% 7% 896 9% 1096 11% 12% 13% 14% 15% Fico Required b> Required a Required b Required Required d Required e Suppose Bond A is currently priced to offer a yield to maturity of 8%. Calculate the percentage) capital gain or loss on the bond if its yield immediately changes to each value in yield to maturity. (Do not round Intermediate calculations. Les amounts should be indicated by a minus sign.) Capital Gain or Yield Loss (Percentage) 2% 3% % 4% % 5% % 6% % 7% % 8% % 99 10% % % % 11% 12% 13% % 96 14% 15% % % Required Required a Required b Required Required d Required e Suppose Bond B is currently priced to offer a yield to maturity of 8%. Calculate the (percentage) capital gain or loss on the bond if its yield immediately changes to each value in yield to maturity. (Do not round intermediate calculations. Loss amounts should be indicated by a minus sign.) Yield Capital Gain or Loss (Percentage) % 2% 3% 4% 5% 96 % % 6% % % 796 896 9% % % 10% 11% % % de 12% 13% 14% 1596 96 96 Complete this question by entering your answers in the tabs below. Required a Required b Required c Required d Required e Which bond's price exhibits greater proportional sensitivity to changes in its yield? High sensitivity bond