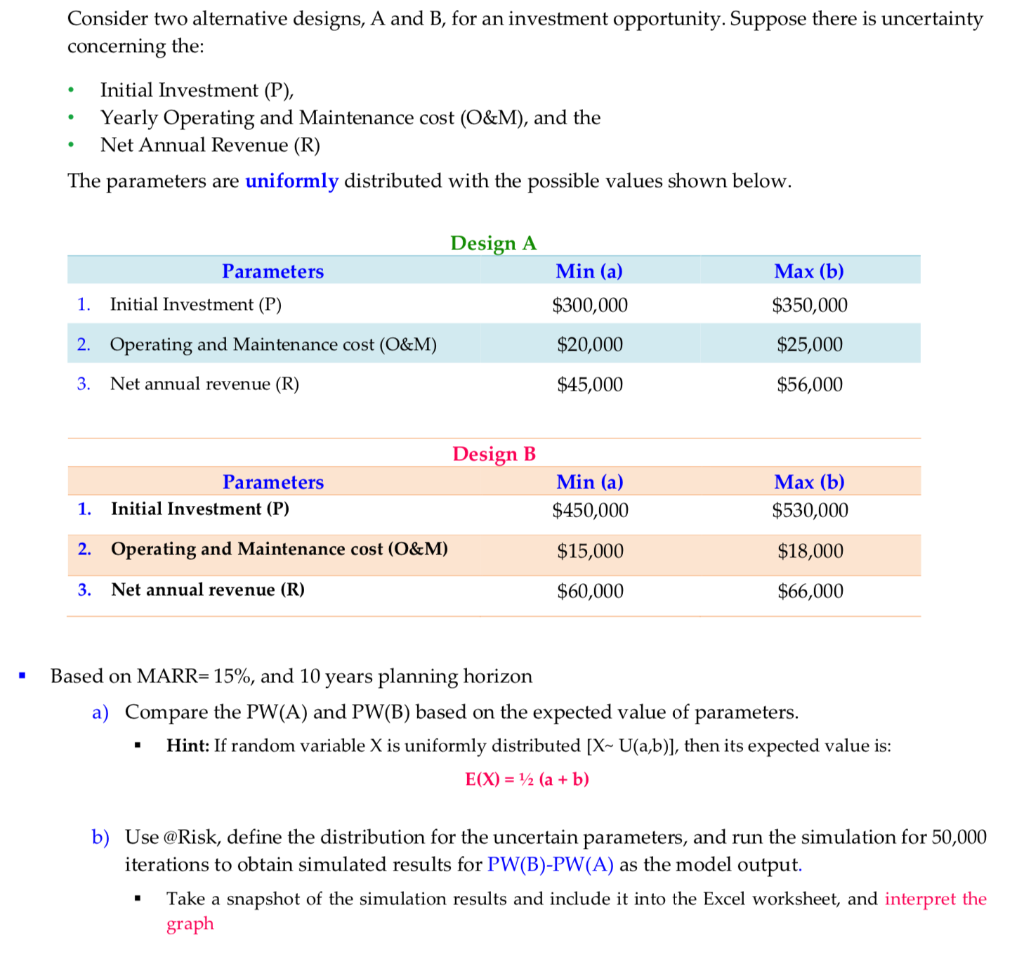

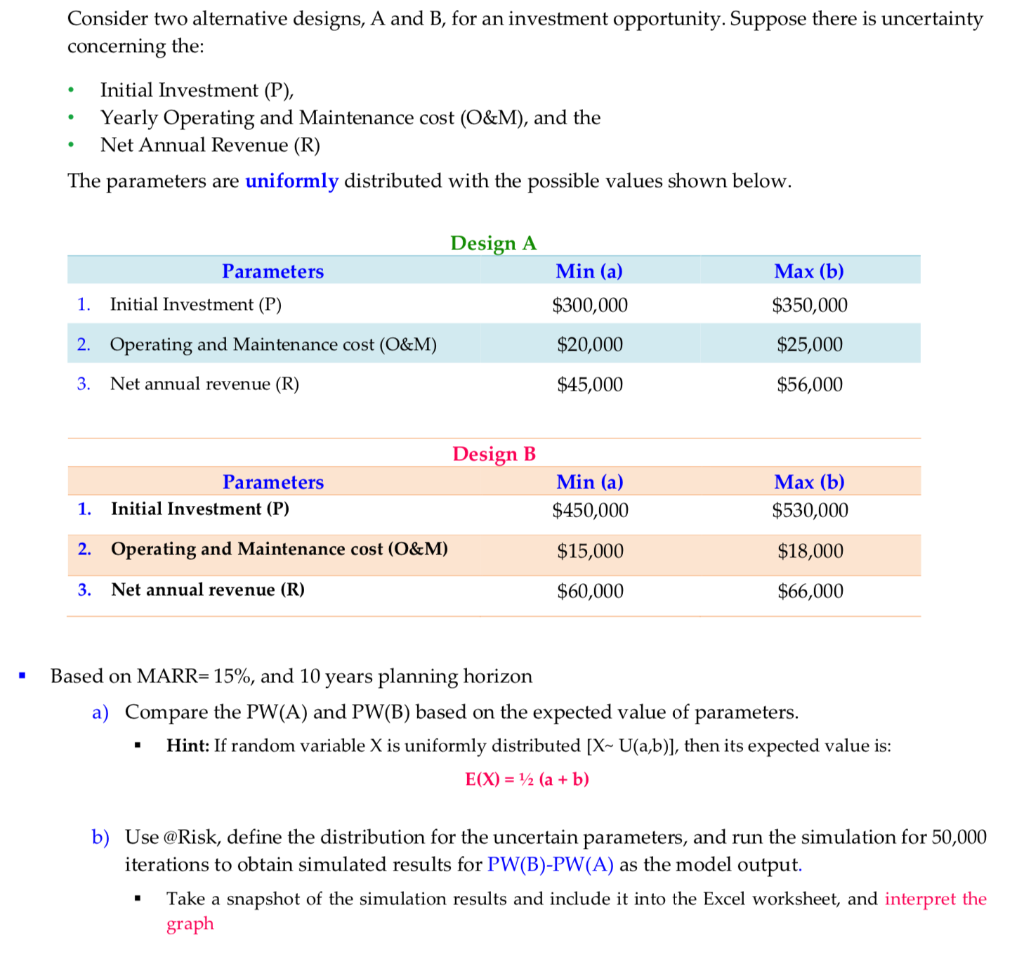

Consider two alternative designs, A and B, for an investment opportunity. Suppose there is uncertainty concerning the: Initial Investment (P), Yearly Operating and Maintenance cost (O&M), and the Net Annual Revenue (R) The parameters are uniformly distributed with the possible values shown below Design A Min (a) Max (b) Parameters Initial Investment (P) $300,000 1. $350,000 $20,000 $25,000 Operating and Maintenance cost (O&M) 2. 3. Net annual revenue (R) $45,000 $56,000 Design B Max (b Min (a) Parameters Initial Investment (P 1. $450,000 $530,000 Operating and Maintenance cost (O&M) 2. $15,000 $18,000 Net annual revenue (R) 3. $60,000 $66,000 Based on MARR= 15%, and 10 years planning horizon a) Compare the PW(A) and PW(B) based on the expected value of parameters Hint: If random variable X is uniformly distributed [X- U(a,b)], then its expected value is: (X) %3D 12 ( +b) b) Use @Risk, define the distribution for the uncertain parameters, and run the simulation for 50,000 iterations to obtain simulated results for PW(B)-PW(A) as the model output Take a snapshot of the simulation results and include it into the Excel worksheet, and interpret the graph Consider two alternative designs, A and B, for an investment opportunity. Suppose there is uncertainty concerning the: Initial Investment (P), Yearly Operating and Maintenance cost (O&M), and the Net Annual Revenue (R) The parameters are uniformly distributed with the possible values shown below Design A Min (a) Max (b) Parameters Initial Investment (P) $300,000 1. $350,000 $20,000 $25,000 Operating and Maintenance cost (O&M) 2. 3. Net annual revenue (R) $45,000 $56,000 Design B Max (b Min (a) Parameters Initial Investment (P 1. $450,000 $530,000 Operating and Maintenance cost (O&M) 2. $15,000 $18,000 Net annual revenue (R) 3. $60,000 $66,000 Based on MARR= 15%, and 10 years planning horizon a) Compare the PW(A) and PW(B) based on the expected value of parameters Hint: If random variable X is uniformly distributed [X- U(a,b)], then its expected value is: (X) %3D 12 ( +b) b) Use @Risk, define the distribution for the uncertain parameters, and run the simulation for 50,000 iterations to obtain simulated results for PW(B)-PW(A) as the model output Take a snapshot of the simulation results and include it into the Excel worksheet, and interpret the graph