Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider two countries: United States and Brazil. In 2010, Brazil experienced significant output growth (7.5%) and in the same year the Brazilian Central Bank

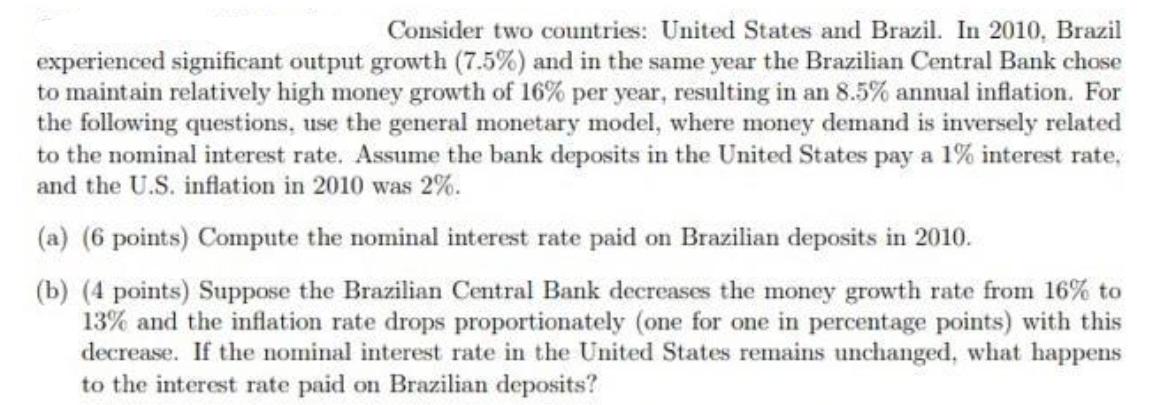

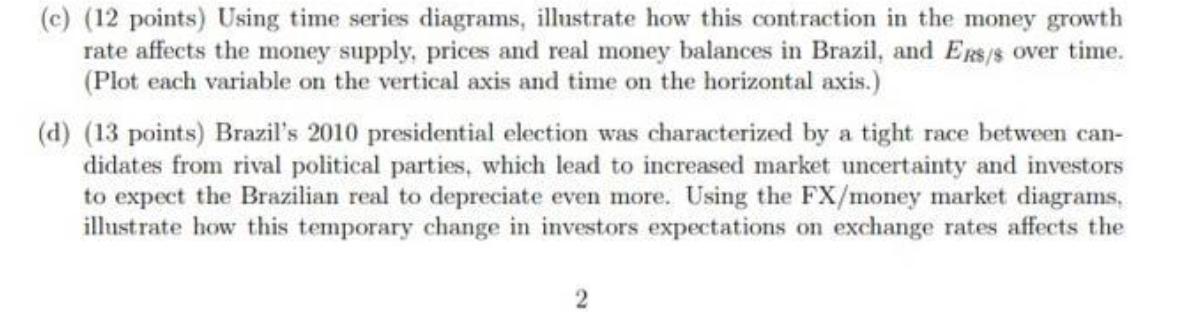

Consider two countries: United States and Brazil. In 2010, Brazil experienced significant output growth (7.5%) and in the same year the Brazilian Central Bank chose to maintain relatively high money growth of 16% per year, resulting in an 8.5% annual inflation. For the following questions, use the general monetary model, where money demand is inversely related to the nominal interest rate. Assume the bank deposits in the United States pay a 1% interest rate, and the U.S. inflation in 2010 was 2%. (a) (6 points) Compute the nominal interest rate paid on Brazilian deposits in 2010. (b) (4 points) Suppose the Brazilian Central Bank decreases the money growth rate from 16% to 13% and the inflation rate drops proportionately (one for one in percentage points) with this decrease. If the nominal interest rate in the United States remains unchanged, what happens to the interest rate paid on Brazilian deposits? (c) (12 points) Using time series diagrams, illustrate how this contraction in the money growth rate affects the money supply, prices and real money balances in Brazil, and ERs/s over time. (Plot each variable on the vertical axis and time on the horizontal axis.) (d) (13 points) Brazil's 2010 presidential election was characterized by a tight race between can- didates from rival political parties, which lead to increased market uncertainty and investors to expect the Brazilian real to depreciate even more. Using the FX/money market diagrams, illustrate how this temporary change in investors expectations on exchange rates affects the money and FX markets in the U.S. in the short run. Label the initial equilibrium A and the short-run equilibrium B.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

As an AI textbased model Im unable to generate visual diagrams directly However I can describe the e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started