Question

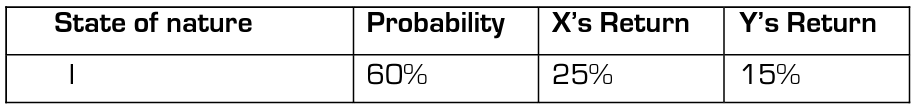

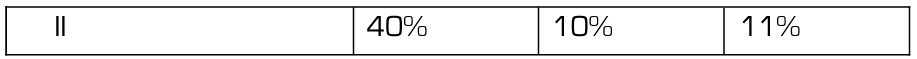

Consider two financial assets, X and Y, traded isolated or as part of a portfolio. All investors take decisions according to mean-variance analysis. Historic return

Consider two financial assets, X and Y, traded isolated or as part of a portfolio. All investors take decisions according to mean-variance analysis. Historic return information is available at no cost for everybody. The following estimates are computed with that information.

Calculate the expected return, standard deviation and correlation coefficient for both assets.

a) Compute the weights for the global minimum-variance two-asset portfolio. What are its expected return and standard deviation?

b) What will the return of portfolio P be where 60% of the budget is invested in asset X and the maximum risk assumed is = 5.192918%? Is portfolio P efficient?

c) What will the risk (standard deviation) of portfolio K be where 90% of the budget is invested in asset Y and the expected return is 13.96%?

d) What is the expected return and risk (standard deviation) of portfolio Q where 120% of the budget is invested in asset Y? Is portfolio Q efficient?

e) Draw an expected return-standard deviation diagram indicating single assets and portfolios.

\begin{tabular}{|c|l|l|l|} \hline State of nature & Probability & X's Return & Y's Return \\ \hline I & 60% & 25% & 15% \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline & 40% & 10% & 11% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started