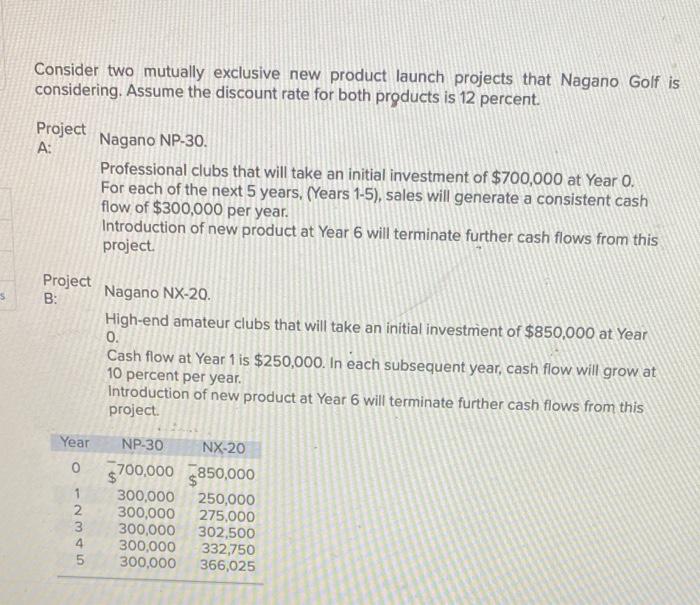

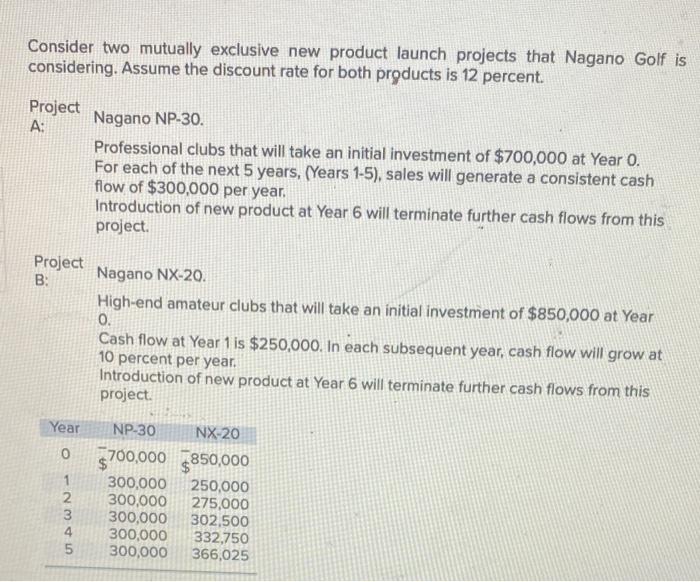

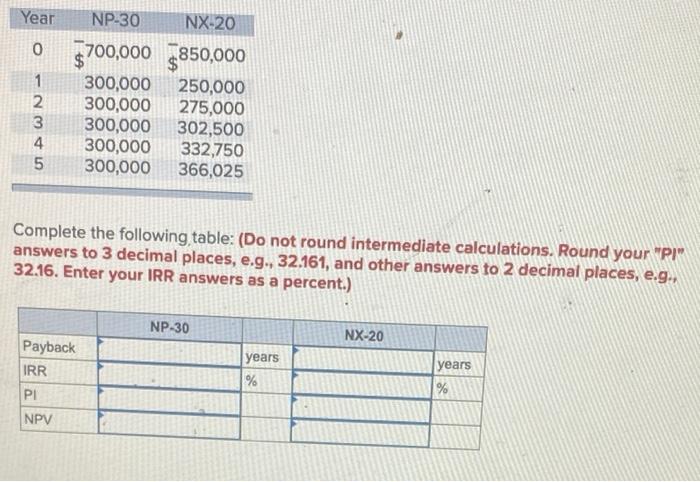

Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both products is 12 percent. Project A: Nagano NP-30. Professional clubs that will take an initial investment of $700,000 at Year O. For each of the next 5 years, (Years 1-5), sales will generate a consistent cash flow of $300,000 per year. Introduction of new product at Year 6 will terminate further cash flows from this project Project B: 5 Nagano NX-20. High-end amateur clubs that will take an initial investment of $850,000 at Year 0. Cash flow at Year 1 is $250,000. In each subsequent year, cash flow will grow at 10 percent per year. Introduction of new product at Year 6 will terminate further cash flows from this project Year 0 1 UWN- NP-30 NX-20 $700,000 $850,000 300,000 250,000 300,000 275,000 300,000 302,500 300,000 332,750 300,000 366,025 Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both products is 12 percent. Project A: Nagano NP-30. Professional clubs that will take an initial investment of $700,000 at Year O. For each of the next 5 years, (Years 1-5), sales will generate a consistent cash flow of $300,000 per year. Introduction of new product at Year 6 will terminate further cash flows from this project Project B: Nagano NX-20 High-end amateur clubs that will take an initial investment of $850,000 at Year 0. Cash flow at Year 1 is $250,000. In each subsequent year, cash flow will grow at 10 percent per year. Introduction of new product at Year 6 will terminate further cash flows from this project. Year 0 1 2 3 4 5 NP-30 NX-20 $700,000 $850,000 300,000 250,000 300,000 275,000 300,000 302,500 300,000 332,750 300,000 366,025 Year NP-30 NX-20 $700,000 3850,000 1 2 3 4 5 300,000 300,000 300,000 300,000 300,000 250,000 275,000 302,500 332,750 366,025 Complete the following table: (Do not round intermediate calculations. Round your "PI" answers to 3 decimal places, e.g., 32,161, and other answers to 2 decimal places, e.g., 32.16. Enter your IRR answers as a percent.) NP-30 NX-20 Payback IRR PI NPV years % years %