Question

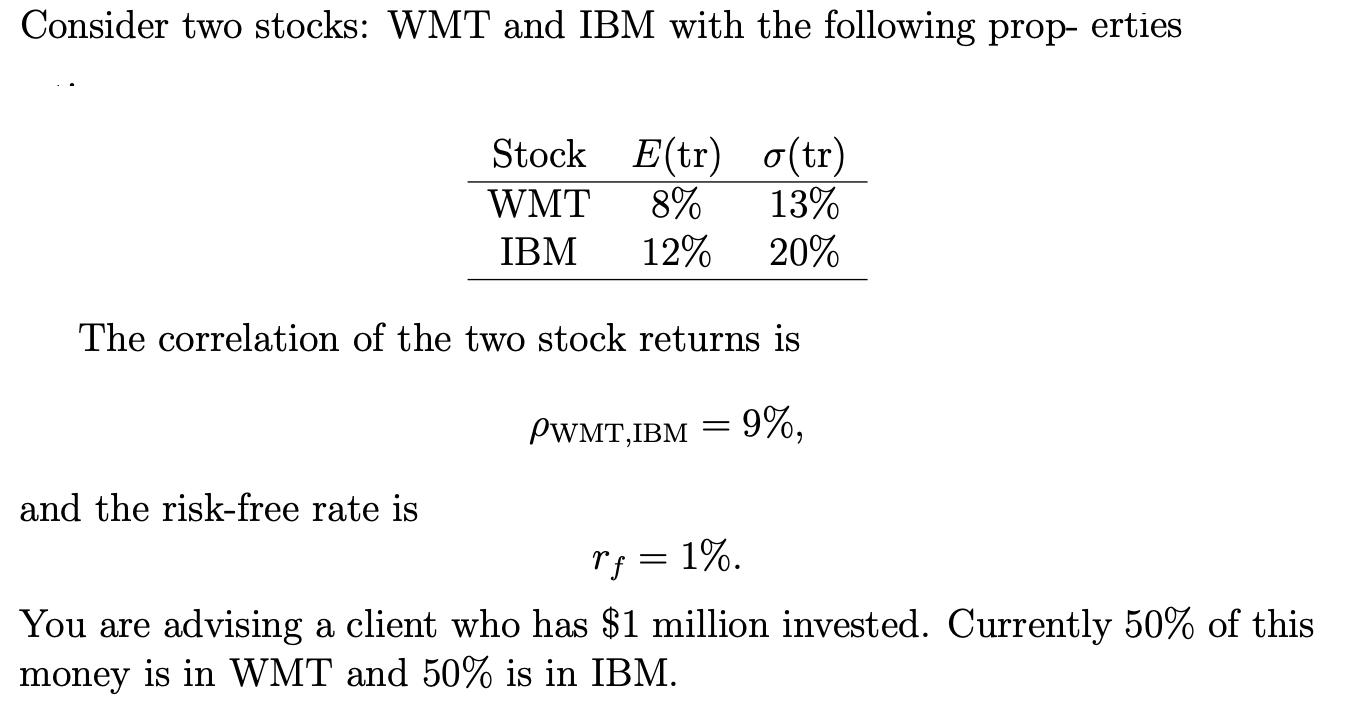

Consider two stocks: WMT and IBM with the following prop- erties Stock E(tr) (tr) WMT 8% 13% IBM 12% 20% The correlation of the

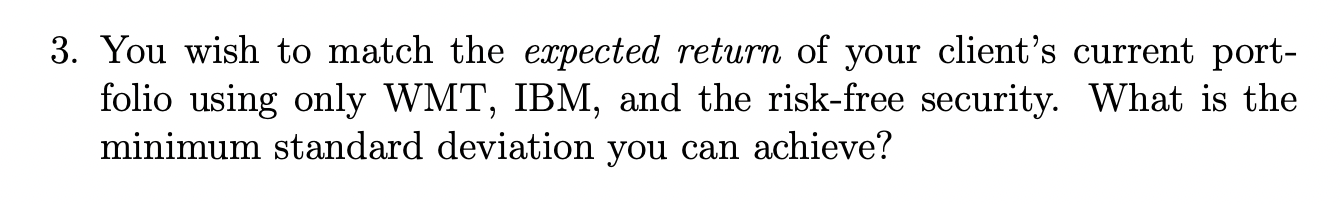

Consider two stocks: WMT and IBM with the following prop- erties Stock E(tr) (tr) WMT 8% 13% IBM 12% 20% The correlation of the two stock returns is and the risk-free rate is PWMT, IBM = 9%, r = 1%. You are advising a client who has $1 million invested. Currently 50% of this money is in WMT and 50% is in IBM. 3. You wish to match the expected return of your client's current port- folio using only WMT, IBM, and the risk-free security. What is the minimum standard deviation you can achieve?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the market share needed to break even we need to find out how many people your ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Calculus

Authors: Ron Larson, Bruce H. Edwards

10th Edition

1285057090, 978-1285057095

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App