Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider whether the transactions described below qualify as a tax-free reorganization. Assume in all cases that P is the acquiring corporation, T is the

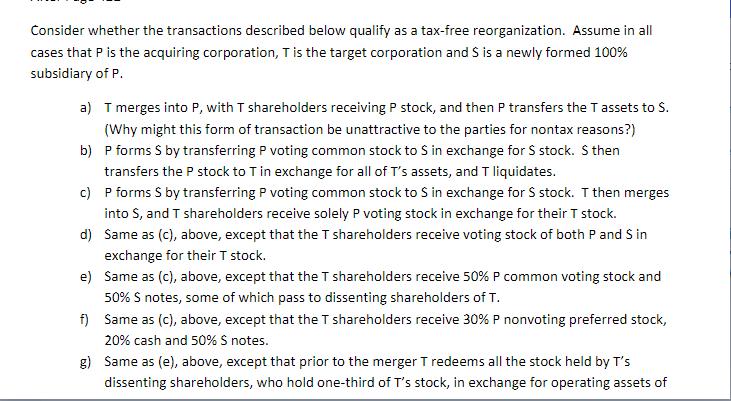

Consider whether the transactions described below qualify as a tax-free reorganization. Assume in all cases that P is the acquiring corporation, T is the target corporation and S is a newly formed 100% subsidiary of P. a) T merges into P, with T shareholders receiving P stock, and then P transfers the T assets to S. (Why might this form of transaction be unattractive to the parties for nontax reasons?) b) P forms S by transferring P voting common stock to S in exchange for S stock. S then transfers the P stock to T in exchange for all of T's assets, and T liquidates. c) P forms S by transferring P voting common stock to S in exchange for S stock. T then merges into S, and T shareholders receive solely P voting stock in exchange for their T stock. d) Same as (c), above, except that the T shareholders receive voting stock of both P and S in exchange for their T stock. e) Same as (c), above, except that the T shareholders receive 50% P common voting stock and 50% $ notes, some of which pass to dissenting shareholders of T. f) Same as (c), above, except that the T shareholders receive 30% P nonvoting preferred stock, 20% cash and 50% S notes. g) Same as (e), above, except that prior to the merger T redeems all the stock held by T's dissenting shareholders, who hold one-third of T's stock, in exchange for operating assets of

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A taxfree reorganization under Section 368 of the Internal Revenue Code allows for certain types of corporate transactions to occur without immediate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started