Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider-a-5-year-structured product of European -type-code-named GOLDEN-GOAL. investment-bank-to-High-Net-Worth Individuals (HNWls)-that-is- offered-by a multinational linked to the Hang Seng Index with the following terms: H Issue-Price:

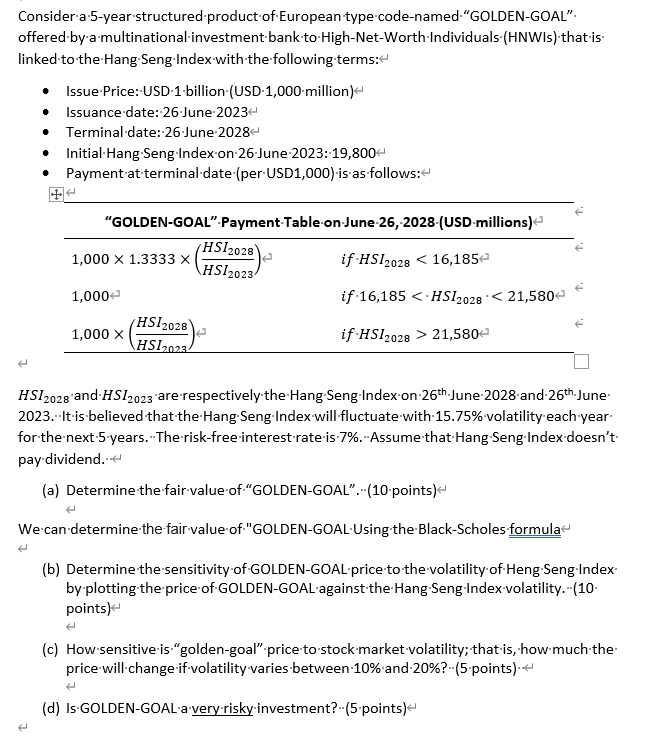

Consider-a-5-year-structured product of European -type-code-named "GOLDEN-GOAL". investment-bank-to-High-Net-Worth Individuals (HNWls)-that-is- offered-by a multinational linked to the Hang Seng Index with the following terms: H Issue-Price: USD-1-billion (USD 1,000-million) Issuance-date: 26-June-2023+ Terminal date: 26-June-20284 Initial Hang Seng-Index on 26-June-2023: 19,800+ Payment at terminal date (per USD1,000) is as follows: "GOLDEN-GOAL"-Payment Table-on-June-26, 2028 (USD-millions) 1,000 X 1.3333 X if HSI2028 < 16,185 if 16,185 < HSI2028 < 21,580 if HSI2028 > 21,580 1,000 1,000 X (HSI2028) HSI2023/ (HSI2028) HSI20234 HSI 2028 and HSI2023 are respectively the Hang Seng Index on 26th June 2028-and-26th June 2023. It is believed that the Hang Seng Index-will-fluctuate with 15.75% volatility each year. for the next 5 years. The risk-free interest rate is 7%. Assume that Hang Seng Index doesn't pay dividend.. (a) Determine the fair value of "GOLDEN-GOAL". (10 points) We can determine the fair value of "GOLDEN-GOAL Using the Black-Scholes formula (b) Determine the sensitivity of GOLDEN-GOAL-price to the volatility of Heng Seng Index by plotting the price of GOLDEN-GOAL against the Hang Seng-Index volatility. (10. points) (c) How-sensitive is "golden-goal" price to stock-market-volatility; that is, how-much-the- price will change-if-volatility varies between 10% and 20%? (5 points). H (d) Is GOLDEN-GOAL a very risky investment? (5-points)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the fair value of GOLDENGOAL we can use the BlackScholes formula with the given param...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started