Answered step by step

Verified Expert Solution

Question

1 Approved Answer

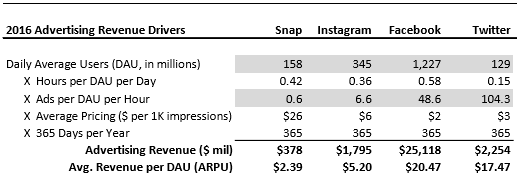

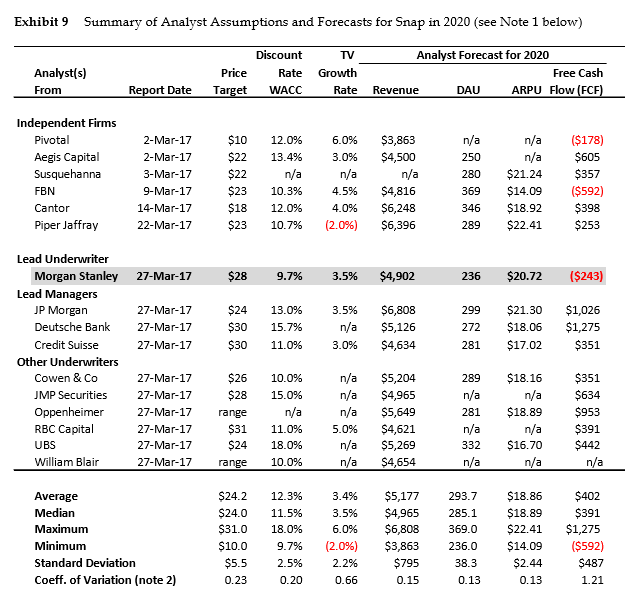

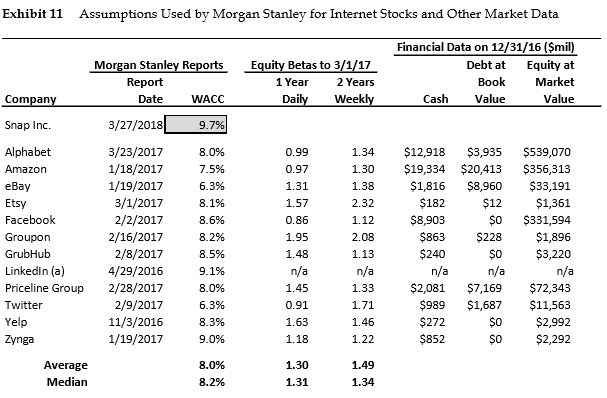

Considering above information, are the assumption used by Morgan 1) WACC=9.7% b)TVGR=3.5% c) forecast of FCF and 2020's revenue forecase reasonable? 2016 Advertising Revenue Drivers

Considering above information, are the assumption used by Morgan 1) WACC=9.7% b)TVGR=3.5% c) forecast of FCF and 2020's revenue forecase reasonable?

2016 Advertising Revenue Drivers Snap Instagram Facebook Twitter 129 0.15 Daily Average Users (DAU, in millions) X Hours per DAU per Day X Ads per DAU per Hour X Average Pricing ($ per 1K impressions) X 365 Days per Year Advertising Revenue ($ mil) Avg. Revenue per DAU (ARPU) 158 0.42 0.6 $26 365 345 0.36 6.6 $6 365 $1,795 $5.20 1,227 0.58 48.6 $2 365 $25,118 $20.47 104.3 $3 365 $2,254 $17.47 $378 $2.39 Exhibit 9 Summary of Analyst Assumptions and Forecasts for Snap in 2020 (see Note 1 below) Analyst(s) From Price Target Discount Rate WACC TV Growth Rate Analyst Forecast for 2020 Free Cash Revenue DAU ARPU Flow (FCF) Report Date n/a Independent Firms Pivotal Aegis Capital Susquehanna FBN Cantor Piper Jaffray 2-Mar-17 2-Mar-17 3-Mar-17 9-Mar-17 14-Mar-17 22-Mar-17 $10 $22 $22 $23 $18 $23 12.0% 13.4% n/a 10.3% 12.0% 10.7% 6.0% 3.0% n/a 4.5% 4.0% (2.0%) $3,863 $4,500 n/a $4,816 $6,248 $6,396 n/a 250 280 369 346 289 n/a $21.24 $14.09 $18.92 $22.41 ($178) $605 $357 ($592) $398 $253 27-Mar-17 $28 9.7% 3.5% $4,902 236 $20.72 ($243) 27-Mar-17 27-Mar-17 27-Mar-17 $24 $30 $30 13.0% 15.7% 3.5% n/a 3.0% $6,808 $5,126 $4,634 299 272 $21.30 $18.06 $17.02 $1,026 $1,275 $351 11.0% 281 Lead Underwriter Morgan Stanley Lead Managers JP Morgan Deutsche Bank Credit Suisse Other Underwriters Cowen & Co JMP Securities Oppenheimer RBC Capital UBS William Blair 27-Mar-17 27-Mar-17 27-Mar-17 27-Mar-17 27-Mar-17 27-Mar-17 $26 $28 range $31 $24 range 10.0% 15.0% n/a 11.0% 18.0% 10.0% n/a n/a n/a 5.0% n/a n/a $5,204 $4,965 $5,649 $4,621 $5,269 $4,654 289 n/a 281 n/a 332 n/a $18.16 n/a $18.89 n/a $16.70 n/a $351 $634 $953 $391 $442 n/a Average Median Maximum Minimum Standard Deviation Coeff. of Variation (note 2) $24.2 $24.0 $31.0 $10.0 $5.5 0.23 12.3% 11.5% 18.0% 9.7% 2.5% 0.20 3.4% 3.5% 6.0% (2.0%) 2.2% 0.66 $5,177 $4,965 $6,808 $3,863 $795 0.15 293.7 285.1 369.0 236.0 38.3 0.13 $18.86 $18.89 $22.41 $14.09 $2.44 0.13 $402 $391 $1,275 ($592) $487 1.21 Exhibit 11 Assumptions Used by Morgan Stanley for Internet Stocks and Other Market Data Morgan Stanley Reports Report Date WACC 3/27/2018 9.7% Equity Betas to 3/1/17 1 Year 2 Years Daily Weekly Financial Data on 12/31/16 (Smil) Debt at Equity at Book Market Cash Value Value Company Snap Inc. Alphabet Amazon eBay Etsy Facebook Groupon GrubHub Linkedin (a) Priceline Group Twitter Yelp Zynga 3/23/2017 1/18/2017 1/19/2017 3/1/2017 2/2/2017 2/16/2017 2/8/2017 4/29/2016 2/28/2017 2/9/2017 11/3/2016 1/19/2017 8.0% 7.5% 6.3% 8.1% 8.6% 8.2% 8.5% 9.1% 8.0% 6.3% 8.3% 9.0% 0.99 0.97 1.31 1.57 0.86 1.95 1.48 n/a 1.45 0.91 1.63 1.18 1.34 1.30 1.38 2.32 1.12 2.08 1.13 n/a 1.33 1.71 1.46 1.22 $12,918 $3,935 $19,334 $20,413 $1,816 $8,960 $182 $12 $8,903 $0 $863 $228 $240 $0 n/a n/a $2,081 $7,169 $989 $1,687 $272 $0 $852 $o $539,070 $356,313 $33,191 $1,361 $331,594 $1,896 $3,220 n/a $72,343 $11,563 $2,992 $2,292 Average Median 8.0% 8.2% 1.30 1.31 1.49 1.34 Exhibit 11 Assumptions Used by Morgan Stanley for Internet Stocks and Other Market Data Morgan Stanley Reports Report Date WACC 3/27/2018 9.7% Equity Betas to 3/1/17 1 Year 2 Years Daily Weekly Financial Data on 12/31/16 (Smil) Debt at Equity at Book Market Cash Value Value Company Snap Inc. Alphabet Amazon eBay Etsy Facebook Groupon GrubHub Linkedin (a) Priceline Group Twitter Yelp Zynga 3/23/2017 1/18/2017 1/19/2017 3/1/2017 2/2/2017 2/16/2017 2/8/2017 4/29/2016 2/28/2017 2/9/2017 11/3/2016 1/19/2017 8.0% 7.5% 6.3% 8.1% 8.6% 8.2% 8.5% 9.1% 8.0% 6.3% 8.3% 9.0% 0.99 0.97 1.31 1.57 0.86 1.95 1.48 n/a 1.45 0.91 1.63 1.18 1.34 1.30 1.38 2.32 1.12 2.08 1.13 n/a 1.33 1.71 1.46 1.22 $12,918 $3,935 $19,334 $20,413 $1,816 $8,960 $182 $12 $8,903 $0 $863 $228 $240 $0 n/a n/a $2,081 $7,169 $989 $1,687 $272 $0 $852 $o $539,070 $356,313 $33,191 $1,361 $331,594 $1,896 $3,220 n/a $72,343 $11,563 $2,992 $2,292 Average Median 8.0% 8.2% 1.30 1.31 1.49 1.34 2016 Advertising Revenue Drivers Snap Instagram Facebook Twitter 129 0.15 Daily Average Users (DAU, in millions) X Hours per DAU per Day X Ads per DAU per Hour X Average Pricing ($ per 1K impressions) X 365 Days per Year Advertising Revenue ($ mil) Avg. Revenue per DAU (ARPU) 158 0.42 0.6 $26 365 345 0.36 6.6 $6 365 $1,795 $5.20 1,227 0.58 48.6 $2 365 $25,118 $20.47 104.3 $3 365 $2,254 $17.47 $378 $2.39 Exhibit 9 Summary of Analyst Assumptions and Forecasts for Snap in 2020 (see Note 1 below) Analyst(s) From Price Target Discount Rate WACC TV Growth Rate Analyst Forecast for 2020 Free Cash Revenue DAU ARPU Flow (FCF) Report Date n/a Independent Firms Pivotal Aegis Capital Susquehanna FBN Cantor Piper Jaffray 2-Mar-17 2-Mar-17 3-Mar-17 9-Mar-17 14-Mar-17 22-Mar-17 $10 $22 $22 $23 $18 $23 12.0% 13.4% n/a 10.3% 12.0% 10.7% 6.0% 3.0% n/a 4.5% 4.0% (2.0%) $3,863 $4,500 n/a $4,816 $6,248 $6,396 n/a 250 280 369 346 289 n/a $21.24 $14.09 $18.92 $22.41 ($178) $605 $357 ($592) $398 $253 27-Mar-17 $28 9.7% 3.5% $4,902 236 $20.72 ($243) 27-Mar-17 27-Mar-17 27-Mar-17 $24 $30 $30 13.0% 15.7% 3.5% n/a 3.0% $6,808 $5,126 $4,634 299 272 $21.30 $18.06 $17.02 $1,026 $1,275 $351 11.0% 281 Lead Underwriter Morgan Stanley Lead Managers JP Morgan Deutsche Bank Credit Suisse Other Underwriters Cowen & Co JMP Securities Oppenheimer RBC Capital UBS William Blair 27-Mar-17 27-Mar-17 27-Mar-17 27-Mar-17 27-Mar-17 27-Mar-17 $26 $28 range $31 $24 range 10.0% 15.0% n/a 11.0% 18.0% 10.0% n/a n/a n/a 5.0% n/a n/a $5,204 $4,965 $5,649 $4,621 $5,269 $4,654 289 n/a 281 n/a 332 n/a $18.16 n/a $18.89 n/a $16.70 n/a $351 $634 $953 $391 $442 n/a Average Median Maximum Minimum Standard Deviation Coeff. of Variation (note 2) $24.2 $24.0 $31.0 $10.0 $5.5 0.23 12.3% 11.5% 18.0% 9.7% 2.5% 0.20 3.4% 3.5% 6.0% (2.0%) 2.2% 0.66 $5,177 $4,965 $6,808 $3,863 $795 0.15 293.7 285.1 369.0 236.0 38.3 0.13 $18.86 $18.89 $22.41 $14.09 $2.44 0.13 $402 $391 $1,275 ($592) $487 1.21 Exhibit 11 Assumptions Used by Morgan Stanley for Internet Stocks and Other Market Data Morgan Stanley Reports Report Date WACC 3/27/2018 9.7% Equity Betas to 3/1/17 1 Year 2 Years Daily Weekly Financial Data on 12/31/16 (Smil) Debt at Equity at Book Market Cash Value Value Company Snap Inc. Alphabet Amazon eBay Etsy Facebook Groupon GrubHub Linkedin (a) Priceline Group Twitter Yelp Zynga 3/23/2017 1/18/2017 1/19/2017 3/1/2017 2/2/2017 2/16/2017 2/8/2017 4/29/2016 2/28/2017 2/9/2017 11/3/2016 1/19/2017 8.0% 7.5% 6.3% 8.1% 8.6% 8.2% 8.5% 9.1% 8.0% 6.3% 8.3% 9.0% 0.99 0.97 1.31 1.57 0.86 1.95 1.48 n/a 1.45 0.91 1.63 1.18 1.34 1.30 1.38 2.32 1.12 2.08 1.13 n/a 1.33 1.71 1.46 1.22 $12,918 $3,935 $19,334 $20,413 $1,816 $8,960 $182 $12 $8,903 $0 $863 $228 $240 $0 n/a n/a $2,081 $7,169 $989 $1,687 $272 $0 $852 $o $539,070 $356,313 $33,191 $1,361 $331,594 $1,896 $3,220 n/a $72,343 $11,563 $2,992 $2,292 Average Median 8.0% 8.2% 1.30 1.31 1.49 1.34 Exhibit 11 Assumptions Used by Morgan Stanley for Internet Stocks and Other Market Data Morgan Stanley Reports Report Date WACC 3/27/2018 9.7% Equity Betas to 3/1/17 1 Year 2 Years Daily Weekly Financial Data on 12/31/16 (Smil) Debt at Equity at Book Market Cash Value Value Company Snap Inc. Alphabet Amazon eBay Etsy Facebook Groupon GrubHub Linkedin (a) Priceline Group Twitter Yelp Zynga 3/23/2017 1/18/2017 1/19/2017 3/1/2017 2/2/2017 2/16/2017 2/8/2017 4/29/2016 2/28/2017 2/9/2017 11/3/2016 1/19/2017 8.0% 7.5% 6.3% 8.1% 8.6% 8.2% 8.5% 9.1% 8.0% 6.3% 8.3% 9.0% 0.99 0.97 1.31 1.57 0.86 1.95 1.48 n/a 1.45 0.91 1.63 1.18 1.34 1.30 1.38 2.32 1.12 2.08 1.13 n/a 1.33 1.71 1.46 1.22 $12,918 $3,935 $19,334 $20,413 $1,816 $8,960 $182 $12 $8,903 $0 $863 $228 $240 $0 n/a n/a $2,081 $7,169 $989 $1,687 $272 $0 $852 $o $539,070 $356,313 $33,191 $1,361 $331,594 $1,896 $3,220 n/a $72,343 $11,563 $2,992 $2,292 Average Median 8.0% 8.2% 1.30 1.31 1.49 1.34Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started