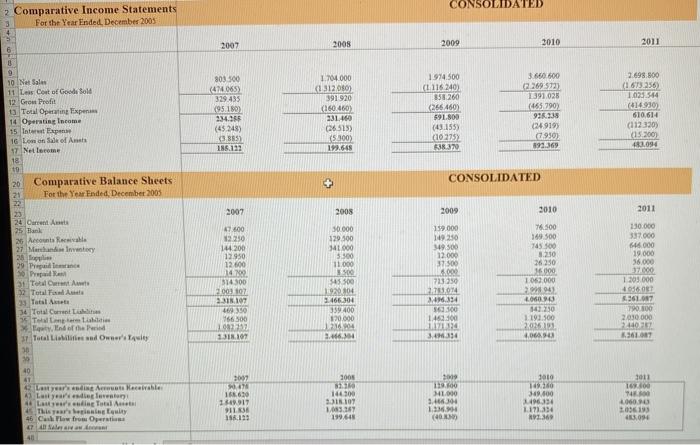

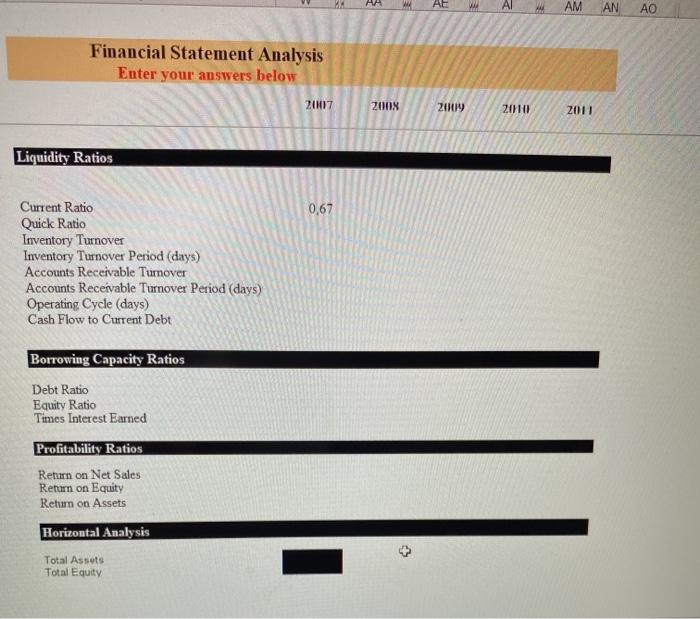

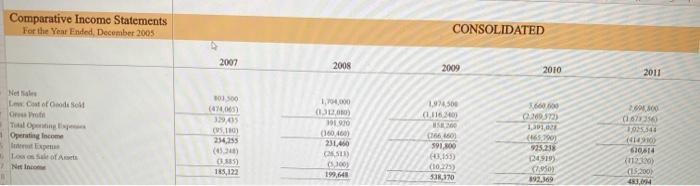

CONSOLIDATED 2 Comparative Income Statements For the Year Ended December 2005 2007 2008 2009 3010 2011 6 1 10 Net Salas 11 Les Cost of Good Sold 19 Grow Profit Total Operating penis 14 Operating Income 15 Inter Expen 10 m t l e l 97 Netleme 18 0 20 Comparative Balance Sheets 21 For the Year Ended, December 2005 22 803500 (414065 329,435 (95 150) 234.31 (45248) (3865) 186.121 1.704000 (312.030) 391 920 (160.460) 231.460 (26 515) 15300) 19.648 1974.500 (1116 240) 351.260 (266460) 591.800 (43.155) (1275) 38.370 3.660.600 2269572) 1391.028 (465.790 936.338 (24919 6.950 191.369 2.698.800 (1 619 356 1.023564 (41490) 610,614 (112330) 05.2003 483,094 CONSOLIDATED 2007 2008 2009 3010 2011 24. Current A 25 Dark 26 Accounts Rece 27 Merchant 26 39 Taille So Praia 31 Towe 2 Total 33 Total 34 Total Comments This of the 37 Total Livind Owner'i Tulty 30 400 19250 144.200 12.950 12.600 14792 374 500 2003 107 50.000 129.500 341.000 3.500 11.000 300 $45.00 1920 104 2.466.304 359400 120.000 104 3.466.14 159.000 149 250 349.500 12.000 37.500 6.000 723250 271014 34394 36.00 1.463.100 1714 3.4334 76.500 369 500 745.500 8.250 26250 16000 106.000 2004 06. 2250 1.191.500 2016193 4,06 130.000 337000 48.000 19.000 36.000 07.000 1.200.000 4016081 5.361,017 790.000 2,030.000 2440 LENICE OSC691 166.500 10022 1312107 LE 3003 14 OASE! 000TH 40 41 Last year's Art Karamables 4 Last year's 4 Lauri Total Art 45 This yearning ie 45 Carn ca 41 16.610 2017 911. 186.123 144.300 2.18 107 1.03.187 199,645 3010 110 349.000 496134 1.171334 2362 1011 17.00 948 2060. 1056195 413.094 9.46304 1.336. (40 AE w AM AN AO Financial Statement Analysis Enter your answers below 2007 2008 2009 2010 2011 Liquidity Ratios 0,67 Current Ratio Quick Ratio Inventory Turnover Inventory Tumover Period (days) Accounts Receivable Turnover Accounts Receivable Turnover Period (days) Operating Cycle (days) Cash Flow to Current Debt Borrowing Capacity Ratios Debt Ratio Equity Ratio Times Interest Earned Profitability Ratios Return on Net Sales Return on Equity Return on Assets Horizontal Analysis Total Assets Total Equity Comparative Income Statements For the Year Ended, December 2005 CONSOLIDATED 2007 2008 2009 2010 2011 Net L.todist Oro 500 (07.06 329,03 (510 254,255 1974.500 (1116301 Operating Income 1.704,000 (2010) 101 970 (160460) 231.450 CSI) 100) 199,648 09:37) 1,01 (65.7901 925.218 24919 2.50 892.369 2.000 (1673 1925:48 10140 610614 112.320) (1200) 483.0044 Los SA 2 Nein 0.535) 185,122 60.168) (1022) 1,170 Comparative Income Statements For the Year Ended, December 2005 CONSOLIDATED 2007 2007 2008 2008 2009 2009 2010 2010 25 Bak 26 Arcticable 2011 2011 0001 17.00 20 141.200 12.90 12.60 14,200 314.300 30 000 129 100 14.000 5.900 150.000 149 250 H. 12.000 37.500 0 500 169.00 948 500 29 Prada 3 Prep Remi 11 CA Til Art 000 TL OLU :100 54500 120.000 2.4004 350.000 370.000 25,30 S000 20600 TO 093 2.23 3.A 2000 16 000 19.000 od 12.000 205000 400 5.261,087 OSO 20 000 20 5.261,087 2,118,107 469,350 26.500 102.21 23.107 RELSE Lund Tallery 1190500 Tod IL NAM34 2664 Financial Statement Analysis Enter your answers below 200M 2009 2010 2011 Liquidity Ratios 0.67 Current Ratio Quick Ratio Inventory Tumover Inventory Turnover Period (days) Accounts Receivable Turnover Accounts Receivable Turnover Period (days) Operating Cycle (days) Cash Flow to Current Debt Borrowing Capacity Ratios Debt Ratio Equity Ratio Times Interest Earned Profitability Ratios Return on Net Sales Return on Equity Return on Assets Horizontal Analysis Total Asset Tulal Equity 2 Comparative Income Statements Por the Yewned, December 2005 CONSOLIDATED 2007 200N 2009 2010 2011 36 Notes 11 Le Colofondo 19. Go Profit 13 Total Optips 14 Operating HOOD (474065 3294315 (95.180) 334255 (45 2400 0335 185.123 1.107.000 (1312050 391920 (16) 231.460 (26.519) (5300) 199.648 (TTT 103 85 260 266 450) 591 800 (41155) 110.275) 1.39 (4690) 925.235 24919 1.95 192.369 16 Las Sale of Art 17 Net came 18 LO541 (414 610.614 (11220 IS 2009 15309 S.370 TA 2005 2009 2010 2011 T500 100 145.500 2.30 36.250 orci 001 LE 000919 0001 47600 2250 146200 12.950 12 600 14700 514300 2.001 807 2.318.107 469350 766 500 1082257 2.318.07 20 Account Receivable 97. Merchandise story 20 Supplies 29 Propalda 10. Prepaid Rent 31 Total Current Assets 32 Total Fixed As 33 Total Assets 34 Total Current Lilities 35 Total Long term Liabilities Equity, find of the Period I Total Liabilities and Owner's Equity CUE 50 000 129.500 10000 5.500 || CHO 18 500 545500 1.920.04 2.466.304 399 400 870.000 126.904 2.466 304 16 000 17000 19.000 140 250 149.500 12000 37500 6000 213250 2732014 3.486.324 362.500 1462 500 1171124 3.4.3.14 1062000 29 0901 142.250 1192.500 2026193 4.000 TOO.RO 2010 000 520NT 2008 CORT BE 41 2. Last year's rading AB Last year's iet 4 Ltrar's rain Total 45 This year's ag Equity 46 Cash Flow from Opera 17 Sala dva 40 90.495 1566 254991 Test 129 3410 2:46 1.33694 (4020) 140.00 IN 107 1,082.257 1956 SENIO TEST 334 LIT1324 2.06.193 CONSOLIDATED 2 Comparative Income Statements For the Year Ended December 2005 2007 2008 2009 3010 2011 6 1 10 Net Salas 11 Les Cost of Good Sold 19 Grow Profit Total Operating penis 14 Operating Income 15 Inter Expen 10 m t l e l 97 Netleme 18 0 20 Comparative Balance Sheets 21 For the Year Ended, December 2005 22 803500 (414065 329,435 (95 150) 234.31 (45248) (3865) 186.121 1.704000 (312.030) 391 920 (160.460) 231.460 (26 515) 15300) 19.648 1974.500 (1116 240) 351.260 (266460) 591.800 (43.155) (1275) 38.370 3.660.600 2269572) 1391.028 (465.790 936.338 (24919 6.950 191.369 2.698.800 (1 619 356 1.023564 (41490) 610,614 (112330) 05.2003 483,094 CONSOLIDATED 2007 2008 2009 3010 2011 24. Current A 25 Dark 26 Accounts Rece 27 Merchant 26 39 Taille So Praia 31 Towe 2 Total 33 Total 34 Total Comments This of the 37 Total Livind Owner'i Tulty 30 400 19250 144.200 12.950 12.600 14792 374 500 2003 107 50.000 129.500 341.000 3.500 11.000 300 $45.00 1920 104 2.466.304 359400 120.000 104 3.466.14 159.000 149 250 349.500 12.000 37.500 6.000 723250 271014 34394 36.00 1.463.100 1714 3.4334 76.500 369 500 745.500 8.250 26250 16000 106.000 2004 06. 2250 1.191.500 2016193 4,06 130.000 337000 48.000 19.000 36.000 07.000 1.200.000 4016081 5.361,017 790.000 2,030.000 2440 LENICE OSC691 166.500 10022 1312107 LE 3003 14 OASE! 000TH 40 41 Last year's Art Karamables 4 Last year's 4 Lauri Total Art 45 This yearning ie 45 Carn ca 41 16.610 2017 911. 186.123 144.300 2.18 107 1.03.187 199,645 3010 110 349.000 496134 1.171334 2362 1011 17.00 948 2060. 1056195 413.094 9.46304 1.336. (40 AE w AM AN AO Financial Statement Analysis Enter your answers below 2007 2008 2009 2010 2011 Liquidity Ratios 0,67 Current Ratio Quick Ratio Inventory Turnover Inventory Tumover Period (days) Accounts Receivable Turnover Accounts Receivable Turnover Period (days) Operating Cycle (days) Cash Flow to Current Debt Borrowing Capacity Ratios Debt Ratio Equity Ratio Times Interest Earned Profitability Ratios Return on Net Sales Return on Equity Return on Assets Horizontal Analysis Total Assets Total Equity Comparative Income Statements For the Year Ended, December 2005 CONSOLIDATED 2007 2008 2009 2010 2011 Net L.todist Oro 500 (07.06 329,03 (510 254,255 1974.500 (1116301 Operating Income 1.704,000 (2010) 101 970 (160460) 231.450 CSI) 100) 199,648 09:37) 1,01 (65.7901 925.218 24919 2.50 892.369 2.000 (1673 1925:48 10140 610614 112.320) (1200) 483.0044 Los SA 2 Nein 0.535) 185,122 60.168) (1022) 1,170 Comparative Income Statements For the Year Ended, December 2005 CONSOLIDATED 2007 2007 2008 2008 2009 2009 2010 2010 25 Bak 26 Arcticable 2011 2011 0001 17.00 20 141.200 12.90 12.60 14,200 314.300 30 000 129 100 14.000 5.900 150.000 149 250 H. 12.000 37.500 0 500 169.00 948 500 29 Prada 3 Prep Remi 11 CA Til Art 000 TL OLU :100 54500 120.000 2.4004 350.000 370.000 25,30 S000 20600 TO 093 2.23 3.A 2000 16 000 19.000 od 12.000 205000 400 5.261,087 OSO 20 000 20 5.261,087 2,118,107 469,350 26.500 102.21 23.107 RELSE Lund Tallery 1190500 Tod IL NAM34 2664 Financial Statement Analysis Enter your answers below 200M 2009 2010 2011 Liquidity Ratios 0.67 Current Ratio Quick Ratio Inventory Tumover Inventory Turnover Period (days) Accounts Receivable Turnover Accounts Receivable Turnover Period (days) Operating Cycle (days) Cash Flow to Current Debt Borrowing Capacity Ratios Debt Ratio Equity Ratio Times Interest Earned Profitability Ratios Return on Net Sales Return on Equity Return on Assets Horizontal Analysis Total Asset Tulal Equity 2 Comparative Income Statements Por the Yewned, December 2005 CONSOLIDATED 2007 200N 2009 2010 2011 36 Notes 11 Le Colofondo 19. Go Profit 13 Total Optips 14 Operating HOOD (474065 3294315 (95.180) 334255 (45 2400 0335 185.123 1.107.000 (1312050 391920 (16) 231.460 (26.519) (5300) 199.648 (TTT 103 85 260 266 450) 591 800 (41155) 110.275) 1.39 (4690) 925.235 24919 1.95 192.369 16 Las Sale of Art 17 Net came 18 LO541 (414 610.614 (11220 IS 2009 15309 S.370 TA 2005 2009 2010 2011 T500 100 145.500 2.30 36.250 orci 001 LE 000919 0001 47600 2250 146200 12.950 12 600 14700 514300 2.001 807 2.318.107 469350 766 500 1082257 2.318.07 20 Account Receivable 97. Merchandise story 20 Supplies 29 Propalda 10. Prepaid Rent 31 Total Current Assets 32 Total Fixed As 33 Total Assets 34 Total Current Lilities 35 Total Long term Liabilities Equity, find of the Period I Total Liabilities and Owner's Equity CUE 50 000 129.500 10000 5.500 || CHO 18 500 545500 1.920.04 2.466.304 399 400 870.000 126.904 2.466 304 16 000 17000 19.000 140 250 149.500 12000 37500 6000 213250 2732014 3.486.324 362.500 1462 500 1171124 3.4.3.14 1062000 29 0901 142.250 1192.500 2026193 4.000 TOO.RO 2010 000 520NT 2008 CORT BE 41 2. Last year's rading AB Last year's iet 4 Ltrar's rain Total 45 This year's ag Equity 46 Cash Flow from Opera 17 Sala dva 40 90.495 1566 254991 Test 129 3410 2:46 1.33694 (4020) 140.00 IN 107 1,082.257 1956 SENIO TEST 334 LIT1324 2.06.193