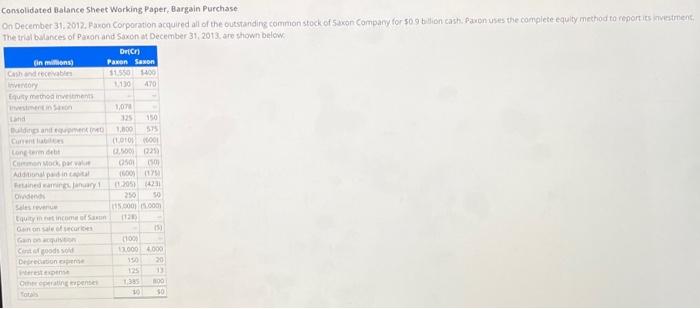

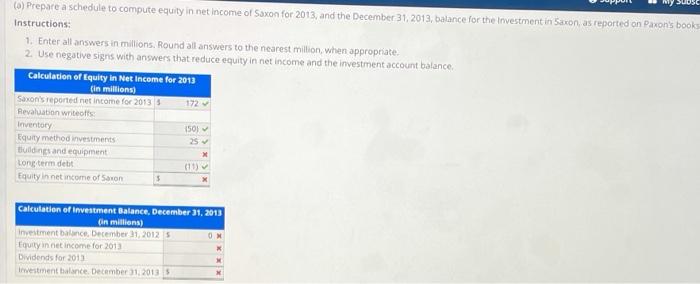

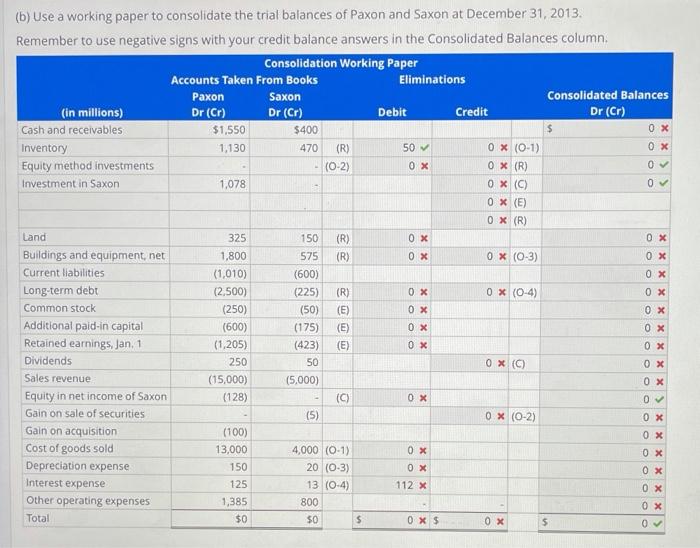

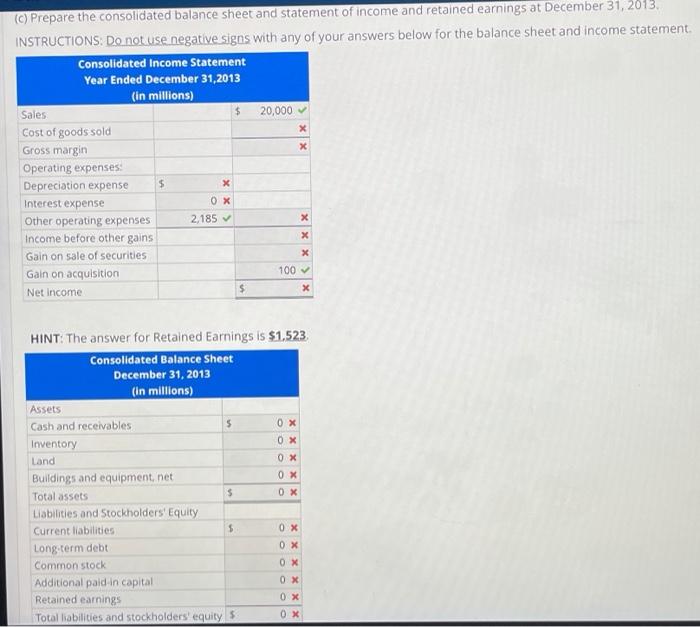

Consolidated Balance Sheet Working Paper, Bargain Purchase On December 31, 2012. Paxon Corporation acquired all of the outstanding common stock of Saxon Company for $0.9 billion cash. Paxon uses the complete equity method to report its vestment The trial balances of Pason and Saxon December 31, 2013. are shown below Drich in mins Paxon Sanon Cash and receivables 51550 100 Chery 1130 470 Erythog investment nin 1,074 325 150 Badanie 1.000 totoo Long 025 COM OS (502 Additional and 100 117 Bened in 1 11205) 1421 OW 250 50 Sales en 1000 m Equity income 1130 15 1100 Codes 12000 4000 Direction 20 Open 133 10 100 50 SUOSC (a) Prepare a schedule to compute equity in net income of Saxon for 2013, and the December 31, 2013, balance for the investment in Saxon as reported on Paxon's books Instructions: 1. Enter all answers in millions. Round all answers to the nearest million when appropriate 2. Use negative signs with answers that reduce equity in net income and the investment account balance. Calculation of Equity in Net Income for 2013 (in millions) Saxon's reported net income for 2013 172 Revaluation writeotts Inventory 150) Equity method investments Buildings and equipment Long term delit (11) Equity in net income of Saron X Calculation of investment Balance, December 31, 2013 On millions) Investment balance December 31, 2012 ON Equity in net income for 2013 Dividends for 2013 Investment balance December 1, 2013 5 (b) Use a working paper to consolidate the trial balances of Paxon and Saxon at December 31, 2013. Remember to use negative signs with your credit balance answers in the Consolidated Balances column Consolidation Working Paper Accounts Taken From Books Eliminations Paxon Saxon Consolidated Balances (in millions) Dr (Cr) Dr (Cr) Debit Credit Dr (Cr) Cash and receivables $1,550 $400 $ Inventory 1,130 470 (R) 50 OX 0x (0-1) Equity method investments (0-2) OX 0X (R) 0 Investment in Saxon 1,078 0X (C) 0 0 X (E) 0X (R) Land 325 150 (R) OX Buildings and equipment net 1,800 575 (R) OX 0X (0-3) OX Current Habilities (1,010) (600) 0 X Long-term debt (2.500) (225) (R) OX 0X (0-4) 0X Common stock (250) (50) (E) OX 0 x Additional paid-in capital (600) (175) (E) OX OX Retained earnings, Jan, 1 (1,205) (423) (E) OX 0 X Dividends 250 0X (0) OX Sales revenue (15,000) (5,000) Equity in net income of Saxon (128) (C) 0 Gain on sale of securities (5) 0X (0-2) 0 x Gain on acquisition (100) 0 X Cost of goods sold 13,000 4,000 (0-1) 0 X Depreciation expense 150 20 (0-3) OX Interest expense 125 13 (0-4) 112 x OX Other operating expenses 1,385 800 OX Total $0 $0 $ 0X $ OX $ 50 OX 0 x X (C) Prepare the consolidated balance sheet and statement of income and retained earnings at December 31, 2013 INSTRUCTIONS. Do not use negative signs with any of your answers below for the balance sheet and income statement Consolidated Income Statement Year Ended December 31,2013 (in millions) Sales $ 20,000 Cost of goods sold x Gross margin Operating expenses Depreciation expense $ Interest expense OX Other operating expenses 2.185 Income before other gains Gain on sale of securities Gain on acquisition 100 Net Income $ X XX X X HINT: The answer for Retained Earnings is $1.523, Consolidated Balance Sheet December 31, 2013 (in millions) Assets Cash and receivables OX Inventory OX Land 0 X Buildings and equipment net 0 x Total assets $ OX Liabilities and Stockholders' Equity Current liabilities $ 0 x Long-term debt 0 X Common stock OX Additional paid in capital OX Retained earnings 0 X Total liabilities and stockholders' equity OX Consolidated Balance Sheet Working Paper, Bargain Purchase On December 31, 2012. Paxon Corporation acquired all of the outstanding common stock of Saxon Company for $0.9 billion cash. Paxon uses the complete equity method to report its vestment The trial balances of Pason and Saxon December 31, 2013. are shown below Drich in mins Paxon Sanon Cash and receivables 51550 100 Chery 1130 470 Erythog investment nin 1,074 325 150 Badanie 1.000 totoo Long 025 COM OS (502 Additional and 100 117 Bened in 1 11205) 1421 OW 250 50 Sales en 1000 m Equity income 1130 15 1100 Codes 12000 4000 Direction 20 Open 133 10 100 50 SUOSC (a) Prepare a schedule to compute equity in net income of Saxon for 2013, and the December 31, 2013, balance for the investment in Saxon as reported on Paxon's books Instructions: 1. Enter all answers in millions. Round all answers to the nearest million when appropriate 2. Use negative signs with answers that reduce equity in net income and the investment account balance. Calculation of Equity in Net Income for 2013 (in millions) Saxon's reported net income for 2013 172 Revaluation writeotts Inventory 150) Equity method investments Buildings and equipment Long term delit (11) Equity in net income of Saron X Calculation of investment Balance, December 31, 2013 On millions) Investment balance December 31, 2012 ON Equity in net income for 2013 Dividends for 2013 Investment balance December 1, 2013 5 (b) Use a working paper to consolidate the trial balances of Paxon and Saxon at December 31, 2013. Remember to use negative signs with your credit balance answers in the Consolidated Balances column Consolidation Working Paper Accounts Taken From Books Eliminations Paxon Saxon Consolidated Balances (in millions) Dr (Cr) Dr (Cr) Debit Credit Dr (Cr) Cash and receivables $1,550 $400 $ Inventory 1,130 470 (R) 50 OX 0x (0-1) Equity method investments (0-2) OX 0X (R) 0 Investment in Saxon 1,078 0X (C) 0 0 X (E) 0X (R) Land 325 150 (R) OX Buildings and equipment net 1,800 575 (R) OX 0X (0-3) OX Current Habilities (1,010) (600) 0 X Long-term debt (2.500) (225) (R) OX 0X (0-4) 0X Common stock (250) (50) (E) OX 0 x Additional paid-in capital (600) (175) (E) OX OX Retained earnings, Jan, 1 (1,205) (423) (E) OX 0 X Dividends 250 0X (0) OX Sales revenue (15,000) (5,000) Equity in net income of Saxon (128) (C) 0 Gain on sale of securities (5) 0X (0-2) 0 x Gain on acquisition (100) 0 X Cost of goods sold 13,000 4,000 (0-1) 0 X Depreciation expense 150 20 (0-3) OX Interest expense 125 13 (0-4) 112 x OX Other operating expenses 1,385 800 OX Total $0 $0 $ 0X $ OX $ 50 OX 0 x X (C) Prepare the consolidated balance sheet and statement of income and retained earnings at December 31, 2013 INSTRUCTIONS. Do not use negative signs with any of your answers below for the balance sheet and income statement Consolidated Income Statement Year Ended December 31,2013 (in millions) Sales $ 20,000 Cost of goods sold x Gross margin Operating expenses Depreciation expense $ Interest expense OX Other operating expenses 2.185 Income before other gains Gain on sale of securities Gain on acquisition 100 Net Income $ X XX X X HINT: The answer for Retained Earnings is $1.523, Consolidated Balance Sheet December 31, 2013 (in millions) Assets Cash and receivables OX Inventory OX Land 0 X Buildings and equipment net 0 x Total assets $ OX Liabilities and Stockholders' Equity Current liabilities $ 0 x Long-term debt 0 X Common stock OX Additional paid in capital OX Retained earnings 0 X Total liabilities and stockholders' equity OX