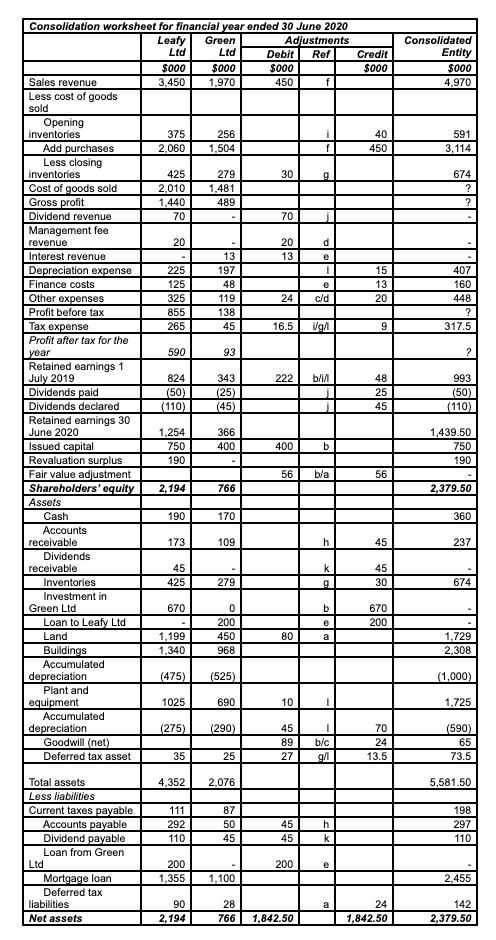

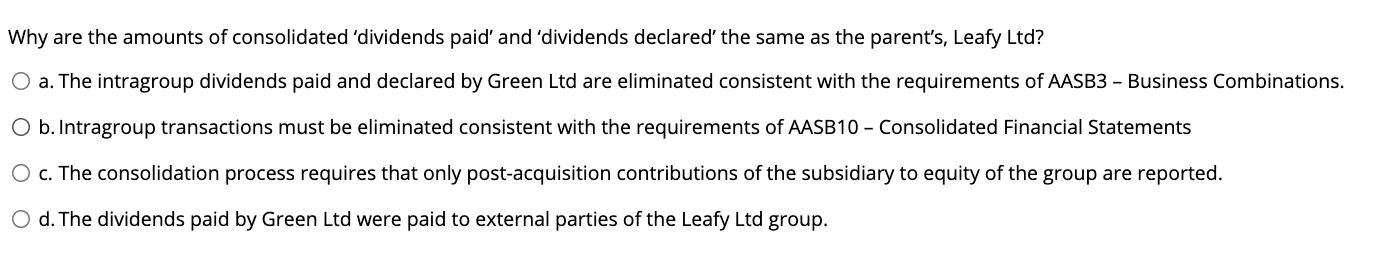

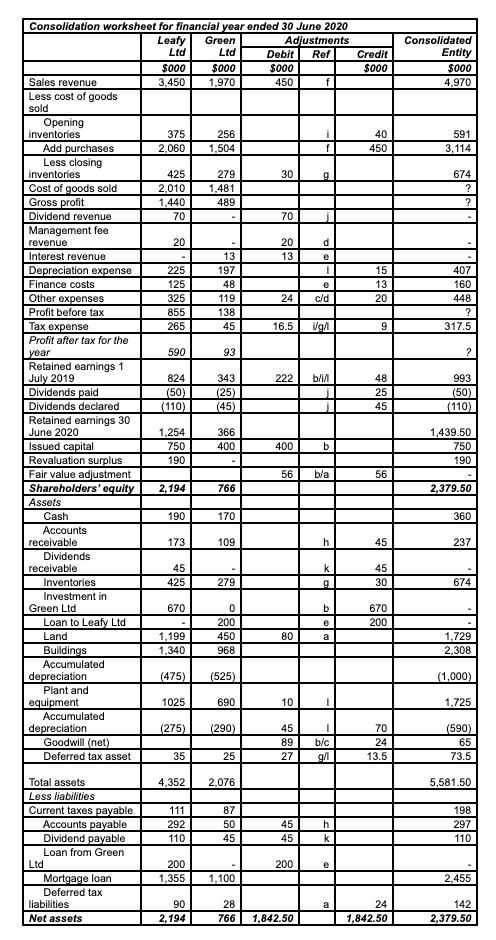

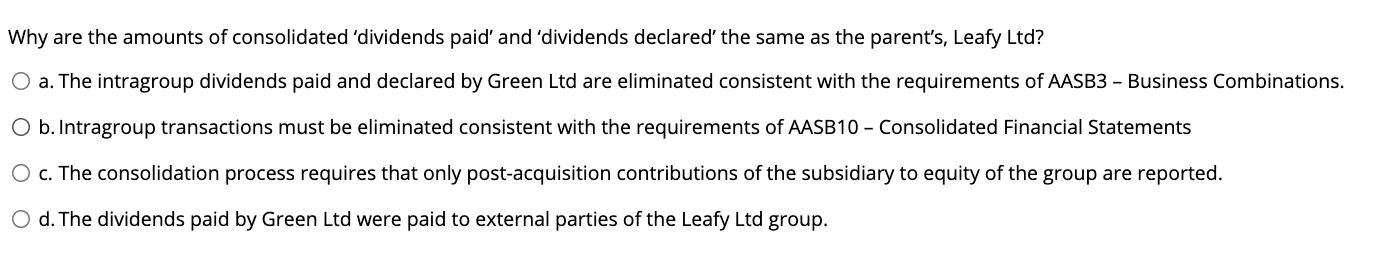

Consolidated Entity $000 4,970 591 3,114 674 ? ? e 407 160 448 ? 317.5 265 ? Consolidation worksheet for financial year ended 30 June 2020 Leafy Green Adjustments Ltd Ltd Debit Ref Credit $000 $000 $000 $000 Sales revenue 3,450 1,970 450 f Less cost of goods sold Opening inventories 375 256 40 Add purchases 2,060 1,504 450 Less closing inventories 425 279 30 Cost of goods sold 2,010 1,481 Gross profit 1,440 489 Dividend revenue 70 70 Management fee revenue 20 20 d Interest revenue 13 13 Depreciation expense 225 197 1 15 Finance costs 125 48 13 Other expenses 325 119 24 cld 20 Profit before tax 855 138 Tax expense 45 16.5 191 9 Profit after tax for the year 590 93 Retained earnings 1 July 2019 824 343 222 b/i/ 48 Dividends paid (50) (25) 25 Dividends declared (110) (45) 45 Retained earnings 30 June 2020 1,254 366 Issued capital 750 400 400 b Revaluation surplus 190 Fair value adjustment 56 b/a 56 Shareholders' equity 2,194 766 Assets Cash 190 170 Accounts receivable 173 109 h 45 Dividends receivable 45 k 45 Inventories 425 279 9 30 Investment in Green Ltd 670 0 b 670 Loan to Leafy Ltd 200 200 Land 1,199 450 80 a Buildings 1,340 968 Accumulated depreciation (475) (525) Plant and equipment 1025 690 10 1 Accumulated depreciation (275) (290) 45 1 70 Goodwill (net) 89 b/c 24 Deferred tax asset 35 25 27 gi 13.5 993 (50) (110) 1,439.50 750 190 2,379.50 360 237 674 1,729 2.308 (1,000) 1,725 (590) 65 73.5 4,352 2,076 5,581.50 87 111 292 110 50 45 45 45 h k 198 297 110 Total assets Less liabilities Current taxes payable Accounts payable Dividend payable Loan from Green Ltd Mortgage loan Deferred tax liabilities Net assets 200 200 1,355 1,100 2,455 90 2,194 28 766 24 1,842.50 142 2,379.50 1,842.50 Why are the amounts of consolidated 'dividends paid' and 'dividends declared the same as the parent's, Leafy Ltd? a. The intragroup dividends paid and declared by Green Ltd are eliminated consistent with the requirements of AASB3 - Business Combinations. O b.Intragroup transactions must be eliminated consistent with the requirements of AASB10 - Consolidated Financial Statements O c. The consolidation process requires that only post-acquisition contributions of the subsidiary to equity of the group are reported. O d. The dividends paid by Green Ltd were paid to external parties of the Leafy Ltd group. Consolidated Entity $000 4,970 591 3,114 674 ? ? e 407 160 448 ? 317.5 265 ? Consolidation worksheet for financial year ended 30 June 2020 Leafy Green Adjustments Ltd Ltd Debit Ref Credit $000 $000 $000 $000 Sales revenue 3,450 1,970 450 f Less cost of goods sold Opening inventories 375 256 40 Add purchases 2,060 1,504 450 Less closing inventories 425 279 30 Cost of goods sold 2,010 1,481 Gross profit 1,440 489 Dividend revenue 70 70 Management fee revenue 20 20 d Interest revenue 13 13 Depreciation expense 225 197 1 15 Finance costs 125 48 13 Other expenses 325 119 24 cld 20 Profit before tax 855 138 Tax expense 45 16.5 191 9 Profit after tax for the year 590 93 Retained earnings 1 July 2019 824 343 222 b/i/ 48 Dividends paid (50) (25) 25 Dividends declared (110) (45) 45 Retained earnings 30 June 2020 1,254 366 Issued capital 750 400 400 b Revaluation surplus 190 Fair value adjustment 56 b/a 56 Shareholders' equity 2,194 766 Assets Cash 190 170 Accounts receivable 173 109 h 45 Dividends receivable 45 k 45 Inventories 425 279 9 30 Investment in Green Ltd 670 0 b 670 Loan to Leafy Ltd 200 200 Land 1,199 450 80 a Buildings 1,340 968 Accumulated depreciation (475) (525) Plant and equipment 1025 690 10 1 Accumulated depreciation (275) (290) 45 1 70 Goodwill (net) 89 b/c 24 Deferred tax asset 35 25 27 gi 13.5 993 (50) (110) 1,439.50 750 190 2,379.50 360 237 674 1,729 2.308 (1,000) 1,725 (590) 65 73.5 4,352 2,076 5,581.50 87 111 292 110 50 45 45 45 h k 198 297 110 Total assets Less liabilities Current taxes payable Accounts payable Dividend payable Loan from Green Ltd Mortgage loan Deferred tax liabilities Net assets 200 200 1,355 1,100 2,455 90 2,194 28 766 24 1,842.50 142 2,379.50 1,842.50 Why are the amounts of consolidated 'dividends paid' and 'dividends declared the same as the parent's, Leafy Ltd? a. The intragroup dividends paid and declared by Green Ltd are eliminated consistent with the requirements of AASB3 - Business Combinations. O b.Intragroup transactions must be eliminated consistent with the requirements of AASB10 - Consolidated Financial Statements O c. The consolidation process requires that only post-acquisition contributions of the subsidiary to equity of the group are reported. O d. The dividends paid by Green Ltd were paid to external parties of the Leafy Ltd group