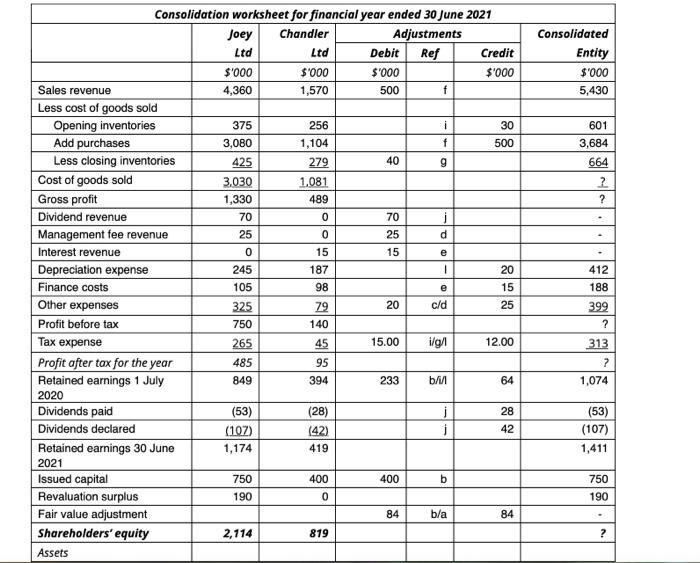

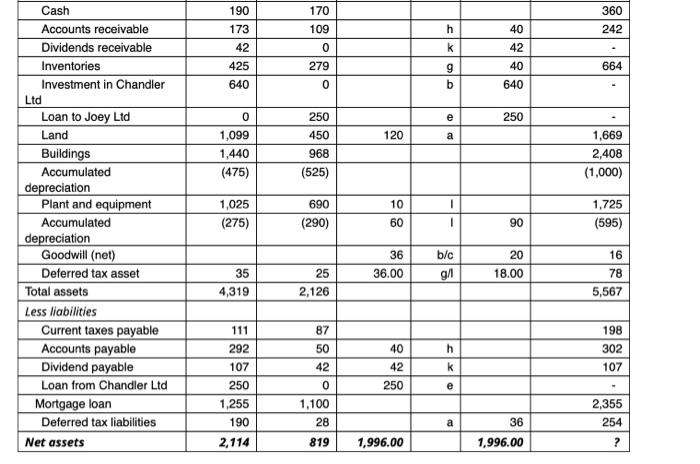

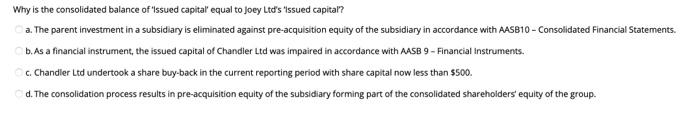

Consolidated Entity $'000 5,430 601 3,684 664 2 ? e Consolidation worksheet for financial year ended 30 June 2021 Joey Chandler Adjustments Ltd Ltd Debit Ref Credit $'000 $'000 $'000 $'000 Sales revenue 4,360 1,570 500 f Less cost of goods sold Opening inventories 375 256 i 30 Add purchases 3,080 1,104 f 500 Less closing inventories 425 279 40 g Cost of goods sold 3.030 1,081 Gross profit 1,330 489 Dividend revenue 70 0 70 j Management fee revenue 25 0 25 d Interest revenue 0 15 15 Depreciation expense 245 187 1 20 Finance costs 105 98 15 Other expenses 325 79 20 cld 25 Profit before tax 750 140 Tax expense 265 45 15.00 i/g1 12.00 Profit after tax for the year 485 95 Retained earnings 1 July 849 394 233 b 64 2020 Dividends paid (53) (28) 28 Dividends declared (107) (42) 42 Retained earnings 30 June 1,174 419 2021 Issued capital 750 400 400 b Revaluation surplus 190 0 Fair value adjustment b/a 84 Shareholders' equity 2,114 819 Assets 412 188 e 399 ? 313 7 1,074 (53) (107) 1,411 750 190 84 ? 190 173 42 360 242 Cash Accounts receivable Dividends receivable Inventories Investment in Chandler h 170 109 0 279 0 k 40 42 40 640 425 664 9 b 640 Ltd e 250 120 a 0 1,099 1,440 (475) 250 450 968 (525) 1,669 2,408 (1,000) 1,025 (275) 690 (290) 10 60 1.725 (595) 90 b/c Loan to Joey Ltd Land Buildings Accumulated depreciation Plant and equipment Accumulated depreciation Goodwill (net) Deferred tax asset Total assets Less liabilities Current taxes payable Accounts payable Dividend payable Loan from Chandler Ltd Mortgage loan Deferred tax liabilities Net assets 36 36.00 20 18.00 g/1 35 4,319 25 2,126 16 78 5,567 40 h 198 302 107 k 111 292 107 250 1,255 190 2,114 87 50 42 0 1,100 28 42 250 e 2,355 254 a 36 1,996.00 819 1,996.00 ? Why is the consolidated balance of issued capital equal to Joey Ltd's "ssued capital? a. The parent investment in a subsidiary is eliminated against pre-acquisition equity of the subsidiary in accordance with AASB10 - Consolidated Financial Statements. b. As a financial instrument, the issued capital of Chandler Ltd was impaired in accordance with AASB 9 - Financial Instruments. c. Chandler Ltd undertook a share buy-back in the current reporting period with share capital now less than $500. d. The consolidation process results in pre-acquisition equity of the subsidiary forming part of the consolidated shareholders' equity of the group. C