Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consolidated Income Statement AZ acquired 80% of the ordinary share capital of B on 1 January 2010 for R800 million. The group's policy is to

Consolidated Income Statement

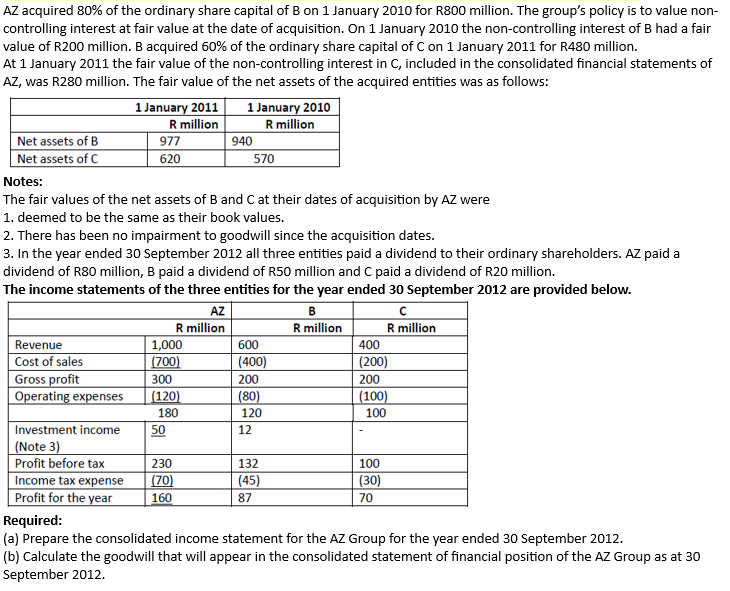

AZ acquired 80% of the ordinary share capital of B on 1 January 2010 for R800 million. The group's policy is to value noncontrolling interest at fair value at the date of acquisition. On 1 January 2010 the non-controlling interest of B had a fair value of R200 million. B acquired 60% of the ordinary share capital of C on 1 January 2011 for R480 million. At 1 January 2011 the fair value of the non-controlling interest in C, included in the consolidated financial statements of AZ, was R280 million. The fair value of the net assets of the acquired entities was as follows: Notes: The fair values of the net assets of B and C at their dates of acquisition by AZ were 1. deemed to be the same as their book values. 2. There has been no impairment to goodwill since the acquisition dates. 3. In the year ended 30 September 2012 all three entities paid a dividend to their ordinary shareholders. AZ paid a dividend of R80 million, B paid a dividend of R50 million and C paid a dividend of R20 million. The income statements of the three entities for the year ended 30 September 2012 are provided below. Required: (a) Prepare the consolidated income statement for the AZ Group for the year ended 30 September 2012. (b) Calculate the goodwill that will appear in the consolidated statement of financial position of the AZ Group as at 30 September 2012

AZ acquired 80% of the ordinary share capital of B on 1 January 2010 for R800 million. The group's policy is to value noncontrolling interest at fair value at the date of acquisition. On 1 January 2010 the non-controlling interest of B had a fair value of R200 million. B acquired 60% of the ordinary share capital of C on 1 January 2011 for R480 million. At 1 January 2011 the fair value of the non-controlling interest in C, included in the consolidated financial statements of AZ, was R280 million. The fair value of the net assets of the acquired entities was as follows: Notes: The fair values of the net assets of B and C at their dates of acquisition by AZ were 1. deemed to be the same as their book values. 2. There has been no impairment to goodwill since the acquisition dates. 3. In the year ended 30 September 2012 all three entities paid a dividend to their ordinary shareholders. AZ paid a dividend of R80 million, B paid a dividend of R50 million and C paid a dividend of R20 million. The income statements of the three entities for the year ended 30 September 2012 are provided below. Required: (a) Prepare the consolidated income statement for the AZ Group for the year ended 30 September 2012. (b) Calculate the goodwill that will appear in the consolidated statement of financial position of the AZ Group as at 30 September 2012

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started