Question

CONSOLIDATED INCOME STATEMENT The Indegenous Group carries on business as a distributor of warehouse equipment and importer of fruit into the country. Indegenous was incorporated

CONSOLIDATED INCOME STATEMENT

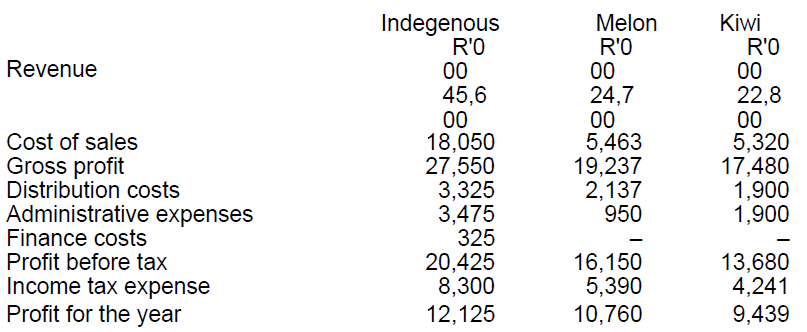

The Indegenous Group carries on business as a distributor of warehouse equipment and importer of fruit into the country. Indegenous was incorporated in 20X1 to distribute warehouse equipment. It diversified its activities during 20X3 to include the import and distribution of fruit, and expanded its operations by the acquisition of shares in Melon in 20X5 and in Kiwi in 20X7.Accounts for all companies are made up to 31 December. The draft income statements for Indegenous, Melon and Kiwi for the year ended 31

December 20X9 are as follows.

The following information is available relating to Indegenous, Melon and Kiwi.

(a) On 1 January 20X5 Indegenous acquired 2,700,000 R1 ordinary shares in Melon for

R6,650,000 at which date there was a credit balance on the retained earnings of Melon

of R1,425,000. No shares have been issued by Melon since Indegenous acquired its

interest.

(b) On 1 January 20X7 Melon acquired 1,600,000 R1 ordinary shares in Kiwi for

R3,800,000 at which date there was a credit balance on the retained earnings of Kiwi

of R950,000. No shares have been issued by Kiwi since Melon acquired its interest.

(c) During 20X9, Kiwi had made intragroup sales to Melon of R480,000 making a profit of

25% on cost and R75,000 of these goods were in inventories at 31 December 20X9.

(d) During 20X9, Melon had made intragroup sales to Indigenous of R260,000 making a

profit of 331/3% on cost and R60,000 of these goods were in inventories at 31 December 20X9.

(e) On 1 November 20X9 Indigenous sold warehouse equipment to Melon for R240,000

from inventories. Melon has included this equipment in its property, plant and

equipment. The equipment had been purchased on credit by indigenous for R200,000

in October 20X9 and this amount is included in its current liabilities as at 31 December

20X9.

(f) Melon charges depreciation on its warehouse equipment at 20% on cost. It is company

policy to charge a full year's depreciation in the year of acquisition to be included in the

cost of sales.

(g) An impairment test conducted at the year-end did not reveal any impairment losses.

(h) It is the group's policy to value the non-controlling interest at fair value at the date of

acquisition. The fair value of the non-controlling interests in Melon on 1 January 20X5

was R500,000. The fair value of the 28% non-controlling interest in Kiwi on 1 January

20X7 was R900,000.

Prepare for the Indigenous Group:

(a) A consolidated income statement for the year ended 31 December 20X9 (25 marks)

\begin{tabular}{lccr} & Indegenous & Melon & \multicolumn{1}{c}{ Kiwi } \\ & R0 & \multicolumn{1}{c}{R0} & \multicolumn{1}{c}{R0} \\ Revenue & 00 & 00 & 00 \\ & 45,6 & 24,7 & 22,8 \\ & 00 & 00 & 00 \\ Cost of sales & 18,050 & 5,463 & 5,320 \\ Gross profit & 27,550 & 19,237 & 17,480 \\ Distribution costs & 3,325 & 2,137 & 1,900 \\ Administrative expenses & 3,475 & 950 & 1,900 \\ Finance costs & 325 & - & 13,680 \\ Profit before tax & 20,425 & 16,150 & 4,241 \\ Income tax expense & 8,300 & 5,390 & 9,439 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started