Answered step by step

Verified Expert Solution

Question

1 Approved Answer

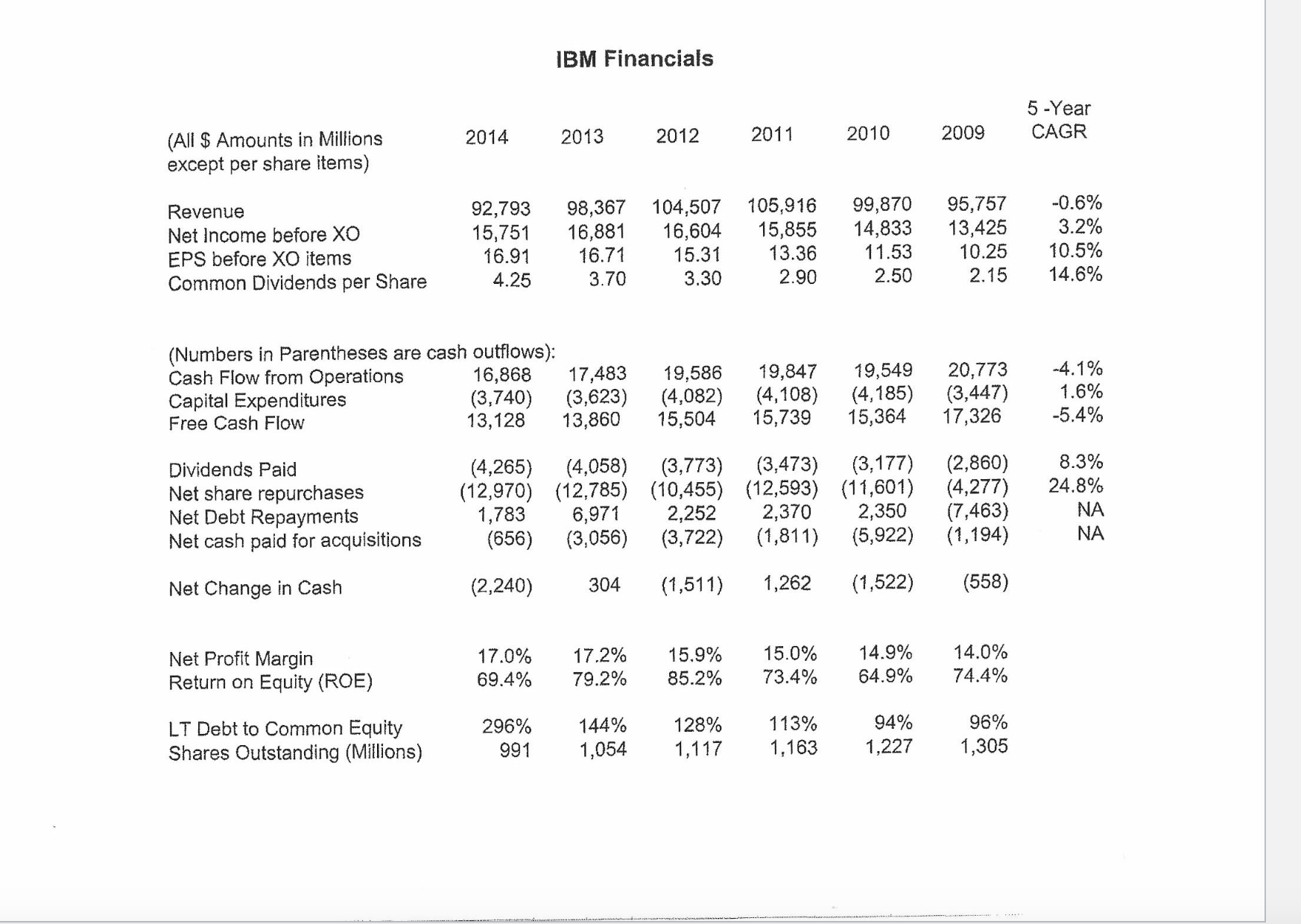

Consolidated Statement of Earnings Internaticnal Business Machines Corporation and Subsidiary Companies IBM Financials ($) in milions) For the year ended December 31: Cash flows from

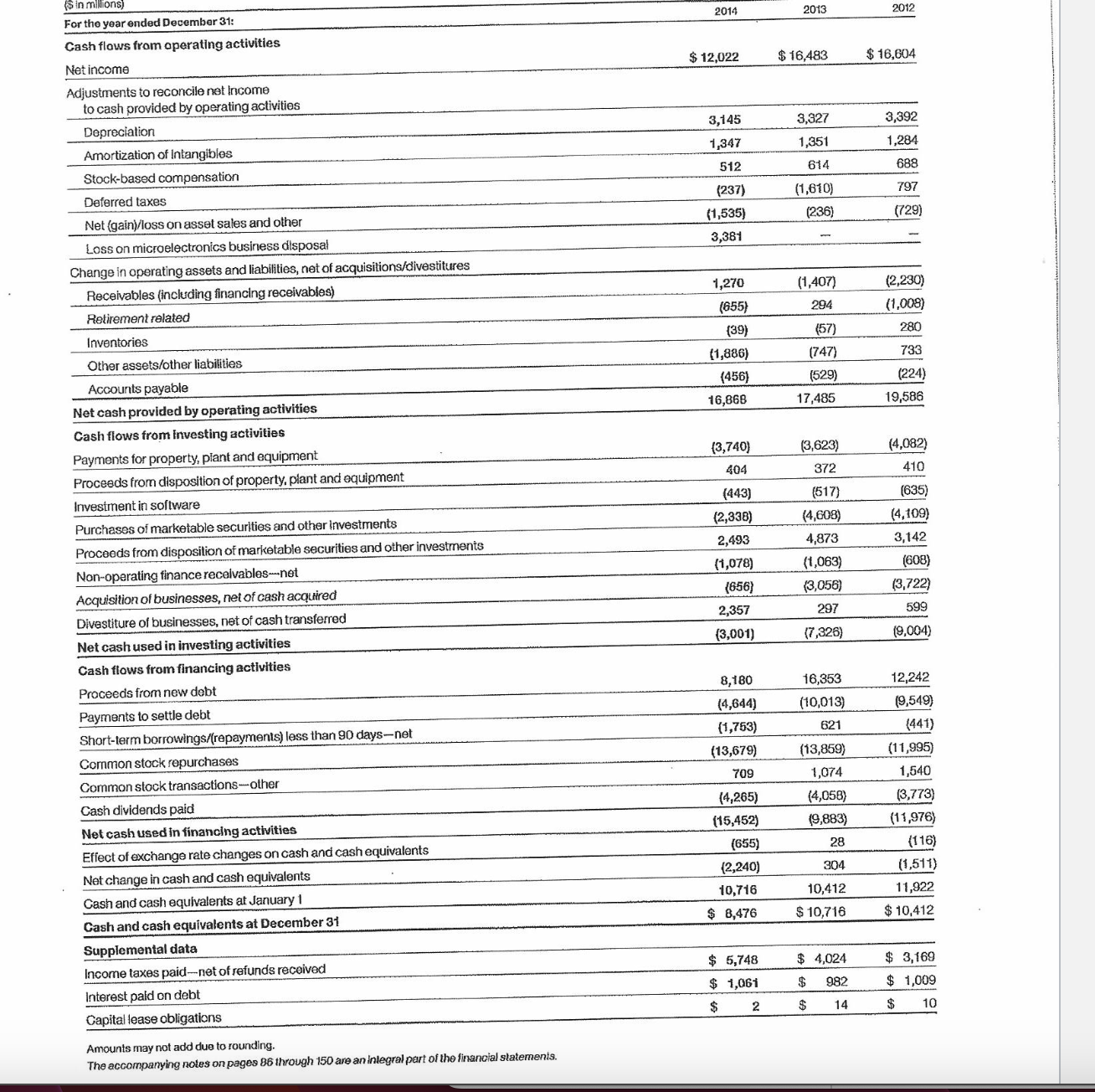

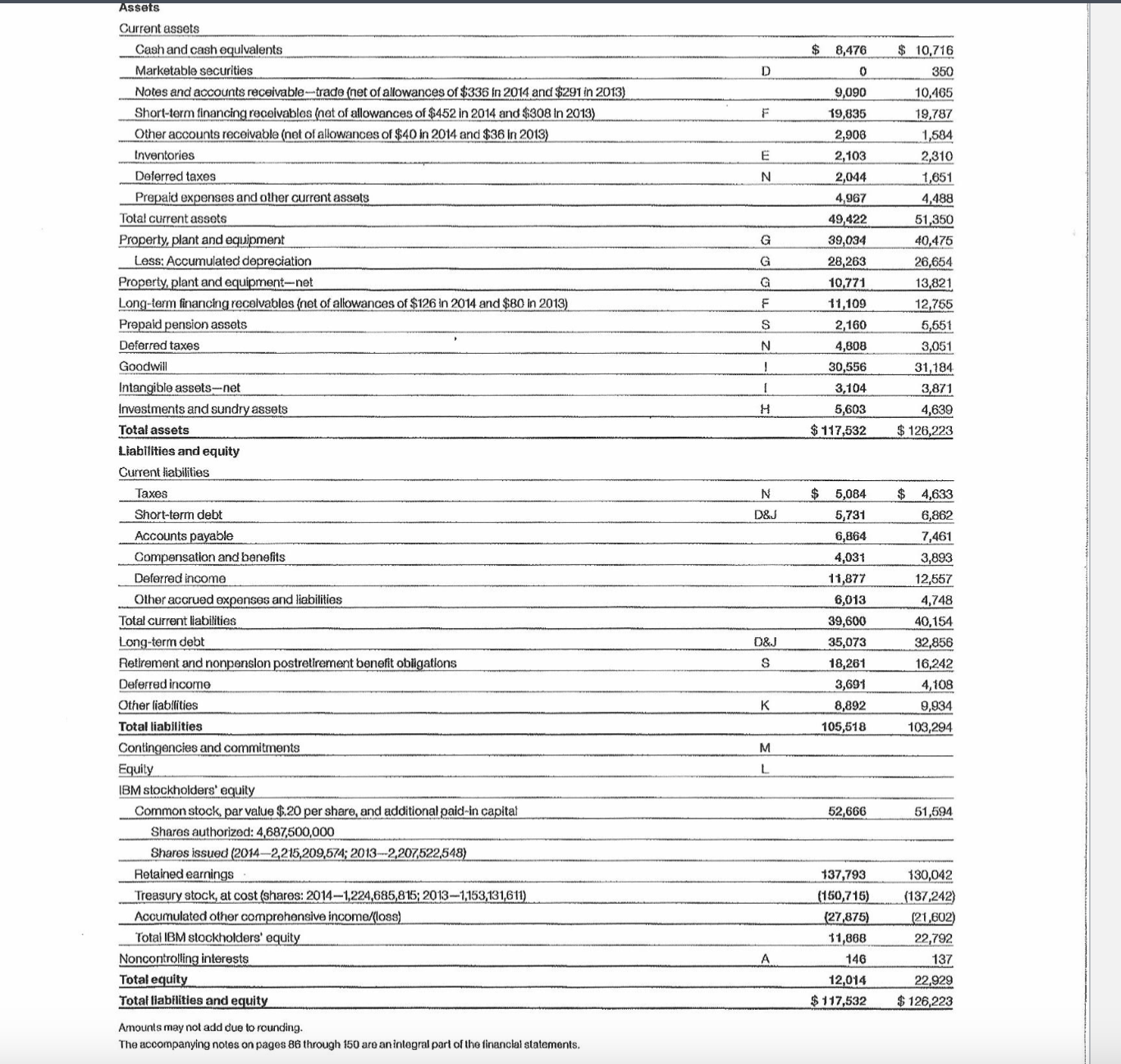

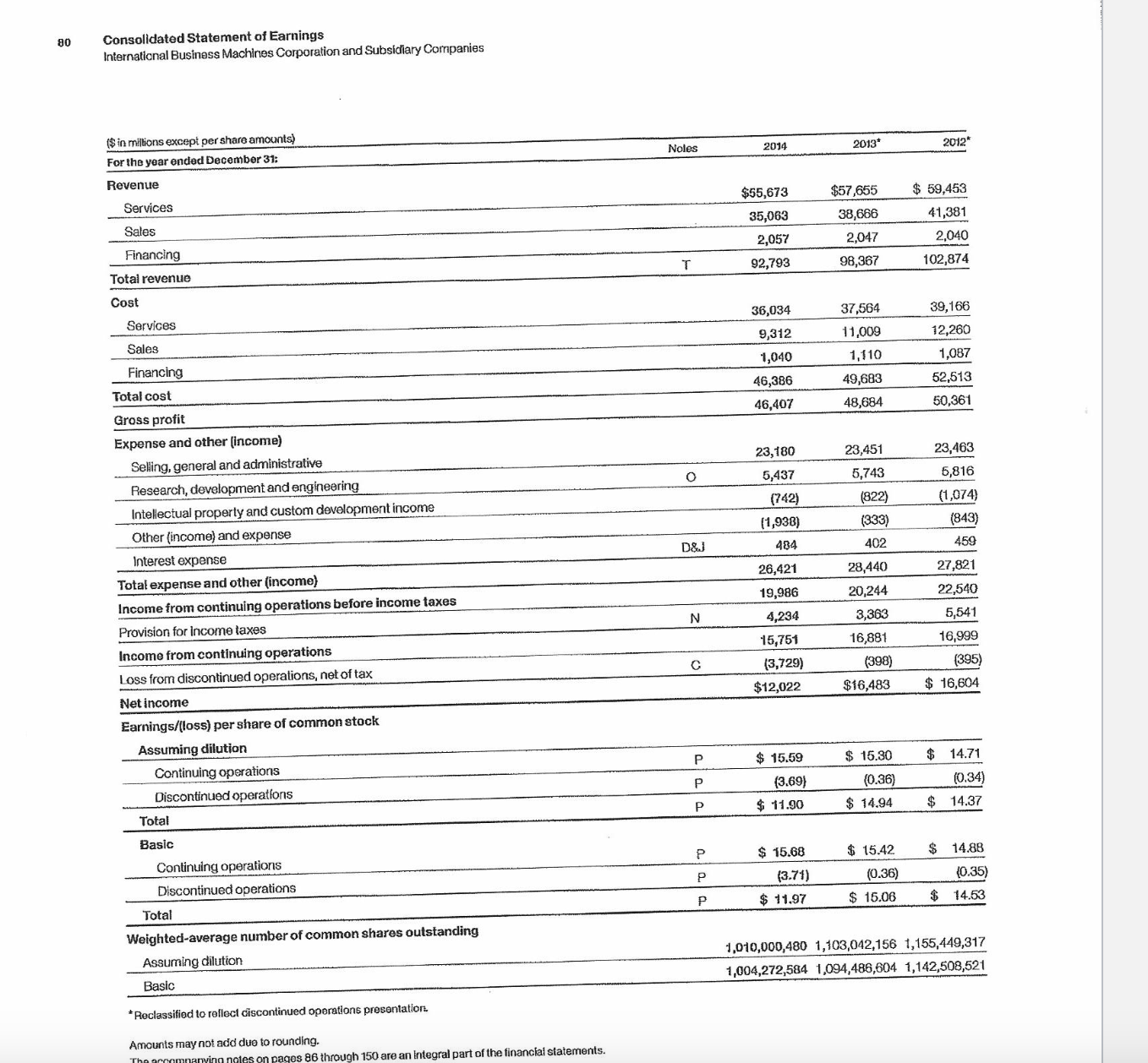

Consolidated Statement of Earnings Internaticnal Business Machines Corporation and Subsidiary Companies IBM Financials (\$) in milions) For the year ended December 31: Cash flows from operating activities Net income $12,022 $16,483 $16,604 Adjustments to reconcile net income to cash provided by operating activities Depreciation Amortization of Intangibles Stock-based compensation Deferred taxes Net (gain)/loss on asset sales and other Loss on microelectronics business disposal Change in operating assets and liabilities, net of acquisitions/divestitures Receivables (including financing receivables) \begin{tabular}{l} Retirement related \\ \hline Inventories \\ \hline Other assets/other liabilities \\ \hline \end{tabular} Accounts payable Net cash provided by operating activities Cash flows from investing activities Payments for property, plant and equipment Proceeds from disposition of property, plant and equipment Investment in software Purchases of marketable securities and other fnvestments Proceeds from disposition of marketable securities and other investments Non-operating finance recelvables - net Acquisition of businesses, net of cash acquired Divestiture of businesses, net of cash transferred Net cash used in investing activities Amounts may not add due to rounding. The accompanying notes on pages 86 through 150 are an integral part of the financial statements. Please see the attached exhibits for the financials of IBM during the 5-year period 2009 to 2014. The video on free cash flow in this module and reviewing the components of the cash flow statement on pages 3639 of the text may be helpful in interpreting the data for the case. In a few sentences please respond to the following four questions: 1) IBM increased its EPS before XO (extraordinary) items by a compounded annual growth rate (CAGR) of 10.5% from 2009 to 2014, but its revenue increased actually. declined over the same time period. How would you explain the divergence? 2) What factors likely contributed to the abnormally high ROE (S\&P 500 average ROE is around 15\%) throughout the 5 -year period? 3) Examining the statement of cash flows, what weaknesses or potential problems can you identify, especially in relating the financing activities section to the other two sections, operating and investing? 4) Based on your analysis of the statement of cash flows for 2014, what recommendations would you make to management? Please answer the four questions in a sentence or two and post your responses to the Discussion. Also respond to at least two of your classmates posts on their responses to the Discussion. See rubric under the Announcements folder dated 3/21/23 or you can see the rubric by clicking on the 3 dots in the upper right-hand corner

Consolidated Statement of Earnings Internaticnal Business Machines Corporation and Subsidiary Companies IBM Financials (\$) in milions) For the year ended December 31: Cash flows from operating activities Net income $12,022 $16,483 $16,604 Adjustments to reconcile net income to cash provided by operating activities Depreciation Amortization of Intangibles Stock-based compensation Deferred taxes Net (gain)/loss on asset sales and other Loss on microelectronics business disposal Change in operating assets and liabilities, net of acquisitions/divestitures Receivables (including financing receivables) \begin{tabular}{l} Retirement related \\ \hline Inventories \\ \hline Other assets/other liabilities \\ \hline \end{tabular} Accounts payable Net cash provided by operating activities Cash flows from investing activities Payments for property, plant and equipment Proceeds from disposition of property, plant and equipment Investment in software Purchases of marketable securities and other fnvestments Proceeds from disposition of marketable securities and other investments Non-operating finance recelvables - net Acquisition of businesses, net of cash acquired Divestiture of businesses, net of cash transferred Net cash used in investing activities Amounts may not add due to rounding. The accompanying notes on pages 86 through 150 are an integral part of the financial statements. Please see the attached exhibits for the financials of IBM during the 5-year period 2009 to 2014. The video on free cash flow in this module and reviewing the components of the cash flow statement on pages 3639 of the text may be helpful in interpreting the data for the case. In a few sentences please respond to the following four questions: 1) IBM increased its EPS before XO (extraordinary) items by a compounded annual growth rate (CAGR) of 10.5% from 2009 to 2014, but its revenue increased actually. declined over the same time period. How would you explain the divergence? 2) What factors likely contributed to the abnormally high ROE (S\&P 500 average ROE is around 15\%) throughout the 5 -year period? 3) Examining the statement of cash flows, what weaknesses or potential problems can you identify, especially in relating the financing activities section to the other two sections, operating and investing? 4) Based on your analysis of the statement of cash flows for 2014, what recommendations would you make to management? Please answer the four questions in a sentence or two and post your responses to the Discussion. Also respond to at least two of your classmates posts on their responses to the Discussion. See rubric under the Announcements folder dated 3/21/23 or you can see the rubric by clicking on the 3 dots in the upper right-hand corner Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started