Question

CONSOLIDATED STATEMENT OF FINANCIAL POSITION BG acquired 25% of the equity share capital of JV several years ago when the retained earnings of JV were

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

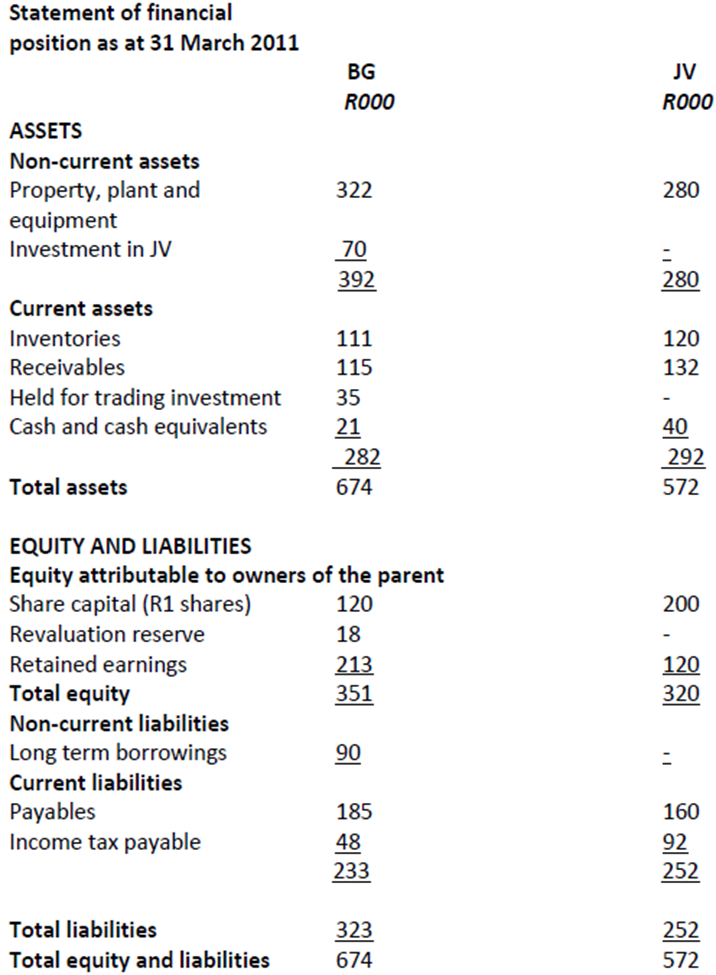

BG acquired 25% of the equity share capital of JV several years ago when the retained earnings of JV were R40,000. JV operates as a separate entity under a contractual agreement between BG and 3 other parties, each party holding an equal proportion of the equity share capital. The investment in JV is held at cost in BGs individual financial statements, and has been correctly classified as a joint venture.

Additional information:

- During the year JV sold goods to BG for R200,000. Half of these goods remain in BGs inventories at 31 March 2011. JV makes a 20% margin on all sales. The most recent invoice for R24,000 sent from JV to BG in respect of these sales remains outstanding at the year end.

- BG holds another investment, which it has correctly classified as held for trading. The fair value of this investment at 31 March 2011 was R42,000, although this has not yet been reflected in the financial statements.

Required:

(a) Prepare the consolidated statement of financial position for the BG group as at 31 March 2011, assuming BG group adopts proportionate consolidation in accounting for joint ventures.

(b) Explain the alternative accounting treatment permitted by IAS 31 Interests in Joint Ventures in accounting for joint venture entities AND how adopting this policy would change the BG groups statement of financial position (no further calculations are required).

Statement of financial position as at 31 March 2011 BG Ro00 ASSETS Non-current assets Property, plant and equipment Investment in JV Current assets Inventories Receivables Held for trading investment Cash and cash equivalents Total assets 322 \begin{tabular}{ll} 39270 & 2 \\ 111 & 280 \\ 115 & 120 \\ 35 & 132 \\ 28221 & - \\ 274 & 40 \\ 292 \end{tabular} EQUITY AND LIABILITIES Equity attributable to owners of the parent Share capital (R1 shares) Revaluation reserve Retained earnings Total equity Non-current liabilities Long term borrowings Current liabilities Payables Income tax payable Total liabilities Total equity and liabilities 120 18 213 351 90 185 48233 323 674 JV ROOO 280 280 120 132 40 572292 200 320120 320 = 160 92252 572252

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started