Question

CONSOLIDATED STATEMENT OF PROFIT OR LOSS Additional information 1. A acquired 80% of the equity share capital of B on 1 January 2010 for AR1,800,000

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

Additional information

1. A acquired 80% of the equity share capital of B on 1 January 2010 for AR1,800,000 when the reserves of B were BR1,900,000. The investment is held at cost in the individual financial statements of A. There have been no issues of share capital since the date of acquisition.

2. The group policy is to value non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interest of B was AR410,000 at the date of acquisition.

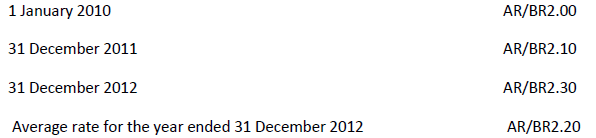

3. The functional currency of A is the AR. The functional currency of B is the BR. Relevant exchange rates (where AR/BR 2.00 means AR1 = BR2.00) are:

4. An impairment review conducted on 31 December 2011 resulted in the goodwill arising on the acquisition of B being written down by 20%.

Prepare the following for the A group:

(a) the consolidated statement of profit or loss for the year ended 31 December 2012;

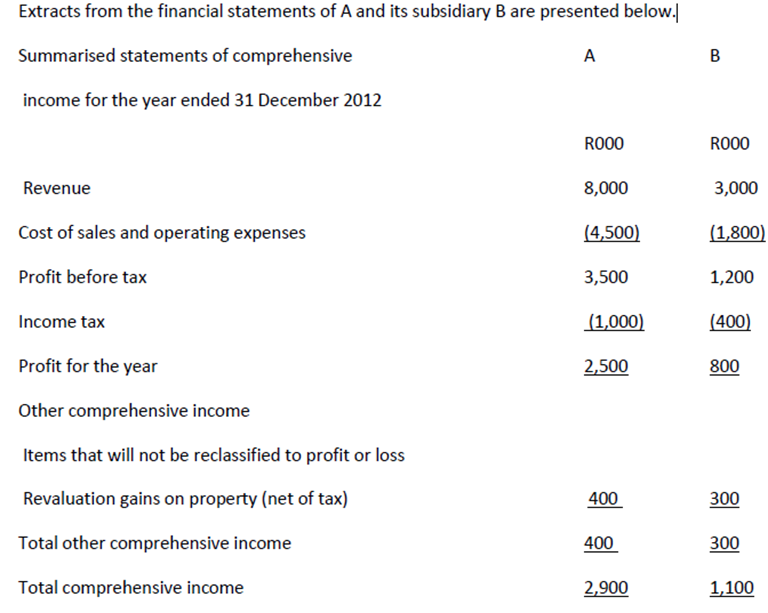

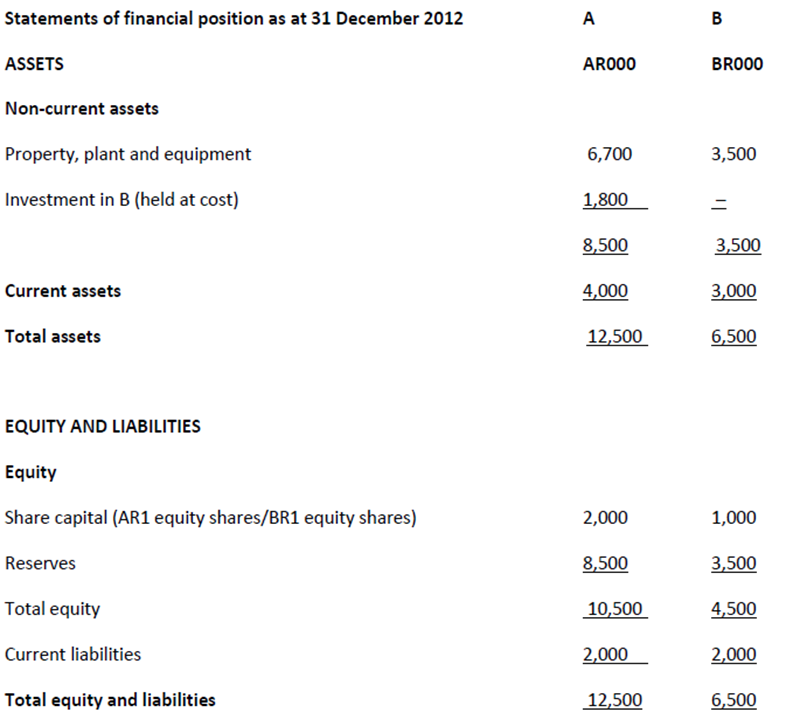

Extracts from the financial statements of A and its subsidiary B are presented below.| Summarised statements of comprehensive income for the year ended 31 December 2012 \begin{tabular}{lcc} & R000 & R000 \\ Revenue & 8,000 & 3,000 \\ Cost of sales and operating expenses & (4,500) & (1,800) \\ Profit before tax & 3,500 & 1,200 \\ Income tax & (1,000) & (400) \\ Profit for the year & 2,500 & 800 \end{tabular} Other comprehensive income Items that will not be reclassified to profit or loss Revaluation gains on property (net of tax) Total other comprehensive income Total comprehensive income A B B \begin{tabular}{ll} R000 & R000 \\ 8,000 & 3,000 \\ (4,500) & (1,800) \\ 3,500 & 1,200 \\ (1,000) & (400) \\ 2,500 & 800 \\ & \end{tabular} Statements of financial position as at 31 December 2012 ASSETS Non-current assets Property, plant and equipment Investment in B (held at cost) Current assets Total assets EQUITY AND LIABILITIES Equity Share capital (AR1 equity shares/BR1 equity shares) Reserves Total equity Current liabilities Total equity and liabilities A B AR000 BR000 \begin{tabular}{lll} 6,700 & & 3,500 \\ 1,800 & & = \\ 8,500 & & 3,500 \\ 4,000 & & 3,000 \\ 12,500 & & 6,500 \end{tabular} \begin{tabular}{ll} 1 January 2010 & AR/BR2.00 \\ 31 December 2011 & AR/BR2.10 \\ 31 December 2012 & AR/BR2.30 \\ Average rate for the year ended 31 December 2012 & AR/BR2.20 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started