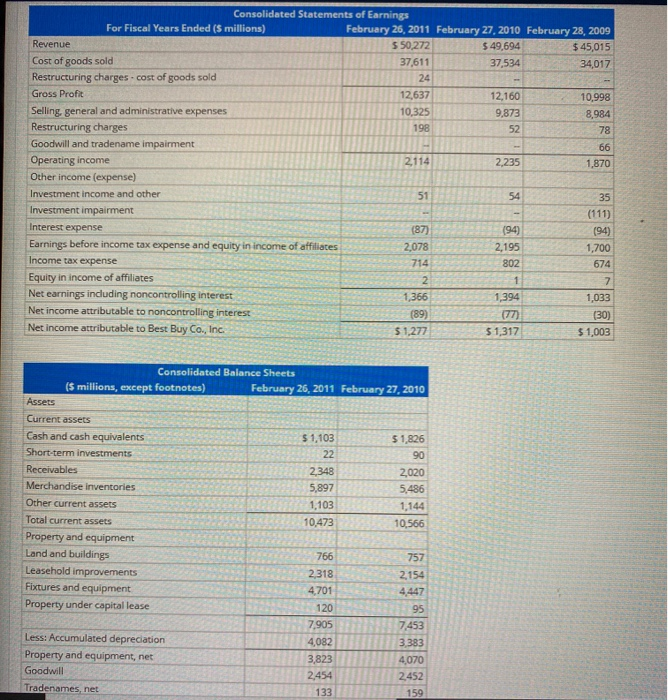

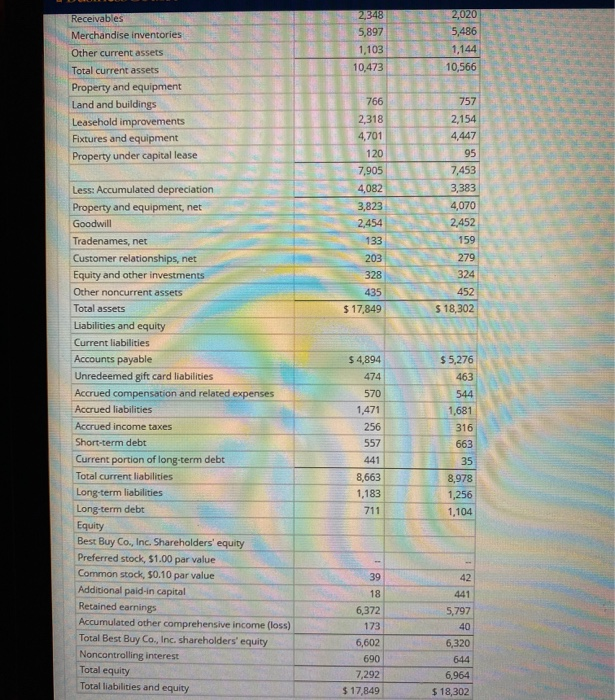

Consolidated Statements of Earnings For Fiscal Years Ended ($ millions) February 26, 2011 February 27, 2010 February 28, 2009 Revenue 50.272 $ 49,694 $ 45,015 Cost of goods sold 37 611 37,534 34,017 Restructuring charges - cost of goods sold Gross Profit 12,637 12,160 10,998 Selling general and administrative expenses 10.325 9,873 Restructuring charges Goodwill and tradename impairment Operating income 2,235 1,870 Other income (expense) Investment income and other 54 Investment impairment (111) Interest expense (94) Earnings before income tax expense and equity in income of affiliates 2,195 1.700 Income tax expense 802 Equity in income of affiliates 1 Net earnings including noncontrolling interest 1,366 Net income attributable to noncontrolling interest (89) Net income attributable to Best Buy Co., Inc. $1,277 $1,003 2,078 1.394 Consolidated Balance Sheets (5 millions, except footnotes) February 26, 2011 February 27, 2010 Assets Current assets Cash and cash equivalents $1,103 51,826 Short-term investments 22 Receivables 2348 2,020 Merchandise inventories 5,897 5,486 Other current assets 1,103 1,144 Total current assets 10,473 10,566 Property and equipment Land and buildings 766 757 Leasehold improvements 2,318 2154 Fixtures and equipment 4701 4.447 Property under capital lease 120 7,905 7,453 Less: Accumulated depreciation 4082 3.383 Property and equipment, net 3,823 10 4,070 Goodwill 2,452 Tradenames net 133 2,454 159 UN 5486 1,144 10,566 Receivables Merchandise inventories Other current assets Total current assets Property and equipment Land and buildings Leasehold improvements Fixtures and equipment Property under capital lease 766 2,318 4,701 120 7,905 4,082 3,823 2,454 133 203 757 2,154 4,447 95 7,453 3,383 4,070 2,452 328 159 279 324 452 $ 18,302 435 $ 17,849 Less: Accumulated depreciation Property and equipment, net Goodwill Tradenames, net Customer relationships, net Equity and other investments Other noncurrent assets Total assets Liabilities and equity Current liabilities Accounts payable Unredeemed gift card liabilities Accrued compensation and related expenses Accrued liabilities Accrued income taxes Short-term debt Current portion of long-term debt Total current liabilities Long-term liabilities Long-term debt Equity $4,894 $5,276 474 463 544 570 1,471 256 316 557 441 8,663 1,183 711 8,978 1,256 1.104 441 Best Buy Co., Inc. Shareholders' equity Preferred stock, $1.00 par value Common stock, 50.10 par value Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) Total Best Buy Co., Inc. shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 6,602 690 7,292 $ 17,849 5,797 40 6,320 644 6,964 $ 18,302 (a) Compute Best Buy's current ratio and quick ratios for 2011 and 2010. Round your answers to two decimal places) 2011 current ratio- 2010 current ratio 2011 quick ratio 2010 quick ratio bj compute Best Buy's times interest earned and its abilities-to-equity ratios for 2011 and 2010. (Round answers to two decimal places. HINTInclude equity income of afates in your times interest earned calculations 2011 times interest earned 2010 times interest earned 2011 liabilities-to-equity 2010 liabilities to equity