Question

Consolidated workpaper (noncontrolling interest, upstream sales, intercompany receivables/payables) Poe Corporation purchased a 90 percent interest in San Corporation on December 31, 2011, for $2,700,000 cash,

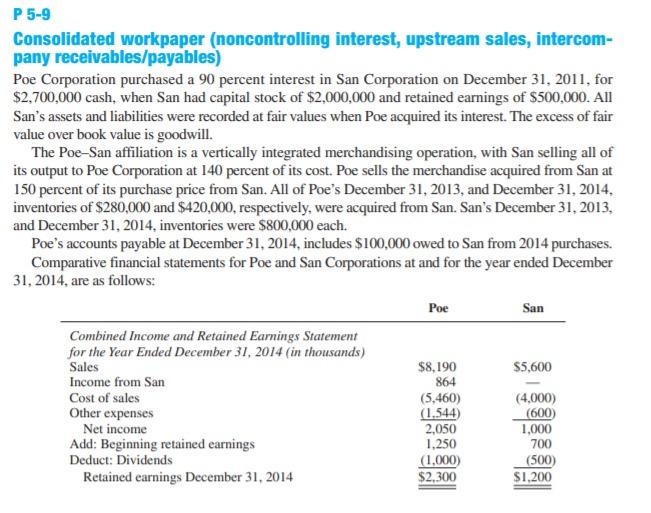

Consolidated workpaper (noncontrolling interest, upstream sales, intercompany receivables/payables) Poe Corporation purchased a 90 percent interest in San Corporation on December 31, 2011, for $2,700,000 cash, when San had capital stock of $2,000,000 and retained earnings of $500,000. All Sans assets and liabilities were recorded at fair values when Poe acquired its interest. The excess of fair value over book value is goodwill. The PoeSan affiliation is a vertically integrated merchandising operation, with San selling all of its output to Poe Corporation at 140 percent of its cost. Poe sells the merchandise acquired from San at 150 percent of its purchase price from San. All of Poes December 31, 2013, and December 31, 2014, inventories of $280,000 and $420,000, respectively, were acquired from San. Sans December 31, 2013, and December 31, 2014, inventories were $800,000 each. Poes accounts payable at December 31, 2014, includes $100,000 owed to San from 2014 purchases. Comparative financial statements for Poe and San Corporations at and for the year ended December 31, 2014, are as follows: Poe San Combined Income and Retained Earnings Statement for the Year Ended December 31, 2014 (in thousands) Sales $8,190 $5,600 Income from San 864 Cost of sales (5,460) (4,000) Other expenses (1,544) (600 ) Net income 2,050 1,000 Add: Beginning retained earnings 1,250 700 Deduct: Dividends (1,000) (500 ) Retained earnings December 31, 2014 $2,300 $1,200

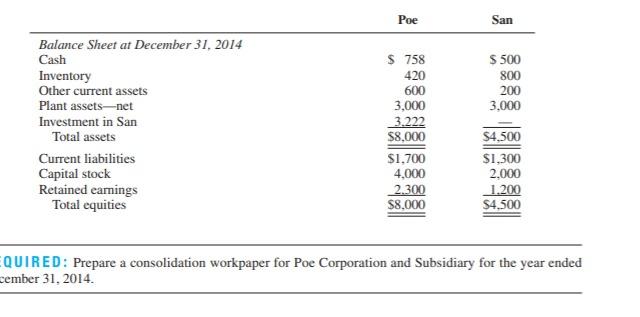

Balance Sheet at December 31, 2014 Cash $ 758 $ 500 Inventory 420 800 Other current assets 600 200 Plant assetsnet 3,000 3,000 Investment in San 3,222 Total assets $8,000 $4,500 Current liabilities $1,700 $1,300 Capital stock 4,000 2,000 Retained earnings 2,300 1,200 Total equities $8,000 $4,500

PLEASE HELP ME MAKE JOURNAL ENTRIES FOR CONSOLIDATION AND ALSO THE CALCULATION. HELP THX

P 5-9 Consolidated workpaper (noncontrolling interest, upstream sales, intercom- pany receivables/payables) Poe Corporation purchased a 90 percent interest in San Corporation on December 31, 2011, for $2,700,000 cash, when San had capital stock of $2,000,000 and retained earnings of $500,000. All San's assets and liabilities were recorded at fair values when Poe acquired its interest. The excess of fair value over book value is goodwill. The Poe-San affiliation is a vertically integrated merchandising operation, with San selling all of its output to Poe Corporation at 140 percent of its cost. Poe sells the merchandise acquired from San at 150 percent of its purchase price from San. All of Poe's December 31, 2013, and December 31, 2014. inventories of $280,000 and $420,000, respectively, were acquired from San. San's December 31, 2013, and December 31, 2014, inventories were $800,000 each. Poe's accounts payable at December 31, 2014, includes $100,000 owed to San from 2014 purchases. Comparative financial statements for Poe and San Corporations at and for the year ended December 31, 2014, are as follows: Poe San Combined Income and Retained Earnings Statement for the Year Ended December 31, 2014 (in thousands) Sales $8,190 $5,600 Income from San Cost of sales (5.460) (4,000) Other expenses (1,544) (600 Net income 2,050 1,000 Add: Beginning retained earnings 1.250 700 Deduct: Dividends (1,000) (500) Retained earnings December 31, 2014 $2.300 $1,200 864 Poe San $ 500 800 200 3,000 Balance Sheet at December 31, 2014 Cash Inventory Other current assets Plant assets-net Investment in San Total assets Current liabilities Capital stock Retained earnings Total equities $ 758 420 600 3,000 3.222 $8,000 $1,700 4,000 2.300 $8,000 $4,500 $1,300 2.000 1.200 $4,500 QUIRED: Prepare a consolidation workpaper for Poe Corporation and Subsidiary for the year ended cember 31, 2014Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started