Question

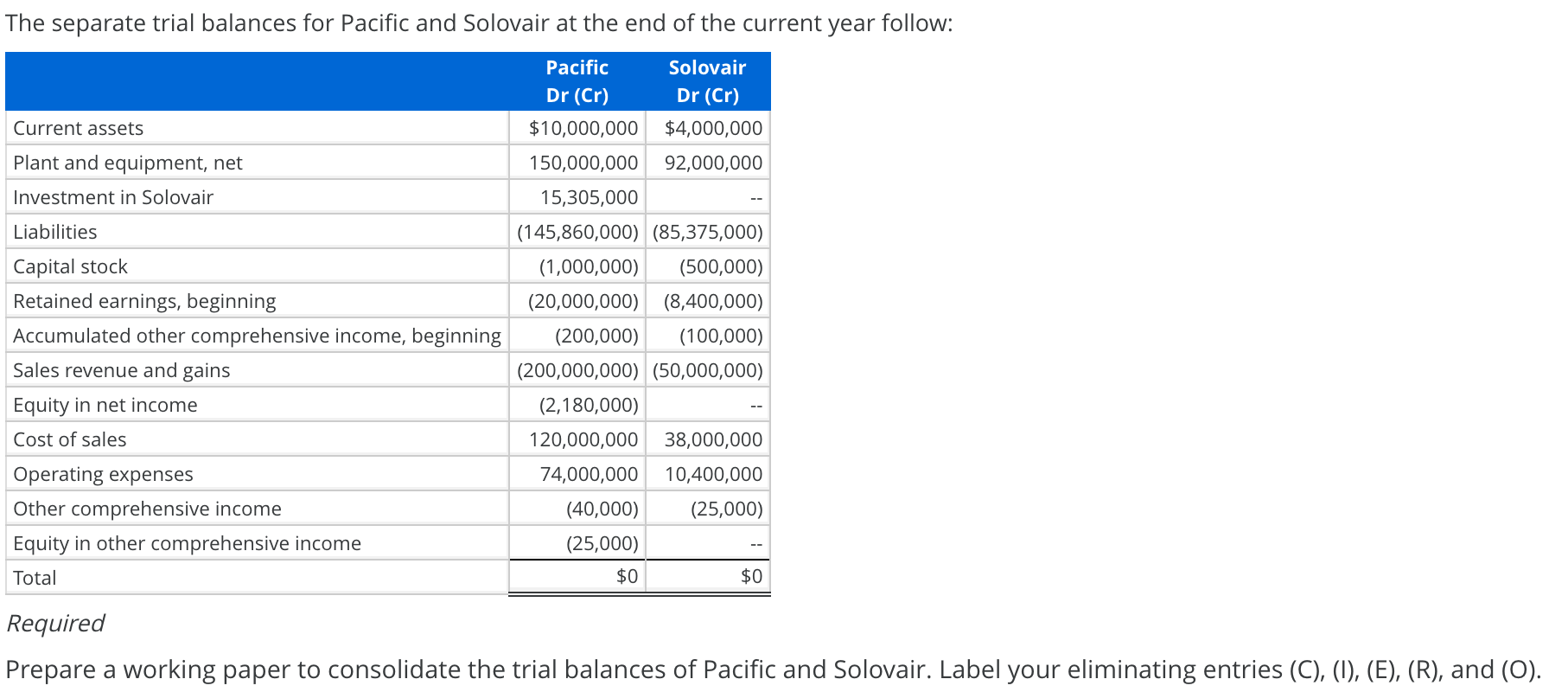

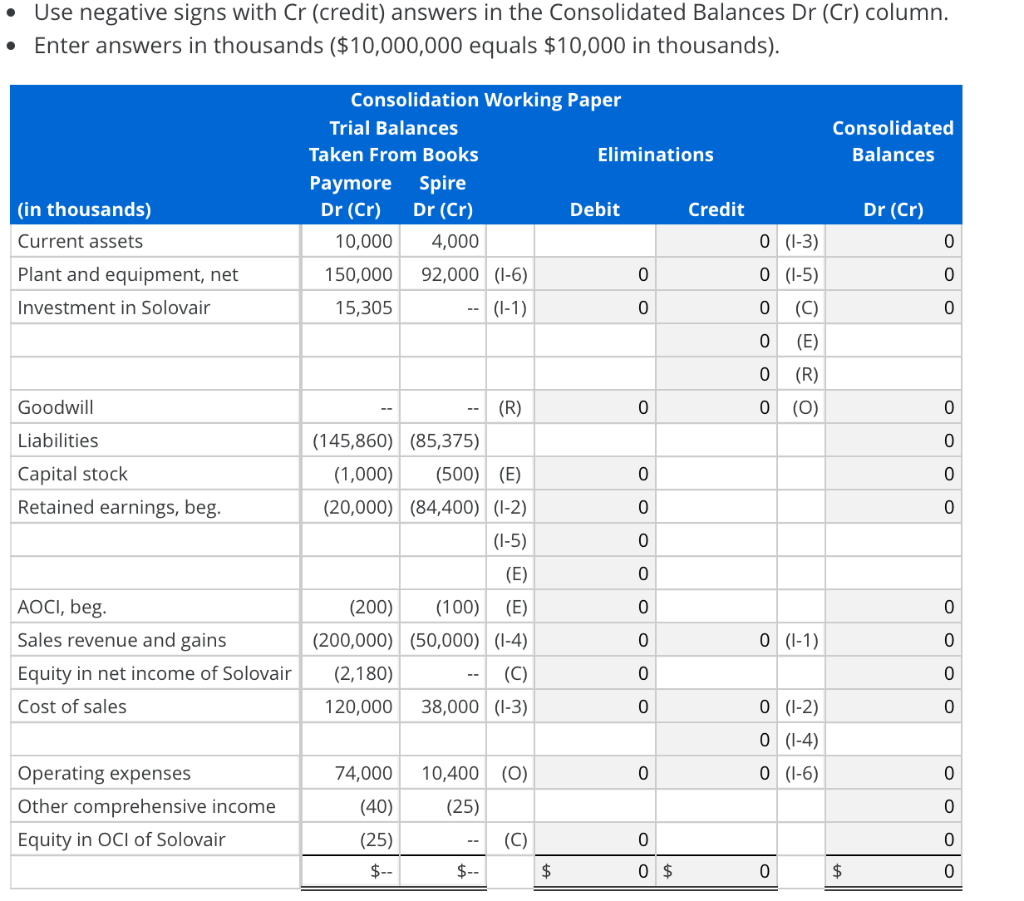

Consolidation Working Paper Eliminations, Variety of Intercompany Transactions Pacific Athletic Corporation owns all of the voting stock of Solovair Apparel. Acquisition cost was $10 million

Consolidation Working Paper Eliminations, Variety of Intercompany Transactions

Pacific Athletic Corporation owns all of the voting stock of Solovair Apparel. Acquisition cost was $10 million in excess of Solovairs book value of $2 million, and the excess was attributed entirely to goodwill. As of the beginning of the current year, goodwill impairment is $4 million. Current year goodwill impairment is $200,000. Following is information on intercompany transactions between Pacific and Solovair for the current year:

Pacific sold land to Solovair in a previous year at a gain of $300,000. Solovair sold the land to an outside party in the current year.

Intercompany profit in Pacifics beginning inventory, purchased from Solovair, is $100,000.

Intercompany profit in Pacifics ending inventory, purchased from Solovair, is $120,000.

Total sales from Solovair to Pacific, at the price charged to Pacific, were $5 million.

Solovair sold equipment with a book value of $2 million to Pacific three years ago for $4.5 million. The equipment had a remaining life of five years, straight-line. Pacific has held the equipment for three years as of the end of the current year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started